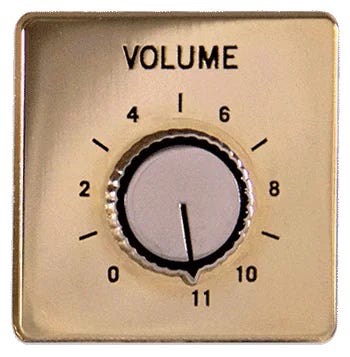

As the new year unfolds, the technology landscape is bracing itself for a significant 2026, particularly in artificial intelligence (AI). Recent analyses suggest that the momentum seen in AI throughout 2025 is poised to intensify, with industry experts likening the upcoming year to a volume dial turned up to eleven. This anticipation comes amid ongoing discussions surrounding the possibility of an ‘AI bubble,’ although many analysts believe that the sector is not yet at that juncture.

The year 2025 witnessed some remarkable developments, notably championed by industry leaders such as Nvidia and OpenAI. These companies have relentlessly pursued advancements in AI technology, with Nvidia culminating its year with a $20 billion deal to license technology from Groq, one of its well-funded competitors. OpenAI, on the other hand, is reportedly aiming to raise $100 billion in capital, with discussions ongoing regarding a potential $10 billion investment from Amazon.

A significant transformation in AI was observed as it transcended from a theoretical concept to an integral part of everyday life for many consumers. Yet, this rapid evolution is not without its challenges. The tech sector is navigating macroeconomic and geopolitical headwinds that uniquely affect the current AI wave.

A recent report from The Information highlights the duality of the year-end sentiment, stating, “For an eventful year, 2025 is ending the same way it started.” The report goes on to emphasize that while much has changed, including how AI is perceived by the public, many foundational elements remain constant, particularly the aggressive strategies employed by leading firms in the AI space.

Market dynamics have also shifted. In U.S. financial markets, AI has emerged as a powerful force, driving inflation partly by increasing electricity costs. This has led to a backlash from communities and local officials who are grappling with the implications of expanding data centers. In the face of such pressures, companies are expected to address these concerns as they venture into 2026.

Moreover, analysts have noted that the deal-making landscape has become increasingly complex. The inquiry surrounding OpenAI’s ambitious fundraising efforts raises eyebrows, as does Nvidia’s multi-billion dollar acquisition approach. Questions linger about the rationale behind spending $20 billion on a company that was valued significantly lower just months prior.

While speculation abounds regarding an AI bubble, some experts argue that current investments are backed by some of the world’s most valuable companies, mitigating fears of an impending collapse. The previous year saw a surge in AI investments fueled by the combined market capitalization of major tech firms, which stands at approximately $22 trillion. This trend is expected to strengthen in the new year, with OpenAI leading the charge.

However, not all AI infrastructure plays have enjoyed consistent success. For instance, CoreWeave, a provider specializing in AI cloud services, experienced a rocky stock performance after an initial public offering (IPO) due to construction delays and concerns over its borrowing capacity. Investors are now approaching companies in the sector with a more cautious outlook, as demonstrated by Oracle’s considerable drop in market capitalization following its AI-fueled earnings report.

Looking ahead, various factors could influence the trajectory of AI investments. Changes in Federal Reserve policy, particularly in interest rates, pose a potential risk for the tech sector. Recent cuts in short-term rates haven’t been mirrored in long-term rates, raising concerns about future funding costs for AI development. Additionally, a political landscape increasingly skeptical of AI’s societal impacts—including job displacement and rising costs—could shape the industry’s regulatory environment in the coming months.

As 2026 approaches, the discourse around AI is set to intensify. With a wealth of challenges and opportunities on the horizon, stakeholders are urged to maintain a vigilant perspective. The landscape could evolve in unexpected ways, making it imperative for both investors and companies to navigate this dynamic sector carefully.

For more insights about the developments in the AI sector, you can visit the official websites of Nvidia, OpenAI, and Amazon.

See also Five AI Stocks to Buy Now for Long-Term Growth as Market Gains 81% Since 2020

Five AI Stocks to Buy Now for Long-Term Growth as Market Gains 81% Since 2020 Grok AI Faces Backlash for Non-Consensual Image Manipulation of World Leaders

Grok AI Faces Backlash for Non-Consensual Image Manipulation of World Leaders DeepSeek Unveils mHC Method to Revolutionize AI Training for Scalable Language Models

DeepSeek Unveils mHC Method to Revolutionize AI Training for Scalable Language Models AI Chatbots’ Dark Side: 33% of Teens Use Them for Emotional Support, Raising Concerns

AI Chatbots’ Dark Side: 33% of Teens Use Them for Emotional Support, Raising Concerns AI in Healthcare: Payment Battles Intensify as 20+ Devices Await CPT Codes by 2026

AI in Healthcare: Payment Battles Intensify as 20+ Devices Await CPT Codes by 2026