Teradyne (NasdaqGS:TER) has entered into a joint venture with MultiLane (MLTP), aiming to enhance high-speed data link testing for artificial intelligence (AI) data centers. This partnership is designed to address the escalating demand for advanced testing solutions as AI-driven workloads proliferate across data center infrastructures.

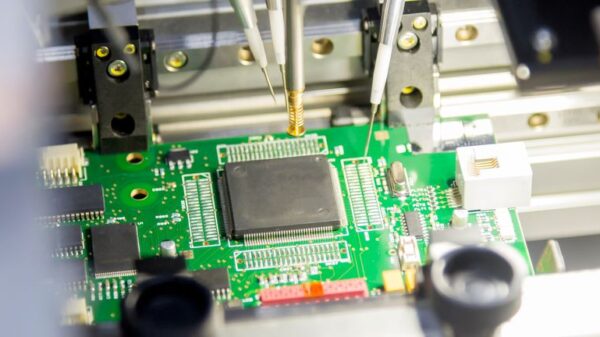

The formation of this joint venture signifies an important expansion of Teradyne’s footprint in a segment that is closely associated with the future of computing and connectivity. With its reputation for automated test equipment utilized in semiconductors and electronics, Teradyne is strategically moving deeper into the hardware ecosystem that supports AI training and inference. As AI models increase in complexity, data centers are increasingly reliant on higher-speed interconnects and denser hardware, necessitating more rigorous and specialized testing protocols. This collaboration aims to directly fulfill that requirement by focusing on high-speed data link validation.

From an investment perspective, this joint venture is noteworthy as it potentially broadens Teradyne’s role beyond chip-level testing to encompass a more comprehensive position within AI-related infrastructure. The venture’s ultimate success will hinge on the pace at which customers adopt its joint offerings and the extent to which these solutions are integrated into large-scale AI data center deployments. This is an area that investors may want to monitor closely in light of future developments.

Teradyne’s recent performance bolsters the significance of this partnership; the company reported fourth quarter 2025 sales totaling US$1,083.34 million, marking its first billion-dollar quarter in several years. By combining its automated testing capabilities with MultiLane’s focus on high-speed instrumentation, Teradyne aims to tap into the substantial AI data center budgets that are also critical for competitors like Advantest and Keysight. The emphasis on high-bandwidth connections linking GPUs, switches, and memory is a focal point of this strategy.

The joint venture aligns neatly with existing analyst narratives that emphasize the growing demand for AI-related testing, silicon photonics, and robotics as key drivers for long-term growth. It complements Teradyne’s recent acquisitions and the introduction of new AI-centric testing platforms, which both optimistic and more cautious analysts have identified as crucial for enhancing Teradyne’s standing in the complex semiconductor and data center testing landscape.

However, potential risks and rewards accompany this venture. The collaboration offers Teradyne direct exposure to AI data center testing expenditures, augmenting its semiconductor testing strengths while potentially expanding its influence throughout the data center stack. Teradyne’s majority ownership of MultiLane positions the venture to align closely with its own product roadmap, tapping into MultiLane’s specialized knowledge in high-speed links.

That said, the contribution of this joint venture will depend on how swiftly AI data center clients embrace MultiLane’s solutions in comparison to established offerings from larger test vendors. Furthermore, integration challenges related to technology, market execution, and customer support could limit the anticipated benefits if MultiLane struggles to scale operations or keep pace with evolving AI hardware demands.

Looking ahead, stakeholders should monitor customer announcements and the manner in which MultiLane’s products are integrated with Teradyne’s existing testing systems. Additionally, it will be important to observe whether company management begins to provide financial metrics specifically related to AI data center activities, alongside its guidance estimates of US$1,150 million to US$1,250 million in first quarter 2026 revenue, with expected GAAP earnings per share ranging from US$1.82 to US$2.19.

This joint venture represents a pivotal move for Teradyne as it seeks to capitalize on the robust demand for AI infrastructure. The evolving landscape of data centers presents both challenges and opportunities, making this partnership one to watch closely as developments unfold in this critical segment of technology.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech