Key Details

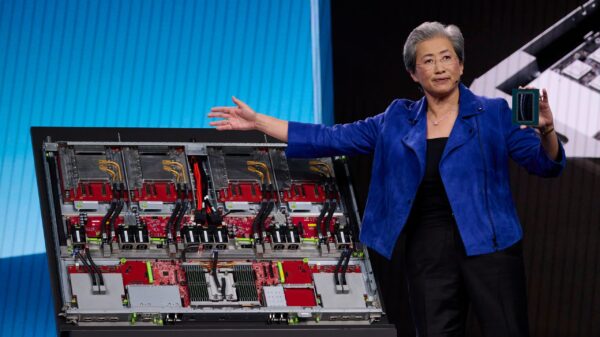

Brookfield Corporation is positioning itself for what it describes as a once-in-a-generation opportunity in the realm of AI infrastructure. The global investment firm, along with its affiliates, is channeling significant capital into the development of specialized AI factories and related infrastructure. Concurrently, Equinix, a leading data center Real Estate Investment Trust (REIT), is making substantial investments to construct AI-ready data centers.

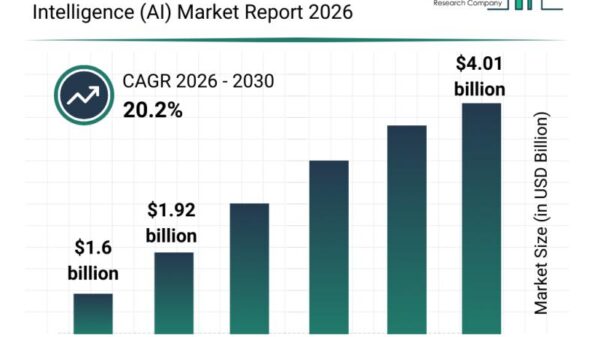

According to estimates from McKinsey, global capital spending on AI data centers alone is projected to reach a staggering $5.2 trillion by 2030. In addition, companies will require an estimated $1.5 billion to bolster traditional data centers that support non-AI workloads. The race to establish the data centers of the future is intensifying, with Brookfield Corporation and Equinix emerging as front-runners in this burgeoning sector, making them attractive stocks for investors looking to capitalize on this megatrend.

Investment Strategies and Future Plans

Brookfield Corporation’s strategy may seem unconventional for a company primarily known for alternative investments. However, the firm views investments in AI infrastructure as a strategic priority. Brookfield plans to allocate significant capital through its balance sheet into funds managed by its affiliate, Brookfield Asset Management. This includes the launch of the inaugural Brookfield AI Infrastructure Fund, which aims to deploy up to $100 billion in AI infrastructure projects.

The fund has already secured opportunities to invest up to $5 billion in advanced fuel cell power solutions for data centers and AI factories. Additionally, Brookfield is launching a cloud services provider named Radiant, focused on developing AI factories. Through its subsidiary, Brookfield Infrastructure, the firm anticipates investing approximately $500 million annually in building AI data centers in collaboration with its parent organization. Moreover, Brookfield Renewable, another of its subsidiaries, is becoming a crucial energy supplier for data center operations.

Equinix’s Expansion Plans

Equinix, the largest data center REIT, currently operates 273 data centers across 77 global markets and controls a significant land position with access to power, allowing for expansive growth. The company is actively engaged in 58 major construction projects worldwide, including 12 xScale projects, which are large-scale data centers essential for supporting AI workloads.

Notably, Equinix has entered joint ventures to finance these expansions, such as a partnership with Singapore’s sovereign wealth fund and the Canada Pension Plan, aimed at developing $15 billion worth of xScale data centers in the U.S. Recently, one of Equinix’s clients successfully launched a high-performance supercomputer in an AI-ready facility, utilizing AI to propel advancements in the healthcare sector.

Equinix aims to double its data center capacity by 2029, leveraging its expertise, financial strength, and strategic partnerships to meet the increasing demand for data center capacity in the future. This strategic positioning enhances the REIT’s potential to generate substantial returns for its investors in the years ahead.

Conclusion: Leaders in AI Infrastructure

Both Brookfield Corporation and Equinix are making aggressive investments to enhance AI data center capabilities, positioning themselves as key players in the growing AI infrastructure market. Their strategic initiatives indicate strong growth potential, making them appealing stocks for investors interested in the future of AI.

Character.AI Faces Safety Backlash as Experts Warn of Risks for Teen Users

Character.AI Faces Safety Backlash as Experts Warn of Risks for Teen Users Erdogan Advocates for Global AI Policies and Resource Security at G20 Summit

Erdogan Advocates for Global AI Policies and Resource Security at G20 Summit Prolific Study Ranks ChatGPT 8th, Behind Gemini and DeepSeek Models

Prolific Study Ranks ChatGPT 8th, Behind Gemini and DeepSeek Models UAE Launches $1 Billion AI Initiative to Transform Infrastructure and Services in Africa

UAE Launches $1 Billion AI Initiative to Transform Infrastructure and Services in Africa OpenAI’s Engagement Metrics Linked to 50 Mental Health Crises During ChatGPT Use

OpenAI’s Engagement Metrics Linked to 50 Mental Health Crises During ChatGPT Use