Investors looking to enter the world of artificial intelligence (AI) stocks now have the option to do so with as little as $100. Contrary to the misconception that substantial capital is required—propagated by the soaring stock prices of prominent AI companies—individuals can gain exposure to a diverse array of leading AI players through an exchange-traded fund (ETF) designed by renowned analyst Dan Ives. The Dan Ives Wedbush AI Revolution ETF was launched by Wedbush in June, allowing investors to tap into Ives’ extensive expertise without needing to be industry experts themselves.

The ETF, trading near $33 per share, offers a practical investment vehicle for those with limited funds. Ives, a managing director and senior equity research analyst at Wedbush, has structured the ETF to include companies benefiting from the AI spending cycle, spanning sectors from infrastructure to implementation. This makes it an attractive option for investors who may not have the resources to build a diversified portfolio of individual AI stocks.

Exchange-traded funds like the Ives ETF enable investors to purchase a basket of stocks related to a specific theme, such as AI technology. This provides immediate diversification, which can help mitigate risks associated with individual stock performance. As many investors may find it challenging to allocate funds across various stocks and industries, the Ives ETF simplifies this process.

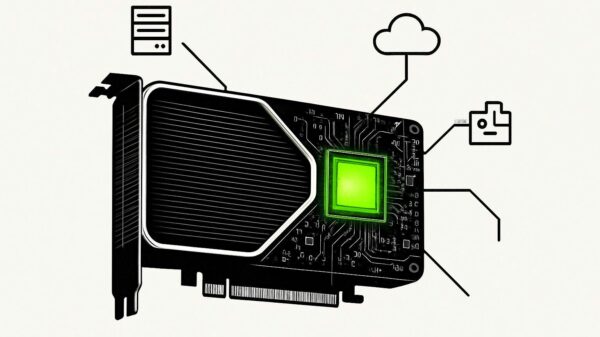

The fund’s current holdings reflect a well-researched approach. The most heavily weighted stock is Taiwan Semiconductor Manufacturing (TSMC), which is pivotal in producing AI chips for industry giants such as Nvidia and Advanced Micro Devices. TSMC constitutes over 5% of the ETF, followed closely by other major players like Micron Technology, Amazon, and Nvidia. A recent update revealed that the fund has expanded its holdings to include cybersecurity firm CrowdStrike and AI cloud services provider Nebius Group, reflecting Ives’ assessment of the evolving AI landscape.

“The AI Revolution is no longer just about chips and cloud,” stated the Wedbush research team in their recent update. “Security, consumer platforms, and power infrastructure are now in focus.” This insight underscores the ETF’s adaptability in a rapidly changing market, as it seeks to capitalize on emerging trends and technologies.

Investing in the Ives ETF not only provides a gateway into the AI sector but also offers a diversified approach to risk management. As AI technology continues to permeate various industries, from healthcare to finance, the fund positions itself as a strategic option for those looking to benefit from this growth. With the potential for significant returns, the ETF serves as a viable entry point for retail investors who may otherwise struggle to construct a balanced portfolio across multiple AI companies.

In conclusion, as the AI boom accelerates, the Dan Ives Wedbush AI Revolution ETF emerges as a compelling choice for investors aiming to invest $100 or less. By leveraging Ives’ research and market insights, investors can participate in the burgeoning AI landscape without requiring extensive capital or expertise, marking a significant opportunity in the current investment climate.

See also Mistral AI Partners with France to Enhance Defense Operations with Advanced AI Solutions

Mistral AI Partners with France to Enhance Defense Operations with Advanced AI Solutions AI Revolutionizes Cybersecurity: Predictive Models Flag 1,100 Fraud Attempts Before Approval

AI Revolutionizes Cybersecurity: Predictive Models Flag 1,100 Fraud Attempts Before Approval Apple Glasses Poised to Drive AI Glasses Market from 6M to 20M Units in 2026

Apple Glasses Poised to Drive AI Glasses Market from 6M to 20M Units in 2026 Nvidia’s NVentures Invests in Harmonic AI’s $120M Series C for Advanced Math Engine

Nvidia’s NVentures Invests in Harmonic AI’s $120M Series C for Advanced Math Engine AI’s Global Impact in 2026: U.S.-China Rivalry Fuels Sovereign Models, Data Control, and Governance

AI’s Global Impact in 2026: U.S.-China Rivalry Fuels Sovereign Models, Data Control, and Governance