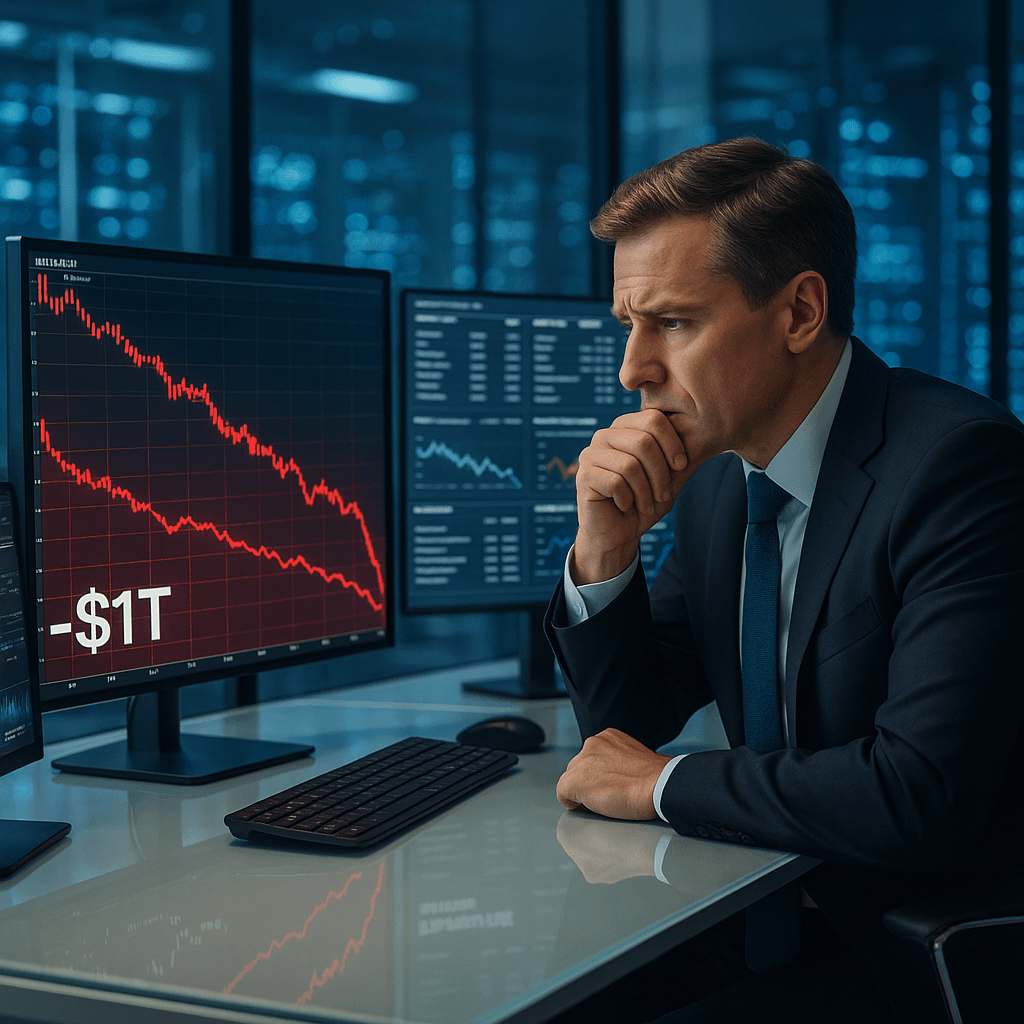

Microsoft, Amazon, Google, and Meta faced a staggering loss of over $1 trillion in combined market value last week, following the announcement of their most ambitious artificial intelligence (AI) spending plans to date. This massive sell-off signals a critical moment in the ongoing AI boom, as investors on Wall Street express skepticism regarding the efficacy of the hyperscalers’ extensive infrastructure investments. With capital expenditures reaching $120 billion for the fourth quarter and projections soaring to $660 billion for 2026, questions about future returns are mounting in what has been characterized as the largest coordinated tech spending spree in history.

The sell-off has left the tech giants reeling. As of premarket trading on Monday morning, Microsoft saw a modest uptick of 0.8%, while Oracle rose by 1.5%. However, Meta slipped 0.3%, Amazon fell by 0.1%, and Google dropped 0.6%. Meanwhile, Nvidia, the chipmaker central to this infrastructure arms race, retraced some of its prior gains, declining about 1% in early trading after a significant Friday rally of 7.9%.

The stark numbers paint a compelling narrative. The four tech leaders reported a combined $120 billion in capital expenditures for just the fourth quarter, as detailed in their latest earnings reports. Analysts from the Financial Times project that the collective AI infrastructure spending could escalate to $660 billion by 2026, a figure that surpasses the GDP of nations such as the United Arab Emirates, Singapore, and Israel.

This unprecedented level of expenditure has led to heightened scrutiny from investors, particularly as the risks associated with such large-scale investments become more pronounced. The questions surrounding the potential returns on these investments could redefine the landscape of the tech industry. Investors are demanding clearer insights into the financial viability of the hyperscalers’ ambitious AI initiatives. The focus now turns to how these companies will justify their spending and whether they can achieve the expected returns that would validate such significant outlays.

As the tech giants grapple with market reactions, the broader implications for the AI industry are significant. Should these companies fail to deliver on their promises, it could trigger a broader reconsideration of investment in AI technologies. This moment serves as a potential inflection point for the tech sector, where the balance between innovation and financial sustainability is more critical than ever.

The future of AI investment will likely depend on how these companies navigate the current turbulence. Analysts and investors will be closely monitoring upcoming earnings reports and strategic announcements as they seek reassurance about the profitability of AI infrastructure projects. In a market increasingly skeptical of extravagant spending without immediate returns, the actions of these hyperscalers could set the tone for the entire tech industry in the years to come.

See also DeFi Technologies Unveils DEFT Valour Investment Opportunity Index for Digital Asset Allocation Insights

DeFi Technologies Unveils DEFT Valour Investment Opportunity Index for Digital Asset Allocation Insights Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032 Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs

Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs