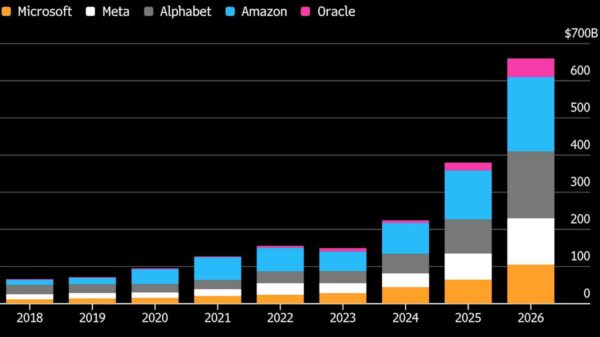

Alphabet Inc. is at a crossroads, with investors questioning whether the tech giant remains a wise investment following its significant market gains this year. The company has seen substantial growth, with its stock soaring 84.1% over the past year, up 68.7% year-to-date and 12.7% over the last month, despite a slight dip of 0.1% in the past week. This remarkable performance invites speculation about the sustainability of further upside potential.

Much of the enthusiasm surrounding Alphabet can be attributed to its advancements in artificial intelligence. The company is actively integrating generative AI tools into its Search and Workspace platforms and expanding its AI services within the cloud sector for enterprise customers. However, the excitement is tempered by regulatory challenges, including ongoing antitrust cases and privacy legislation, which can impact investor sentiment swiftly even as the core business remains robust.

Valuation assessments indicate that Alphabet scores only 2 out of 6, suggesting that it may be undervalued on certain checks. This prompts a deeper look into various valuation methodologies to determine whether its current market price reflects its intrinsic worth.

The first approach is a Discounted Cash Flow (DCF) analysis, which evaluates a company’s current worth based on expected future cash flows. Alphabet generated approximately $92.6 billion in free cash flow over the last twelve months, with projections estimating this could rise to $257.8 billion by 2035. The DCF model calculates an intrinsic value of around $289.53 per share, indicating that the stock is trading about 10.4% above its estimated fair value, suggesting it is modestly overvalued according to cash flow fundamentals.

In contrast, a Price to Earnings (PE) analysis provides a different perspective. Alphabet currently trades at a PE ratio of about 31.0x, significantly above the broader Interactive Media and Services industry average of 16.4x, but below the peer group average of approximately 47.6x. This positioning reflects investors’ perception of Alphabet as a higher-quality company within its sector. Simply Wall St’s Fair Ratio for Alphabet is pegged at 37.3x, which accounts for the company’s earnings growth potential, margins, risk profile, and market capitalisation. Consequently, the current ratio indicates that the stock appears modestly undervalued on an earnings basis.

Beyond traditional methods, investors can leverage a narrative approach to better understand Alphabet’s potential. This entails constructing a story that connects assumptions about growth drivers, margins, and risks with financial forecasts and fair evaluations. For instance, one investor might project a fair value of $340 based on a 17.36% revenue growth assumption, viewing Alphabet as a robust cash generator with significant assets in digital advertising, Google Cloud, and AI innovations. Conversely, a more conservative view may set a fair value at $212.34, anticipating slower growth at an average of 13.47% and recognizing the potential constraints posed by high computing costs and regulatory pressures.

While the bullish narrative emphasizes Alphabet’s cash-generating abilities and prospects for future growth, the bearish perspective highlights the challenges the company might face in maintaining its momentum. Amidst these mixed signals, the broader market context will play a crucial role in shaping investor decisions regarding Alphabet. The contrasting narratives illustrate the diversity of opinion on Alphabet’s future, underscoring the importance of individual analysis in stock valuation.

As Alphabet continues to harness its capabilities in AI and digital advertising, investors must weigh these opportunities against the potential risks from market dynamics and regulatory scrutiny. Engaging with community insights and varying perspectives can further enhance the understanding of this complex and evolving landscape. With Alphabet at such a pivotal juncture, its trajectory remains a subject of keen interest for investors and analysts alike.

See also CISA Unveils Essential Guidelines for Secure AI Integration in Critical Infrastructure

CISA Unveils Essential Guidelines for Secure AI Integration in Critical Infrastructure Cisco Duo Reveals Urgent Need for Security-First Identity Strategies to Combat AI-Driven Threats

Cisco Duo Reveals Urgent Need for Security-First Identity Strategies to Combat AI-Driven Threats DeepSeek Launches V3.2 Models, Surpassing GPT-5 and Gemini 3 Pro in Benchmarks

DeepSeek Launches V3.2 Models, Surpassing GPT-5 and Gemini 3 Pro in Benchmarks Space Debris Threatens Google’s Project Suncatcher: Risks to AI Data Centers in Orbit

Space Debris Threatens Google’s Project Suncatcher: Risks to AI Data Centers in Orbit Orq.ai Raises €5 Million Seed Funding to Enhance Enterprise AI Agent Platform

Orq.ai Raises €5 Million Seed Funding to Enhance Enterprise AI Agent Platform