As investments in artificial intelligence (AI) escalate, the landscape of technology is poised for significant transformation. A recent analysis by CRN forecasts the evolution of AI within the channel through 2026, spotlighting rising expenditures in AI channel programs, the burgeoning of edge AI, and the growing menace of cyberattacks specifically designed for the AI era. This shift comes amidst a backdrop of increasing concern over technology component shortages that may impact pricing across the IT sector.

According to a report from Morgan Stanley, approximately 20 percent of IT budgets are now directed toward AI initiatives, reflecting a consolidation of spending in this domain. The financial firm projects that the growth of IT budgets will moderate to 3.4 percent year-on-year from 3.5 percent in 2025, as organizations continue to seek efficiencies by reallocating funds from hardware and communications budgets to AI projects.

As AI adoption accelerates, vendors such as OpenAI and Accenture are rapidly forging partnerships to integrate AI capabilities across various sectors. For instance, OpenAI has collaborated with Accenture to equip thousands of professionals with ChatGPT Enterprise, aiming to embed AI across client operations. This kind of strategic partnership underscores the industry’s intent to broaden AI’s application in business processes.

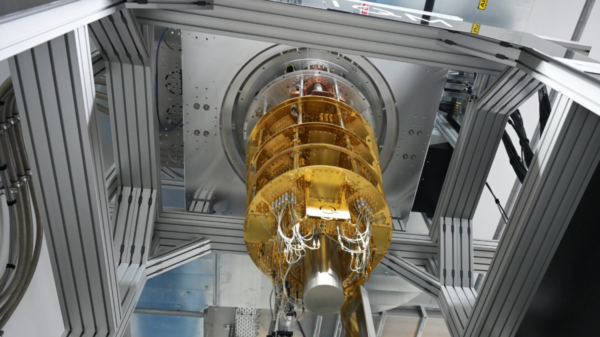

The rise of “neoclouds,” a new category of cloud and graphics processing unit service providers, is also noteworthy. Companies like Vultr, Armada, and Lambda are positioning themselves to capitalize on AI’s growing compute demands, with projections suggesting that neoclouds could capture $20 billion in revenue by prioritizing AI workloads. These providers are expected to invest heavily in open-source model support and orchestration capabilities in 2026.

As generative AI matures, vendors are urged to pivot from experimental initiatives to tangible return on investment. In the coming years, the industry is expected to see deeper, more nuanced use cases tailored to specific sectors. For instance, AI applications in manufacturing could enhance predictive maintenance, while in healthcare, generative AI might accelerate drug discovery and treatment planning.

Moreover, advancements in physical AI and edge AI are anticipated to drive broader adoption, particularly in sectors dealing with physical goods. The market for humanoid robots is projected to reach $38 billion by 2035, with autonomous vehicles poised for commercial viability as early as 2026, according to Morgan Stanley.

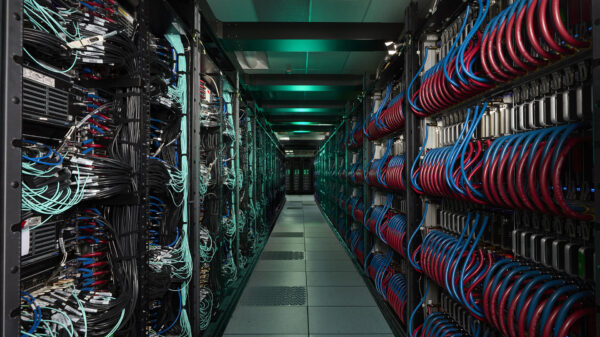

On the networking front, the demand for enhanced data storage solutions is expected to surge as edge AI applications proliferate. Companies like Sandisk and Dell are positioned to benefit from this trend, while the increasing volume of data generated will necessitate more robust storage and networking infrastructure. The growth of on-premises data centers, fueled by the need for cost-effective and secure data processing, signals a promising outlook for enterprises invested in this space.

However, the industry faces significant challenges, notably from supply chain disruptions impacting hardware availability. A recent report from Morgan Stanley highlights a severe shortage of hard disk drives, projecting a deficit of 200 exabytes over the next year. This is compounded by rising prices in NAND and DRAM markets, driven by heightened demand from hyperscalers. As a result, manufacturers may need to increase prices by around 20 percent in 2026, further straining the IT budget landscape.

As the AI landscape evolves, the industry also braces for heightened scrutiny from cybersecurity threats. Cyberattacks targeting AI systems are anticipated to escalate, challenging solution providers to develop robust security measures. With potential legal ramifications surrounding AI liability, the industry must navigate an increasingly complex regulatory environment, which may involve landmark lawsuits as early as 2026.

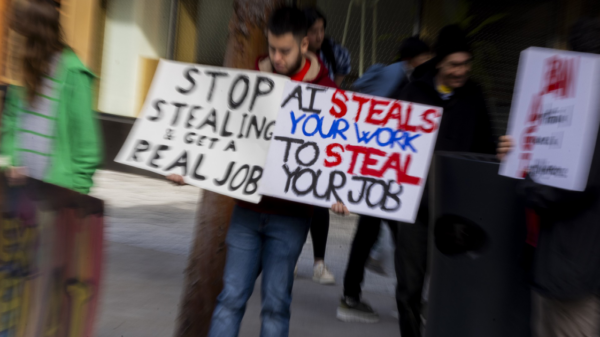

The advent of AI will also redefine the dynamics of IT work, automating lower-level tasks and reshaping workforce expectations. As solution providers increasingly rely on AI, the demand for junior engineers with diverse capabilities—beyond mere coding skills—will become paramount. This evolution may lead to a resurgence in developer roles, as AI tools optimize productivity and streamline operations.

Looking ahead, the trend of consolidation among vendors and solution providers is likely to intensify. As companies seek to enhance their capabilities through mergers and acquisitions, the landscape could shift significantly, driven by a need for comprehensive service offerings. The AI era promises a surge in innovation, yet the path forward will require navigating both opportunities and challenges intrinsic to this rapidly evolving field.

See also AI Emotion Recognition Achieves 86% Accuracy; DeepMind Documentary Released

AI Emotion Recognition Achieves 86% Accuracy; DeepMind Documentary Released AI Chatbot Adoption Surges: Consumer Confidence Rises Amid Growing Skepticism in 2026

AI Chatbot Adoption Surges: Consumer Confidence Rises Amid Growing Skepticism in 2026 Tech Hiring Projected to Rise 12-15% by 2026 Driven by AI and Cybersecurity Demand

Tech Hiring Projected to Rise 12-15% by 2026 Driven by AI and Cybersecurity Demand Enhans Launches Agentic AI ‘CommerceOS’ at NRF 2026, Establishes San Francisco HQ for Growth

Enhans Launches Agentic AI ‘CommerceOS’ at NRF 2026, Establishes San Francisco HQ for Growth