The global cybersecurity landscape is poised for significant expansion, with analysts projecting the market to potentially double in the coming years. Notably, CrowdStrike anticipates its total addressable market will reach $140 billion by 2026 and soar to $300 billion by 2030. This growth forecast presents a compelling opportunity for investors looking to capitalize on the rising demand for cybersecurity solutions.

In terms of revenue generation, CrowdStrike has established itself as a market leader, reporting nearly $4.6 billion in revenue over the past year. In contrast, its competitor, SentinelOne, generated approximately $956 million during the same period. While both firms exhibit comparable growth rates, CrowdStrike’s dominant market position affords it a significant advantage in profitability.

The valuation of these companies further highlights the disparity between them. CrowdStrike’s price-to-sales ratio stands at 24, a figure that exceeds the typical range for software firms. This premium valuation is often justified by its strong performance and competitive edge in the cybersecurity sector. Conversely, SentinelOne trades at below five times sales, suggesting a considerable potential for long-term growth that investors may want to consider.

As the threat landscape evolves, with AI-assisted attackers becoming increasingly prevalent, the importance of effective cybersecurity measures cannot be overstated. Accordingly, analysts suggest that holding shares in both CrowdStrike and SentinelOne could be a prudent long-term investment strategy that allows investors to benefit from future market dynamics.

Wall Street analysts are optimistic about CrowdStrike’s stock performance, projecting an average price target of $562.25 over the next year. These forecasts include a low estimate of $353.00 and a high of $640.00. However, it is crucial for investors to recognize that analyst price targets are subjective and often lag behind stock price movements. A more strategic approach involves focusing on the underlying fundamentals driving analyst rating changes.

Currently, CrowdStrike shares are trading at around $453.77, positioning it within a competitive pricing range relative to the analysts’ forecasts. As interest in cybersecurity increases, the market appears ripe for further investment.

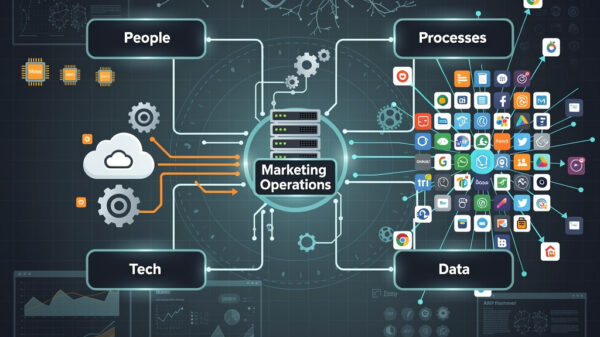

CrowdStrike Holdings, Inc. is renowned for its cloud-based cybersecurity solutions, specifically its Falcon platform, which provides comprehensive protection for endpoints, cloud workloads, identities, and data. This platform collects and integrates data from various sources across enterprises, enabling organizations to enhance their security posture effectively. With 29 cloud modules offered through a software-as-a-service (SaaS) model, CrowdStrike addresses multiple large markets, including corporate endpoint and cloud workload security, managed services, and threat intelligence.

As the demand for robust cybersecurity solutions continues to rise, driven by increasing digital threats and regulatory pressures, companies like CrowdStrike and SentinelOne are likely to play pivotal roles in shaping the industry’s future. Investors keen to tap into this growth may find that diversifying their portfolios with stakes in these leading cybersecurity firms could yield significant returns in the coming years.

AI-Driven Ad Surge Floods Platforms, Threatens Brand Integrity and Consumer Trust

AI-Driven Ad Surge Floods Platforms, Threatens Brand Integrity and Consumer Trust Google’s AI Overviews Cite YouTube 16.5% for Health Advice, Overriding Trusted Sources

Google’s AI Overviews Cite YouTube 16.5% for Health Advice, Overriding Trusted Sources Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032