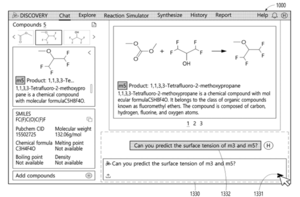

One Stop Systems (OSS) has unveiled a new lineup of PCI Express 6.0 CopprLink cable adapters and a 4UPro-Max PCIe expansion accelerator at the SuperComputing Conference 2025 in St. Louis. This launch marks a significant milestone for OSS as it continues to innovate in the rapidly evolving field of AI-driven hardware.

OSS’s announcement follows a remarkable year-to-date share price increase of 69%, with a total shareholder return exceeding 156% over the past year. The company’s momentum is attributed to its cutting-edge product offerings and a broader excitement within the technology sector. Additionally, recent portfolio adjustments by investors like Lynrock Lake LP highlight ongoing shifts in risk perceptions and valuation debates surrounding the company.

The recent stock performance raises critical questions for investors: Is OSS’s current price a bargain with further upside, or has the market already priced in the potential growth driven by its technological advancements?

The prevailing narrative among analysts suggests OSS is undervalued, with an estimated fair value of $8. The company’s latest closing price of $6.09 indicates there may still be substantial upside potential. Investors are closely monitoring how OSS’s long-term strategies align with tangible product wins and upward revisions in earnings forecasts.

Multi-year defense and commercial platform wins, as well as sole-source supplier agreements, provide strong revenue visibility for OSS. This positions the company as a key supplier for next-generation AI-driven and autonomous edge platforms, potentially leading to sustained revenue and margin growth.

Despite the optimism surrounding OSS’s trajectory, the company faces challenges. Its reliance on variable government contracts and rapid shifts in technology trends could hinder earnings visibility and market share outlook. Analysts are eager to dissect these dynamics further, particularly regarding the aggressive upgrades to revenue, earnings, and profit margins that suggest a growth story extending beyond current market expectations.

Contrasting this bullish outlook, some analysts caution regarding OSS’s valuation metrics. The company currently trades at a revenue multiple of 2.5x, which is significantly higher than the US tech industry’s average of 1.6x and its peer average of just 0.6x. This premium valuation raises concerns that the stock may be overvalued if growth expectations falter, leading to questions about whether the market is adequately rewarding OSS’s strong prospects or simply pricing in too much future success.

Investors seeking to understand OSS’s valuation are encouraged to explore detailed analyses that break down the numbers and provide insight into the company’s pricing dynamics. As the technology landscape evolves, OSS’s ability to navigate these challenges will be critical for its ongoing success.

In this context, those interested in evaluating OSS further can access resources to build their own independent narratives, examining the potential rewards and risks tied to their investment decisions. The analysis highlights two key rewards and two important warning signs that could influence investor sentiment.

As OSS continues to reveal new products and solidify its market position, investors are urged to stay informed, especially in a climate where emerging growth opportunities abound. With the introduction of advanced AI Stock Screeners, investors can uncover potential stocks poised for significant growth, ensuring they do not miss the next breakthrough company.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology. Our articles are not intended to serve as financial advice and do not constitute recommendations to buy or sell any stock, taking into account individual investment objectives or financial situations. Our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

See also Google’s Gemini 3 Launch Transforms AI Landscape, Challenging Nvidia’s Dominance

Google’s Gemini 3 Launch Transforms AI Landscape, Challenging Nvidia’s Dominance Google CEO Pichai: Quantum Computing Approaching Major Breakthroughs in 5 Years

Google CEO Pichai: Quantum Computing Approaching Major Breakthroughs in 5 Years Q.ANT Launches NPU 2.0, Promising 30x Lower Energy Use and 50x Higher Performance

Q.ANT Launches NPU 2.0, Promising 30x Lower Energy Use and 50x Higher Performance Pusan National University Study Reveals New Framework for AI Accountability Distribution

Pusan National University Study Reveals New Framework for AI Accountability Distribution 2026 Sees AI Agents Transform Industries, Quantum Threats Challenge Cybersecurity Resilience

2026 Sees AI Agents Transform Industries, Quantum Threats Challenge Cybersecurity Resilience