HCL Technologies is set to report its third-quarter fiscal results for 2026 on January 19, 2026, amid growing expectations for continued growth in the technology services sector. The announcement comes at a time when the company is focusing on various strategic initiatives, including advancements in artificial intelligence and maintaining its growth momentum. Analysts will be closely watching the earnings call for insights into HCL’s performance and future guidance.

The company has been under scrutiny regarding its ability to sustain growth rates, particularly as it navigates a competitive landscape marked by rapid technological advancements. In the previous quarter, HCL reported a significant increase in both revenue and net income, bolstered by strong demand for its IT services. This trend has set a positive tone leading up to the upcoming earnings report.

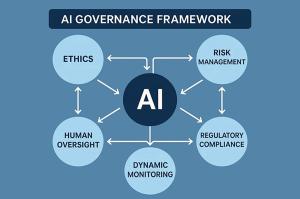

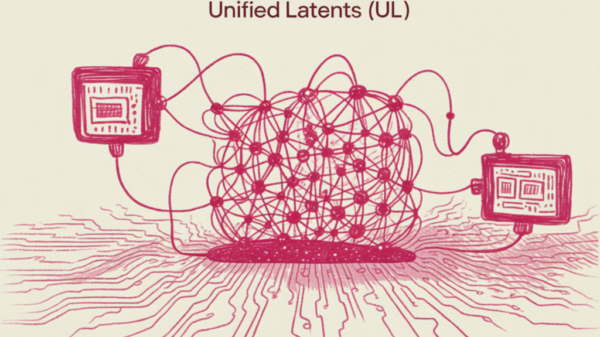

One of the key areas of interest for investors and analysts is HCL’s approach to AI adoption. The company’s leadership has indicated a commitment to integrating AI solutions into its service offerings, which is seen as crucial for enhancing operational efficiency and meeting client demands. As businesses increasingly look towards digital transformation, HCL’s initiatives in AI may provide a competitive edge.

The upcoming earnings call is also expected to address the company’s dividend policy, which has garnered attention in light of fluctuating market conditions. HCL Technologies has historically maintained a consistent dividend payout, and any changes to this policy could influence investor sentiment. The management’s stance on dividends will likely be a focal point for stakeholders eager to gauge the company’s financial health.

In the broader context, HCL’s performance will be compared against its peers in the IT services sector, particularly in light of ongoing economic challenges. Companies like TCS and Infosys have also reported mixed results, reflective of the varying impacts of inflation and global supply chain disruptions on technology spending. As these companies adapt to shifting market conditions, HCL’s strategies and financial outcomes will be critical to watch.

The significance of this earnings report extends beyond HCL, as it could provide insights into the overall health of the IT services industry, particularly in relation to AI investments. Analysts predict that companies emphasizing AI capabilities may be better positioned to leverage growth opportunities in a rapidly evolving landscape. As the demand for digital solutions continues to rise, the outcomes of this earnings call may inform future trends in technology spending.

As HCL Technologies prepares to unveil its results, stakeholders are poised to assess how effectively the company is adapting to current market dynamics. The focus on AI adoption, revenue growth, and dividend strategies will likely shape investor expectations in the coming months. With a commitment to innovation and strategic growth, HCL’s performance in the third quarter will be pivotal in determining its trajectory moving forward.

For more information, you can visit HCL Technologies.

See also Anthropic Launches HIPAA-Ready Claude Tools for Healthcare, Enhancing Billing and Compliance

Anthropic Launches HIPAA-Ready Claude Tools for Healthcare, Enhancing Billing and Compliance Unit4 Celebrates 100th ERPx Go-Live, Accelerates AI Investments Amid Growing Demand

Unit4 Celebrates 100th ERPx Go-Live, Accelerates AI Investments Amid Growing Demand AI Mimics Human Perception of Optical Illusions Using Quantum-Driven Neural Networks

AI Mimics Human Perception of Optical Illusions Using Quantum-Driven Neural Networks Alibaba Cloud’s Qwen AI Models Surpass 700 Million Downloads on Hugging Face

Alibaba Cloud’s Qwen AI Models Surpass 700 Million Downloads on Hugging Face Gates Forecasts AI-Driven Wealth Shift: Urgent Call for Investment in Global Health and Climate Solutions

Gates Forecasts AI-Driven Wealth Shift: Urgent Call for Investment in Global Health and Climate Solutions