Amid ongoing fluctuations in the stock market, particularly concerning artificial intelligence (AI)-related stocks, the debate surrounding a potential “AI bubble” has intensified. Investors are increasingly cautious as they seek expert insights into the current investment landscape, with a notable shift in focus from mere growth to profitability.

As of October 9, 2023, key players in the AI infrastructure sector have reported actual sales and profit growth, a positive sign for some investors. However, many stocks continue to surge primarily based on speculative expectations, creating confusion among market participants. Recent market trends indicate that various concerns regarding AI investments have contributed to volatility, especially within technology stocks.

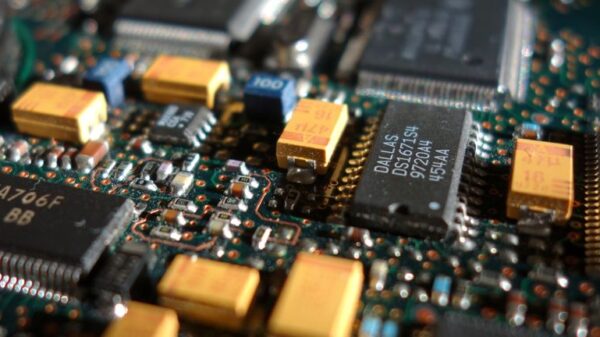

The emergence of the “AI bubble” theory has been fueled by two primary factors: the diminishing competitiveness of established cloud-based software companies as AI technology advances, and ongoing debates about the effectiveness of substantial investments in AI infrastructure. Analysts like Yoo Seung Min from Samsung Securities describe the current phase of the AI industry as one of “construction,” characterized by significant data center expansions and fierce competition for infrastructure.

Experts caution that an overzealous investment mentality, driven by inflated expectations, could exacerbate market volatility as the AI sector continues to mature. Kim Kyung-tae, a researcher at Sangsang Certification Center, noted that the stock market’s recent gains have been heavily concentrated on a limited number of major tech firms and AI infrastructure stocks. This trend raises concerns about the overall market’s balance, especially in the absence of robust economic recovery in traditional sectors.

In light of these developments, stock industry experts recommend a more cautious approach to AI investments. The prevailing sentiment is that a thorough assessment of whether current stock prices accurately reflect underlying business fundamentals is crucial for navigating future volatility. As Yoo Seung Min elaborates, excessive focus on the core AI value chain could be perilous; thus, diversified investment strategies are advisable. He emphasized that the process of market value adjustment is ongoing, making risk management increasingly vital.

As expectations surrounding AI have shifted towards a demand for profitability verification, short-term volatility in technology stocks appears unavoidable. Yoon Jae-hong from Mirae Asset Securities underscores the importance of diversifying investments, recommending a mix of value-oriented stocks, dividends, and more stable options like buffer-type exchange-traded funds (ETFs). This diversified approach stands in contrast to the previous trend of focusing solely on AI-centric investments.

Further emphasizing the need for balance, Moon-woo from Daishin Securities advocates for diversifying investments into performance-based industries such as infrastructure and distribution, rather than pursuing speculative purchases in the technology sector. As the debate surrounding the AI bubble evolves, targeting industries with confirmed structural demand may prove to be a more effective strategy.

As the AI landscape continues to develop, the market’s focus on profitability rather than unbridled growth will likely shape future investment strategies. It remains crucial for investors to stay informed and adaptable in navigating the complexities of an evolving market.

For further insights on AI trends and investments, consider exploring resources from Microsoft and IBM.

See also Broadcom’s AI Chip Surge and VMware Overhaul Set to Transform Tech Landscape

Broadcom’s AI Chip Surge and VMware Overhaul Set to Transform Tech Landscape Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032 Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs

Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs