Restb.ai has introduced the industry’s first AI-powered computer vision solution aimed at aiding compliance with the upcoming Uniform Appraisal Dataset (UAD) 3.6 regulations, which are set to take effect in 2026. The newly launched API, dubbed Feature UAD, is designed to provide automated visual insights that enhance the property appraisal process by extracting and organizing data directly from photographs. This innovation seeks to bolster the consistency and efficiency of appraisal reports, allowing lenders, appraisal management companies (AMCs), and appraisers to meet heightened data requirements and streamline workflows. By facilitating automated rule checks and data enrichment, Restb.ai’s technology aims to modernize an industry facing significant regulatory challenges.

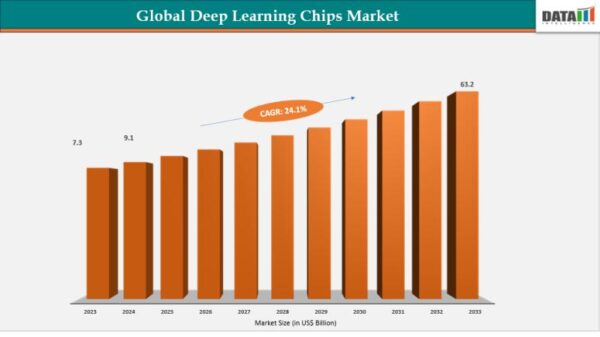

In related market movements, shares of Suzhou Maxwell Technologies (SZSE:300751) surged by 20%, closing at CN¥324.36, reflecting strong investor interest. Conversely, Lasertec (TSE:6920) experienced a decline of 5.8%, finishing the day at ¥36,490. Such fluctuations underscore the volatility that can characterize the technology sector amid evolving market conditions.

NVIDIA continues to position itself as a leader in AI and digital infrastructure, with recent innovations likely to sustain growth and enhance customer loyalty. This strategic direction could positively impact margins, as the company develops solutions tailored to the increasing demand for AI capabilities across various industries.

For further insights into these developments, readers are encouraged to explore our recent Market Insights article. This piece delves into the implications of AI companies flooding the bond market with debt, highlighting potential repercussions for both the technology sector and the broader financial landscape.

In the realm of AI chip stocks, Micron Technology (NasdaqGS:MU) concluded trading at $397.58, reflecting a 2.2% increase and nearing its 52-week high. Recently, Micron approved a charter amendment that reduces certain officers’ personal liability for monetary damages, signaling a shift in governance structure. Advanced Micro Devices (NasdaqGS:AMD) also finished the trading day positively at $253.73, up 1.6% and close to its 52-week high. The company appointed KC McClure to its Board of Directors, expanding the board from eight to nine members, a move aimed at strengthening its leadership. Meanwhile, NVIDIA (NasdaqGS:NVDA) ended at $184.84, marking a 0.8% rise. Notably, the company collaborated with Otto Group and Reply to launch an AI-driven virtual control system for robotic orchestration, which is expected to improve logistics efficiency.

As the landscape of artificial intelligence continues to evolve, the implications for market players and consumers alike grow increasingly complex. The introduction of regulatory frameworks like the UAD 3.6, alongside advancements in technology from leading firms, suggests a period of significant transformation for the appraisal industry and technology markets as a whole. Stakeholders are urged to remain vigilant and adaptable as they navigate these changes, which promise to reshape operational practices and investment strategies moving forward.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech