Alfia Ilicheva, who transitioned from public markets to the private sector, identified significant gaps in fund administration while leading an Apollo-backed investment platform. After four years at Bridgewater, one of the world’s largest hedge funds, she found that private equity and venture capital operations lacked the real-time and accurate data readily available in public markets. “How could it be that hedge funds are so into the future and private capital markets are so backward,” she recalled questioning as she faced the challenges of manually compiled and fragmented data, often marred by human error.

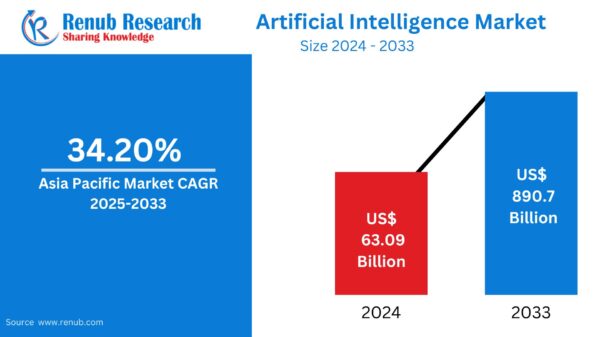

With the private markets expanding and artificial intelligence enhancing automation capabilities, Ilicheva saw an opportunity to innovate in fund administration software. She founded Formulary, initially intending to bootstrap the project, but her introduction to Hari Arul, a partner at Khosla Ventures, changed the trajectory. Khosla is spearheading a $4.6 million seed funding round for Formulary, which Ilicheva stated was three times oversubscribed, with participation from firms like Human Ventures and Serena Williams’s venture capital firm.

Despite the allure of burgeoning private investment sectors, including highly valued companies like SpaceX and OpenAI, fund administration has often been overlooked. However, the ability to track investments, returns, and performance remains critical for effectively communicating with investors and limited partners. Current solutions are bifurcated into high-touch accounting services, such as SS&C and Citco, and software providers like Carta. During her user research, Ilicheva found a pervasive dissatisfaction among general partners and former clients, many of whom resorted to shadow fund administration, maintaining their own records while engaging outside firms. “When you raise a fund, your dream is to generate alpha by investing capital, not redoing someone’s work,” she noted.

Ilicheva aims to bridge the gap between high-touch services and software by utilizing AI to enhance operational efficiency. This approach focuses on developing software for in-house accountants, whom Ilicheva humorously labels “bionic accountants.” This model aims to shift away from the manual data entry that has long plagued the industry, allowing accountants to concentrate on providing service while relying on automated processes for data management.

However, scaling a tech-enabled services company presents challenges, particularly compared to a pure SaaS model that can expand more rapidly. Arul emphasized that for investors and entrepreneurs to evaluate an AI-enabled services business, it is crucial that the operational margins resemble those of a technology company rather than a services firm. While Khosla Ventures has not yet employed Formulary, Arul expressed optimism about a future where tedious processes, such as ensuring data accuracy for limited partners, can be automated effectively. Ilicheva highlighted one potential application for Formulary: drafting investor letters. Arul supported this vision, noting the potential for a portal where investors can directly interact with the system to gain insights into their positions, fund deployments, and anticipated capital calls. “That sounds pie in the sky relative to what the reality is today,” he remarked, “But it doesn’t feel out of reach.”

As Formulary emerges from stealth mode, its development may signal a significant shift in how private capital markets operate, especially as demand for transparency and efficiency becomes ever more critical. The intersection of artificial intelligence and fund administration could reshape the landscape, making it easier for investors and firms alike to navigate the complexities of private equity and venture capital.

See also Machine Learning Tool Enhances Osteoporosis Screening Accuracy Using SHAP Method

Machine Learning Tool Enhances Osteoporosis Screening Accuracy Using SHAP Method Manus AI Launches Platform to Publish Apps Without Xcode or Android Studio

Manus AI Launches Platform to Publish Apps Without Xcode or Android Studio Last Chance: Register for The Caterer’s AI Webinar on Guest Experience Before Jan 28

Last Chance: Register for The Caterer’s AI Webinar on Guest Experience Before Jan 28 LexisNexis Launches Protégé AI Workflows to Enhance Legal Automation Capabilities

LexisNexis Launches Protégé AI Workflows to Enhance Legal Automation Capabilities AI Transforms Health Care Workflows, Elevating Patient Care and Outcomes

AI Transforms Health Care Workflows, Elevating Patient Care and Outcomes