AI Investment Outlook for 2026

Investing in the artificial intelligence (AI) sector is expected to remain a strong strategy through 2026, with analysts from Bank of America affirming that AI is “the place to be.” Amid a surge in company valuations attributed to AI advancements, three firms stand out as particularly well-positioned for sustained growth: Nvidia, International Business Machines (IBM), and Astera Labs.

These companies operate across diverse aspects of the AI landscape, offering investors the opportunity for portfolio diversification while benefiting from the ongoing demand for AI solutions. Nvidia, a pivotal player in the AI ecosystem, has established itself through its advanced semiconductor technology and software capabilities. IBM is making significant strides in quantum computing, while Astera Labs plays a crucial role in enhancing AI infrastructure with its connectivity solutions.

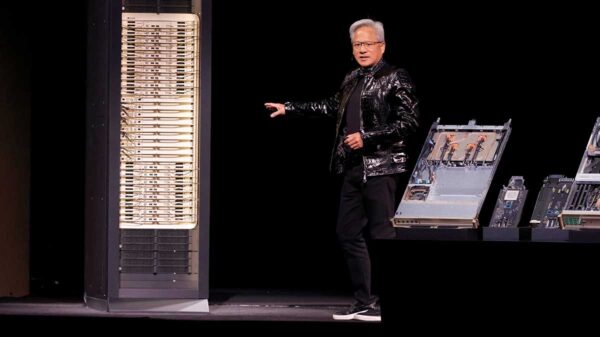

Nvidia’s reputation for delivering cutting-edge semiconductor chips for AI applications is well-documented. Equally significant is its compute unified device architecture (CUDA) software platform, which has become a key asset for the company. CUDA empowers customers to tailor Nvidia’s hardware to their specific operational needs, solidifying its status as the industry standard for AI programming. This competitive edge contributed to Nvidia’s remarkable fiscal performance, with revenue reaching $147.8 billion in the first nine months of 2025, a notable increase from $91.2 billion in the previous year. The company has partnered with major players like Palantir Technologies, Uber Technologies, and Intel, further embedding itself within the AI sector. Palantir is utilizing CUDA for its AI initiatives, while Uber plans to leverage Nvidia technology in its self-driving fleet by 2027. Intel’s collaboration with Nvidia aims to deliver AI-enabled PCs and custom chips for data centers.

IBM, known as Big Blue, is on the cusp of a transformative leap in computing. The company anticipates achieving quantum advantage by the end of 2026, a breakthrough that would enable its quantum computers to outperform conventional supercomputers in complex calculations. This capability is critical for evolving AI applications, and IBM’s recent announcements about its quantum computing progress have already paid dividends, with its stock reaching an all-time high of $324.90. Moreover, IBM offers a robust dividend, yielding over 2%, and has consistently increased its dividend payouts for 30 consecutive years, presenting a reliable income stream for investors.

Astera Labs, while less renowned, has made significant strides in supporting AI infrastructure. Investing legend Warren Buffett has often advocated for “boring” stocks, and Astera might fit that definition. The company specializes in connectivity solutions that optimize data center operations, crucial for the effective functioning of AI systems. With AI driving the need for upgraded tech infrastructure, Astera Labs reported record Q3 revenue of $230.6 million, marking a 104% year-over-year increase. Its net income rose significantly to $91.1 million, a remarkable turnaround from the previous year’s loss of $7.6 million. However, Astera’s forward price-to-earnings (P/E) ratio stands at about 77, suggesting that the stock is currently priced higher than its peers, making it advisable to wait for a more favorable entry point.

While Astera Labs holds potential, it did not make the recent list of the 10 best stocks identified by The Motley Fool’s analyst team, which suggests that other stocks may offer better immediate prospects. Historical comparisons highlight the potential benefits of investing early in winning stocks, as demonstrated by Netflix and Nvidia, both of which produced substantial returns for early investors.

The landscape of AI investment is evolving, and these three companies exemplify the diverse opportunities within the sector. As AI technology continues to advance and integrate into various industries, firms like Nvidia, IBM, and Astera Labs are well-positioned to harness this trend, potentially delivering significant returns for investors through 2026 and beyond. For those considering an investment in the AI sector, evaluating the respective strengths and market positions of these companies may provide valuable insights into future opportunities.

To stay informed, explore more about these companies: Nvidia, IBM, and Astera Labs.

See also Samsung Unveils Bespoke AI Appliances to Transform Homes at CES 2026, Enhancing Smart Living

Samsung Unveils Bespoke AI Appliances to Transform Homes at CES 2026, Enhancing Smart Living Microsoft Cancels Exchange Online’s 2,000 Recipient Limit, Shifts to AI-Driven Protections

Microsoft Cancels Exchange Online’s 2,000 Recipient Limit, Shifts to AI-Driven Protections LG Unveils W6 Wallpaper TV: 4K at 165Hz, Reflection-Free, and Art Display Features at CES 2026

LG Unveils W6 Wallpaper TV: 4K at 165Hz, Reflection-Free, and Art Display Features at CES 2026 Utah Tests $4 AI Prescription Refills, Streamlining Chronic Care with Doctronic

Utah Tests $4 AI Prescription Refills, Streamlining Chronic Care with Doctronic Startups Shift Strategies Amid Antitrust Scrutiny, Embrace Reverse Acquihires and Centaurs

Startups Shift Strategies Amid Antitrust Scrutiny, Embrace Reverse Acquihires and Centaurs