Intel is set to redefine its strategy following a significant investment from the Trump administration, aiming to regain its dominance in the semiconductor market. The company’s newly appointed CEO, Lip-Bu Tan, is spearheading this transformation with a focus on artificial intelligence (AI) as a cornerstone of its revitalization efforts.

Historically, Intel has been a leading player in chip manufacturing but has struggled to keep pace with competitors like Qualcomm and Nvidia over the past decade, particularly in mobile and AI markets. While Intel continues to lead in laptop and desktop chip production, it faces intensified competition, compelling the company to innovate and adapt.

Under Tan’s leadership since March, Intel is rolling out the Core Ultra Series 3 chip, which is expected to feature in nearly every major laptop launch this year. However, the company recognizes that merely being a dominant force in laptops won’t suffice; it aims to embed its chips in a broader array of devices, including robots, to tap into AI’s burgeoning market.

“The devices between PCs and the cloud are almost infinite,” said Jim Johnson, head of Intel’s client computing group, during an interview at the CES tech conference in Las Vegas. This vision underscores the company’s intent to expand beyond traditional computing and into emerging tech sectors.

According to the International Data Corporation, Intel holds over 71% of the PC chip market as of 2024, although the company is under increasing pressure from competitors like AMD, which has announced new chips that can handle larger AI models without cloud reliance. Meanwhile, Apple has shifted to its own processors for MacBooks, further intensifying the competitive landscape. Additionally, Intel’s stock has declined over 18% in the last five years, reflecting investor concerns about its future.

Intel’s strategy with the new chip involves enhancing not only AI capabilities but also traditional performance metrics that consumers prioritize, such as battery life. The new chip is anticipated to support over 200 new PC designs, optimizing them for AI applications like coding tools and enhanced video conferencing services.

Johnson emphasized that consumer needs for AI capabilities vary widely, stating, “It’s like, what does a reporter need that may be different than what a gamer wants?” This tailored approach is essential as Intel navigates a landscape where its rivals are rapidly advancing.

AMD’s recent announcements at CES highlight its commitment to AI, with new chips designed to enhance privacy and reduce latency for users. Similarly, Qualcomm, a smaller player in the PC sector, introduced a new laptop chip that promises multi-day battery life and is optimized for AI functions.

In this competitive environment, Intel must avoid past strategic errors, which includes not only understanding consumer preferences but also ensuring its chips can match or exceed rival performance. The company is actively engaging with its customers, encouraging feedback to address concerns promptly.

Innovations in humanoid robotics are also being explored as potential growth areas for Intel. Companies like Oversonic Robotics, known for building humanoid robots for healthcare, have opted to switch from Nvidia to Intel’s Core Ultra 3 chip, citing lower costs and faster performance. However, Oversonic still uses Nvidia’s technology for training its AI models, demonstrating the complexities of the competitive landscape.

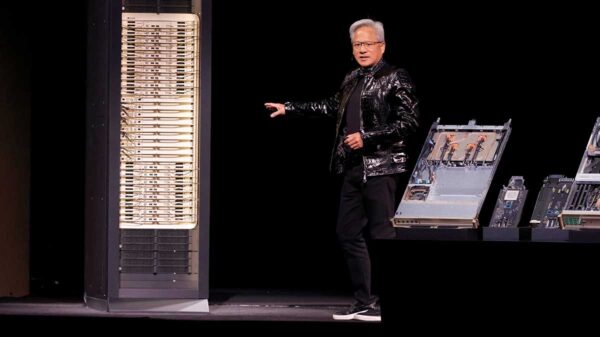

Despite Intel’s advancements, Nvidia remains a dominant force in the AI sector, with its chips being central to data centers powering AI services. The company recently marked a milestone as the world’s first $5 trillion public company, bolstered by its extensive work in robotics and AI technologies showcased at CES.

The demand for humanoid robots remains uncertain, with industry analysts noting that operational deployments are currently sparse due to technical challenges. Nevertheless, Johnson maintains an optimistic outlook for Intel, underscored by a 84% stock increase in 2025 and a 98% year-over-year surge, buoyed in part by a 10% investment from the U.S. government.

“I see Intel getting back in shape like it used to be,” Johnson remarked, reflecting the company’s renewed focus on innovation and customer satisfaction as it strives to reclaim its leadership position in the semiconductor space.

For further information, visit Intel’s official website, and for insights on the latest AI technologies, check Nvidia and Qualcomm.

See also China Targets AI Supremacy by 2027 with Safe, Reliable Tech Supply Plan

China Targets AI Supremacy by 2027 with Safe, Reliable Tech Supply Plan Nvidia Tightens H200 Chip Sales Amid China’s Regulatory Uncertainty, Demand Surges

Nvidia Tightens H200 Chip Sales Amid China’s Regulatory Uncertainty, Demand Surges Modi Urges Indian AI Startups to Lead Global Innovation with Ethical, Inclusive Models

Modi Urges Indian AI Startups to Lead Global Innovation with Ethical, Inclusive Models