The rise of artificial intelligence (AI) has reshaped the stock market, with many leading AI companies experiencing substantial gains. Over the past three years, the sector has surged, driving an impressive 81% increase in market value for top players. As we look ahead to 2026, questions arise regarding whether this momentum will continue or if a potential bubble looms. For investors seeking to capitalize on AI’s vast potential, diversifying their portfolios while focusing on promising stocks could be a prudent strategy.

Among the frontrunners in the AI space is Taiwan Semiconductor Manufacturing (TSMC), a giant in the semiconductor foundry sector. TSMC is crucial not only for producing chips for its clients but also for enabling the future of AI technology. Reporting a remarkable 41% year-over-year sales increase in the third quarter of 2025, driven mainly by demand from smartphones and autonomous vehicles, TSMC demonstrates strong growth potential. With a gross margin of 59.5% and operating margin of 50.6%, the stock’s current price-to-earnings ratio (P/E) of 31 positions it as an attractive investment with promising prospects for continued growth.

Another significant player is Alphabet, the parent company of Google, which commands around 90% of the global search engine market. This commanding presence creates a self-reinforcing advantage, as increased user searches lead to improved product offerings and advertising revenue. Alphabet utilizes AI to enhance user engagement and optimize its advertising strategies. Trading at a P/E of 31, Alphabet’s diversified portfolio beyond Google—including YouTube and Android—enhances its long-term appeal for investors.

Amazon stands out as the largest global cloud services provider, controlling nearly a third of the market. CEO Andy Jassy emphasizes the transformative shift from on-premises spending to cloud solutions, indicating a robust growth trajectory over the next decade. Amazon plans to invest over $125 billion in AI development by 2026, more than any other major competitor. As Amazon Web Services (AWS) continues to grow at an accelerated rate of more than 20% year over year, the company’s diversified business model and a P/E ratio of 33 make it a compelling long-term investment.

On the other hand, Nvidia has established itself as a formidable force in the AI sector, despite facing increased competition as more companies enter the market. Nvidia’s extensive portfolio and commitment to innovation keep it at the forefront, although its stock trades at a high P/E of 47. Analysts project that Nvidia’s earnings per share (EPS) will more than triple by 2028, suggesting that if the company maintains its growth trajectory, it could continue to outperform the market in 2026.

Lastly, Lemonade offers a unique take on AI application within the insurance industry. Utilizing AI and machine learning from its inception, Lemonade has developed a streamlined system for pricing and processing claims. This approach has resonated with younger consumers, resulting in a 30% year-over-year growth in in-force premiums reported in the third quarter. As Lemonade aims for adjusted EBITDA breakeven this year, its potential for stock price appreciation could be substantial as it scales its operations.

As these companies navigate a rapidly evolving landscape driven by AI advancements, their resilience and growth potential remain in focus. Investors appear optimistic about the opportunities in this sector, but prudent diversification remains essential in managing risks associated with potential market fluctuations. The unfolding narrative of AI will significantly influence market dynamics, making the upcoming years crucial for these industry leaders.

See also Grok AI Faces Backlash for Non-Consensual Image Manipulation of World Leaders

Grok AI Faces Backlash for Non-Consensual Image Manipulation of World Leaders DeepSeek Unveils mHC Method to Revolutionize AI Training for Scalable Language Models

DeepSeek Unveils mHC Method to Revolutionize AI Training for Scalable Language Models AI Chatbots’ Dark Side: 33% of Teens Use Them for Emotional Support, Raising Concerns

AI Chatbots’ Dark Side: 33% of Teens Use Them for Emotional Support, Raising Concerns AI in Healthcare: Payment Battles Intensify as 20+ Devices Await CPT Codes by 2026

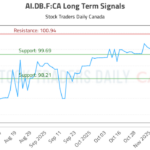

AI in Healthcare: Payment Battles Intensify as 20+ Devices Await CPT Codes by 2026 AI.DB.F:CA Trading Strategy Revealed—Buy at 99.69, Target 100.94 with Neutral Outlook

AI.DB.F:CA Trading Strategy Revealed—Buy at 99.69, Target 100.94 with Neutral Outlook