In a move that could reshape the artificial intelligence landscape, Amazon is reportedly in advanced negotiations to invest $50 billion in OpenAI, according to a report from TechCrunch. This potential deal would not only surpass previous investments in the AI sector but also position Amazon as a major player, aligning it closely with Microsoft, which has already invested approximately $13 billion in OpenAI since 2019. The timing of these discussions reflects the growing financial demands associated with pushing towards artificial general intelligence, as OpenAI’s operational costs have surged due to the resource-intensive nature of advanced model training.

The substantial investment would furnish OpenAI with critical funding needed to sustain its ambitious research goals while solidifying Amazon Web Services (AWS) as the preferred cloud provider for OpenAI’s computational infrastructure. Analysts suggest that the deal may include provisions for OpenAI to utilize AWS resources, creating a mutually beneficial relationship that aligns with both companies’ objectives. Amazon’s strategy of investing across various AI entities, including its earlier $4 billion commitment to Anthropic, illustrates a hedging approach, allowing the tech giant to maintain negotiating leverage across the competitive AI landscape.

The dynamics of Amazon’s potential investment are complicated by Microsoft’s existing relationship with OpenAI, as the software giant has integrated the AI firm’s technology into its own products, including Bing and Office. Should Amazon enter as a major investor, it could lead to the renegotiation of exclusivity arrangements, creating potential friction between OpenAI’s two largest backers. This competitive tension underscores the broader stakes involved as technology companies vie for dominance in AI capabilities.

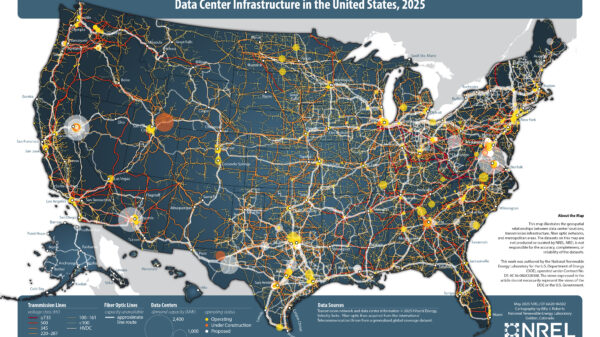

Amazon’s move to invest in OpenAI coincides with its own developments in AI hardware, including custom chips like Trainium and Inferentia, aimed at reducing dependence on Nvidia‘s GPUs. Integrating OpenAI’s advanced research could accelerate the adoption of these proprietary chips, providing Amazon with a significant endorsement while also potentially lowering costs for OpenAI in its training and inference workloads. This vertical integration aligns with Amazon’s historical approach of developing internal capabilities to minimize reliance on outside suppliers.

However, a $50 billion investment would likely attract scrutiny from regulatory bodies, particularly around antitrust issues. The Federal Trade Commission (FTC) has previously initiated investigations into AI partnerships among dominant cloud providers, questioning whether such investments create unfair competitive advantages. European regulators, known for their aggressive stance on tech investments, could also require approval if the agreement is viewed as a merger, even if structured as a minority investment. Consequently, Amazon may need to navigate complex legal frameworks to ensure its strategic objectives do not compromise OpenAI’s operational independence.

OpenAI’s unique corporate structure—operating as a capped-profit entity governed by a nonprofit parent—adds another layer of complexity to any investment. Current valuations place OpenAI at approximately $86 billion, and a $50 billion investment could significantly alter this landscape or represent a substantial ownership stake. The financial architecture may include intricate provisions to manage returns while ensuring that OpenAI remains true to its mission of advancing AI technologies that benefit humanity.

For AWS, securing OpenAI as a major client would enhance its credibility in AI infrastructure, particularly as it faces increasing competition from Microsoft Azure and Google Cloud. An effective partnership could validate AWS’s AI offerings, potentially attracting other AI enterprises in search of top-tier cloud solutions. Furthermore, direct collaboration with OpenAI could expedite the enhancement of AWS’s machine learning services, offering customers cutting-edge AI capabilities.

The potential $50 billion investment aligns with a broader trend of escalating AI funding in the technology sector. Major players such as Google and Meta have similarly devoted billions to their AI initiatives as the global investment in AI surpasses $200 billion annually. While some analysts express concerns about an impending AI bubble, others argue that the transformative potential of AI justifies significant upfront investment, even if immediate profitability remains elusive.

If finalized, Amazon’s investment could set a new standard for AI financing, prompting competitors to consider similar commitments. This influx of capital may consolidate the industry around a few well-funded entities, complicating the competitive landscape for smaller players. The structure and terms of the investment will be closely monitored, as they may establish templates for future AI collaborations, particularly in terms of governance, technology access, and infrastructure commitments.

Ultimately, should this historic investment come to fruition, it would not only underscore Amazon’s strategic intent to lead in AI but also shape the future trajectory of AI development across multiple industries. The implications of this deal extend beyond the corporate realm, as the geopolitical dimension of AI continues to evolve, underscoring the critical role of technological superiority in national security and economic power.

See also Virginia Beach Mom Sues Character.AI After Son’s Disturbing Chatbot Encounters

Virginia Beach Mom Sues Character.AI After Son’s Disturbing Chatbot Encounters Microsoft’s AI Copilot Faces Scrutiny as $50B Investment Sparks Adoption Doubts

Microsoft’s AI Copilot Faces Scrutiny as $50B Investment Sparks Adoption Doubts Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032