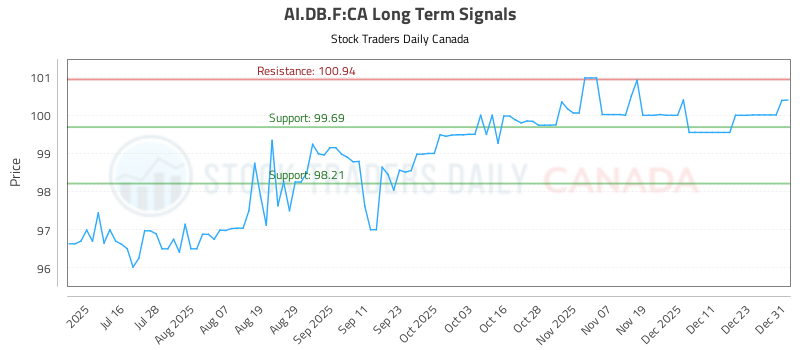

Atrium Mortgage Investment Corporation’s 5.00% convertible unsecured subordinated debentures (AI.DB.F:CA) are currently attracting attention from traders looking to capitalize on short-term price movements. The latest trading signals suggest a buying opportunity near 99.69, with a target price of 100.94 and a stop loss set at 99.19. Conversely, short positions may be considered near 100.94, targeting a return to 99.69, with a stop loss at 101.44. This guidance reflects a cautious yet strategic approach as market participants analyze the performance of these debentures.

As of January 2, the ratings for AI.DB.F:CA indicate a neutral stance across short-term, mid-term, and long-term evaluations. This neutral rating suggests that, while market conditions could support movements in either direction, significant volatility may not be expected in the immediate future. Traders are advised to remain vigilant, keeping an eye on macroeconomic indicators that could influence market sentiment in the coming weeks.

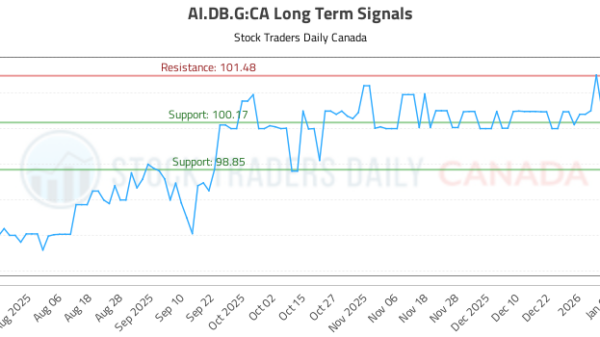

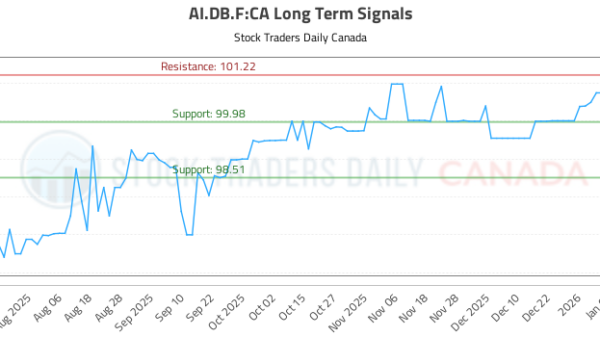

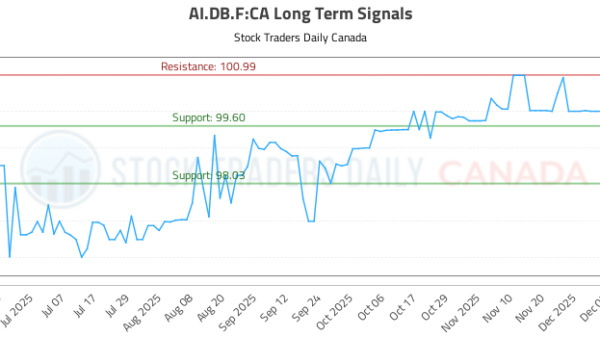

The current financial environment is marked by uncertainty, with fluctuations in interest rates and inflation affecting investor sentiment. As such, investors are increasingly reliant on AI-generated signals to navigate potential trades. The interactive chart provided illustrates the recent price movements of AI.DB.F:CA, highlighting key support and resistance levels. This visualization serves as a crucial tool for traders seeking to time their entries and exits effectively.

The market for convertible debentures is becoming more complex, with many investors looking for opportunities that balance risk and return. The signals generated for Atrium Mortgage Investment Corporation’s offerings provide insights into potential price movements, but traders should also consider external factors, such as the overall economic landscape and sector-specific developments. Staying informed through reliable sources and real-time data will be essential for optimizing trading strategies.

Moving forward, the performance of AI.DB.F:CA will depend heavily on broader market trends and investor behavior. As more traders adopt AI-driven analytics, the landscape will evolve, potentially leading to increased liquidity and sharper price movements. Investors are urged to continue monitoring updates and adjust their strategies accordingly to capitalize on the shifts within this financial space. The interplay between technology and finance is likely to shape the future of trading as both sectors increasingly converge.

For those interested in further insights, updated AI-generated signals are available through various platforms, including stock trading sites that specialize in real-time analytics. These tools can enhance decision-making for both experienced traders and those newer to the market.

For more details on Atrium Mortgage Investment Corporation and its offerings, visit their official page at Atrium Mortgage Investment Corporation.

As the trading week progresses, the focus on AI.DB.F:CA will likely intensify, providing opportunities for astute investors to capitalize on market movements.

See also Musk’s xAI Acquires Third Building, Boosting AI Compute Capacity to Nearly 2GW

Musk’s xAI Acquires Third Building, Boosting AI Compute Capacity to Nearly 2GW SoundHound AI Stock Plummets 56%: Assessing Buy Opportunities Amid Growth Potential

SoundHound AI Stock Plummets 56%: Assessing Buy Opportunities Amid Growth Potential 2026 Sees Surge in Power, Cooling, Networking Stocks as AI Dependency Grows

2026 Sees Surge in Power, Cooling, Networking Stocks as AI Dependency Grows OpenAI Launches Sora 2, Revolutionizing AI Image-to-Video Generation with Sound and Dialogue

OpenAI Launches Sora 2, Revolutionizing AI Image-to-Video Generation with Sound and Dialogue India AI Impact Summit 2026: Global Leaders Forge Inclusive AI Standards for All Nations

India AI Impact Summit 2026: Global Leaders Forge Inclusive AI Standards for All Nations