In a rapidly evolving technological landscape, the quantum computing market is poised for remarkable growth, with McKinsey forecasting an increase from $4 billion today to a staggering $72 billion by 2035. This impressive trajectory is drawing significant attention from investors eager to capitalize on the burgeoning potential of this disruptive technology.

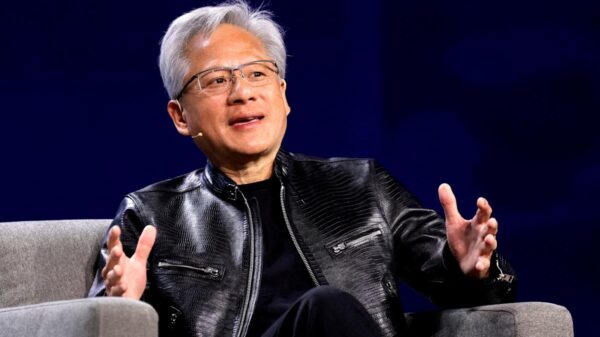

Leading the charge is Nvidia, whose innovative NVQLink architecture effectively bridges the realms of quantum and classical computing. This advancement has propelled Nvidia’s market capitalization to an impressive $4.57 trillion, supported by a remarkable revenue growth rate of 87% annually over the past three years. Such robust performance underscores Nvidia’s significant foothold in both quantum and classical sectors of computing.

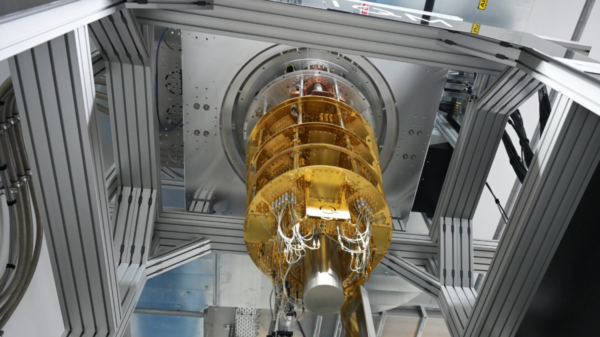

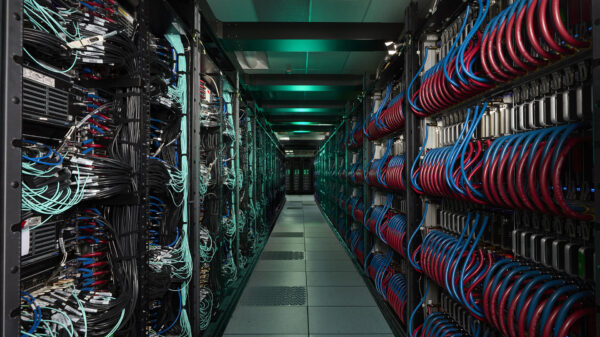

Meanwhile, IBM continues its legacy in the quantum field, having laid the groundwork for quantum computing since the 1970s. The company’s Nighthawk quantum processor currently boasts 120 qubits and is expected to support over 15,000 two-qubit gates by the year 2028. This ongoing innovation highlights IBM’s commitment to advancing quantum technology and its potential applications.

Alphabet, too, has achieved a notable milestone within the quantum computing space. Its Willow quantum computer recently solved a complex mathematical problem in a mere five minutes—an endeavor that would require classical computers an estimated 10 septillion years to accomplish. This breakthrough, coupled with a significantly reduced error rate, solidifies Alphabet’s leadership in the quantum computing sector and showcases the transformative capabilities of this technology.

As these industry giants jockey for position, Wall Street analysts project a bullish outlook for Alphabet Inc. (GOOGL), forecasting an average 12-month price target of $338.25, with estimates ranging from a low of $279.00 to a high of $390.00. While these projections are inherently subjective and may lag behind actual stock prices, they nonetheless reflect a growing confidence in the company’s fundamentals and market potential.

Currently trading at $332.78, the GOOGL stock price illustrates the company’s resilience in a competitive market. Alphabet operates as a holding company with diverse segments, including Google Services, Google Cloud, and Other Bets. The Google Services division encompasses a wide range of products, from advertisements to its ubiquitous search engine and platforms like YouTube. The Google Cloud segment offers infrastructure and platform services tailored for enterprise customers, enhancing the company’s appeal in the growing cloud computing market.

Google Cloud also features cutting-edge artificial intelligence offerings, including its AI infrastructure and Vertex AI platform, which positions the company well for ongoing technological advancements. This suite of services extends to cybersecurity and data analytics, providing comprehensive solutions for businesses navigating the complexities of the digital age.

As investment and innovation in quantum computing accelerate, the implications for industries across the board are profound. The convergence of quantum and classical computing technologies, particularly as exemplified by companies like Nvidia and IBM, could redefine computational capabilities and lead to breakthroughs in various fields, from healthcare to finance.

In summary, as the quantum computing market continues to expand and mature, it brings with it not only financial opportunities but also the promise of transformative technological advancements. The ongoing efforts by industry leaders to push the boundaries of what is possible in computing will likely shape the future landscape, making it a sector to watch in the coming years.

See also China’s AI Chip Firms Dominate 2025 Rankings with Seven in Top Ten, Hurun Report Reveals

China’s AI Chip Firms Dominate 2025 Rankings with Seven in Top Ten, Hurun Report Reveals Salesforce Enhances AI Strategy to Tackle Last-Mile Adoption Challenges in Enterprises

Salesforce Enhances AI Strategy to Tackle Last-Mile Adoption Challenges in Enterprises