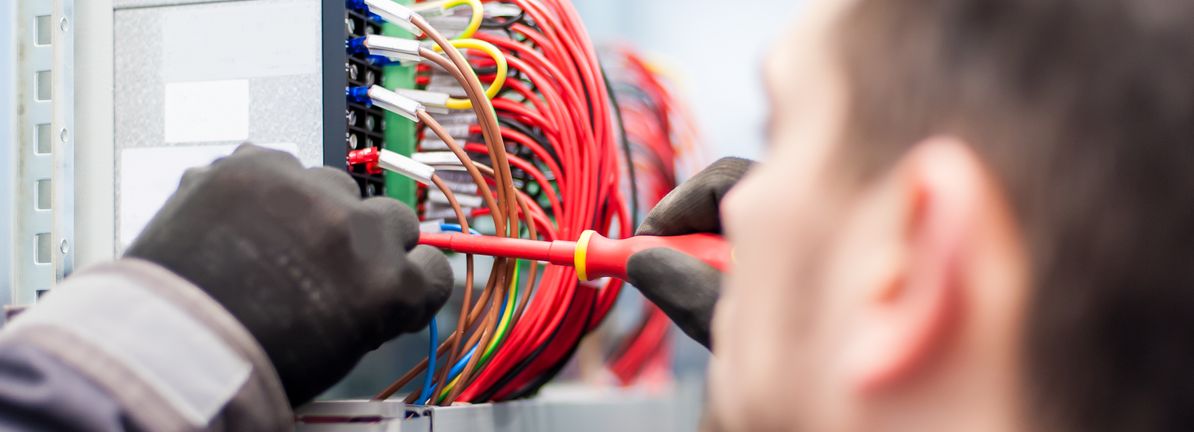

Corning Inc. (NYSE:GLW) has secured a multiyear contract valued at up to US$6 billion with Meta Platforms Inc. aimed at bolstering the AI infrastructure for the tech giant’s data center projects. This agreement underscores Corning’s strategic positioning within the burgeoning AI sector, as it anticipates meeting the increasing demands for high-bandwidth connectivity associated with AI workloads over the coming years.

In addition to the contract with Meta, Corning has announced plans to expand its international manufacturing capabilities, including a new fiber optic facility in India. This expansion highlights Corning’s intention to align its production resources with the growing infrastructure needs tied to AI technology, suggesting a long-term vision rather than a temporary spike in demand.

The significance of the Meta contract extends beyond immediate financial gains; it places Corning’s optical communications business at the forefront of AI data center developments. The company, which has historically been recognized for its expertise in glass and ceramics, is now positioning itself as a critical player in the optical communications market, a segment that is increasingly vital for enabling AI operations.

As investors consider the implications of this deal, key questions arise regarding Corning’s ability to convert this substantial order book into sustainable profit margins. The company has already reached its target of a 20% operating margin ahead of schedule and has raised its sales goal under its Springboard initiative to achieve an additional US$11 billion in annual revenue by 2028. However, mixed sentiments among analysts, with some rating the stock as Equal Weight while others advocate for a Buy, indicate that concerns around execution risk, customer concentration, and competitive pressures from companies like Prysmian and CommScope remain pertinent.

The contract with Meta reinforces the narrative that growth in Corning’s Optical Communications division is closely linked to the expansion of AI data center connectivity. However, reliance on large clients such as Meta raises concerns that the company’s fortunes may become closely tied to a few overarching trends, which could introduce risks if these themes do not unfold as anticipated. This latest agreement could serve as a bellwether for Corning’s future in AI-related network investments, particularly as it seeks to diversify its customer base.

Furthermore, the establishment of a facility in India marks a significant shift in Corning’s manufacturing strategy, which has historically been centered in the U.S. This international capacity expansion could enhance the company’s ability to secure contracts with other major players in technology and telecommunications, thereby broadening its market reach.

Investors must weigh the risks associated with Corning’s intensified focus on AI and data center demand, particularly how susceptible this reliance makes the company to fluctuations in spending by hyperscale clients like Meta. Analysts have also raised concerns regarding increased competition and transparency in financial reporting, alongside issues of insider selling that may cause unease among shareholders. On the positive side, the long-term revenue visibility provided by the Meta contract contributes to a favorable outlook for the Optical Communications sector at a time when AI-related connectivity is pivotal for growth.

Looking ahead, monitoring the ramp-up of volumes from Meta and understanding how much of the US$6 billion contract will translate into booked sales will be critical for investors. Observing Corning’s ability to maintain or improve operating margins while expanding its capacity will also be essential. Additionally, tracking potential new contracts with other AI or cloud computing entities could provide insights into whether Corning’s prospects hinge solely on its relationship with Meta or if they reflect a broader industry trend. Stakeholders should also keep an eye on insider trading activity, dividend policies, and revisions from analysts as the dynamics of the Meta contract evolve from announcement to actual cash flow.

This article serves as a general overview and does not constitute financial advice. Investors are encouraged to conduct their own research and consider their individual financial situations before making investment decisions.

See also Applied Optoelectronics Invests $300M in Sugar Land, Boosts AI Transceiver Production with 500 New Jobs

Applied Optoelectronics Invests $300M in Sugar Land, Boosts AI Transceiver Production with 500 New Jobs Ginkgo Bioworks Soars 5.69% as AI Breakthrough Cuts Protein Synthesis Costs by 40%

Ginkgo Bioworks Soars 5.69% as AI Breakthrough Cuts Protein Synthesis Costs by 40% Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032