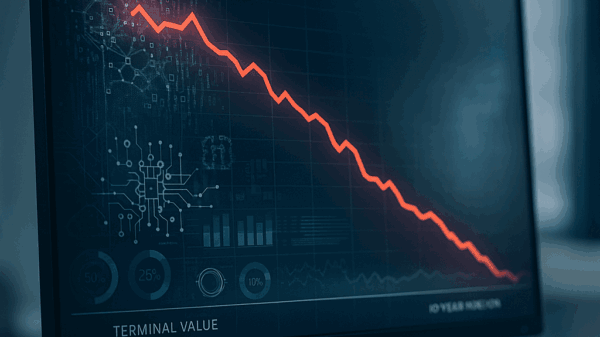

Wall Street has experienced notable volatility recently, with significant corrections evident in the Nasdaq, Bitcoin, and high-profile stocks known as the “Magnificent Seven,” including Nvidia, Meta, and Tesla. However, investor sentiment has shifted dramatically, ushering in a robust “risk-on” rally across U.S. markets. The ongoing debate among market participants centers on whether the soaring valuations of AI-linked technologies signify a speculative bubble or represent a transformational long-term opportunity akin to the internet boom of the late 1990s.

Despite concerns over inflated valuations, many investors remain optimistic about the potential of artificial intelligence to drive significant economic change. This optimism is reflected in the increasing investments being funneled into AI-related ventures. Notably, OpenAI and Google are among companies making substantial strides in AI development, fueling hopes that this technological wave will lead to pervasive enhancements across various industries.

The sustainability of AI’s impact will likely play a crucial role in shaping global financial markets through 2026. As AI technologies mature, they could redefine sectors from healthcare to finance, prompting a reevaluation of traditional business models. This transformative potential continues to attract capital, though the question of whether this influx is justified remains a point of contention among analysts.

For Indian equities, a pressing question arises: Can robust domestic fundamentals insulate them from the rippling effects of U.S. market volatility? India’s economy, characterized by a youthful demographic and a burgeoning tech sector, presents a unique landscape for investors. Analysts are closely monitoring how Indian companies engage with AI technology, particularly in sectors like e-commerce and fintech, where innovations could yield significant competitive advantages.

As U.S. markets grapple with concerns about valuation bubbles, Indian investors are looking for indicators that can mitigate risks associated with external shocks. Companies such as Infosys and Tata Consultancy Services are increasingly adopting AI to streamline operations and enhance service offerings, potentially enabling them to navigate the uncertainties ahead.

The global conversation about AI’s future is not limited to market trends; it extends to ethical considerations and regulatory frameworks. Governments and institutions worldwide are evaluating how to harness AI responsibly while mitigating risks related to privacy, security, and job displacement. In this context, the role of regulatory bodies becomes crucial as they seek to establish guidelines that foster innovation without compromising public trust.

As the discussion intensifies, major tech players, including Microsoft and Amazon, are also investing heavily in AI research and development, positioning themselves to capitalize on the technology’s full potential. The competitive landscape is likely to evolve rapidly, with companies vying not only for market share but also for leadership in ethical AI practices.

Ultimately, the unfolding narrative of AI’s integration into the economy is poised to influence market dynamics profoundly. Investors will need to remain vigilant, balancing the tantalizing prospects of growth against the backdrop of potential market corrections. As sentiment shifts, the capacity to adapt and innovate will delineate successful companies from those unable to keep pace.

In conclusion, the current climate in both U.S. and Indian markets underscores a critical juncture for investors. With AI at the forefront of technological advancement, the next several years may define new paradigms in market behavior and economic sustainability. The intersection of innovation and regulation will likely play a pivotal role in determining how effectively markets can harness AI’s potential while mitigating inherent risks.

See also UAE Invests $1 Billion to Enhance Africa’s AI Infrastructure Amid Growing Demand

UAE Invests $1 Billion to Enhance Africa’s AI Infrastructure Amid Growing Demand HGC Launches Strategic Transformation to Leverage AI for Market Leadership and Innovation

HGC Launches Strategic Transformation to Leverage AI for Market Leadership and Innovation Microsoft’s Fara-7B AI Agents Enable On-Device Automation with Enhanced Governance Needed

Microsoft’s Fara-7B AI Agents Enable On-Device Automation with Enhanced Governance Needed NVIDIA Empowers Businesses with Specialized AI Agents Achieving 98.5% Accuracy

NVIDIA Empowers Businesses with Specialized AI Agents Achieving 98.5% Accuracy AI’s Misguided Pursuit of Superintelligence: Why Language Models Fall Short of Human Cognition

AI’s Misguided Pursuit of Superintelligence: Why Language Models Fall Short of Human Cognition