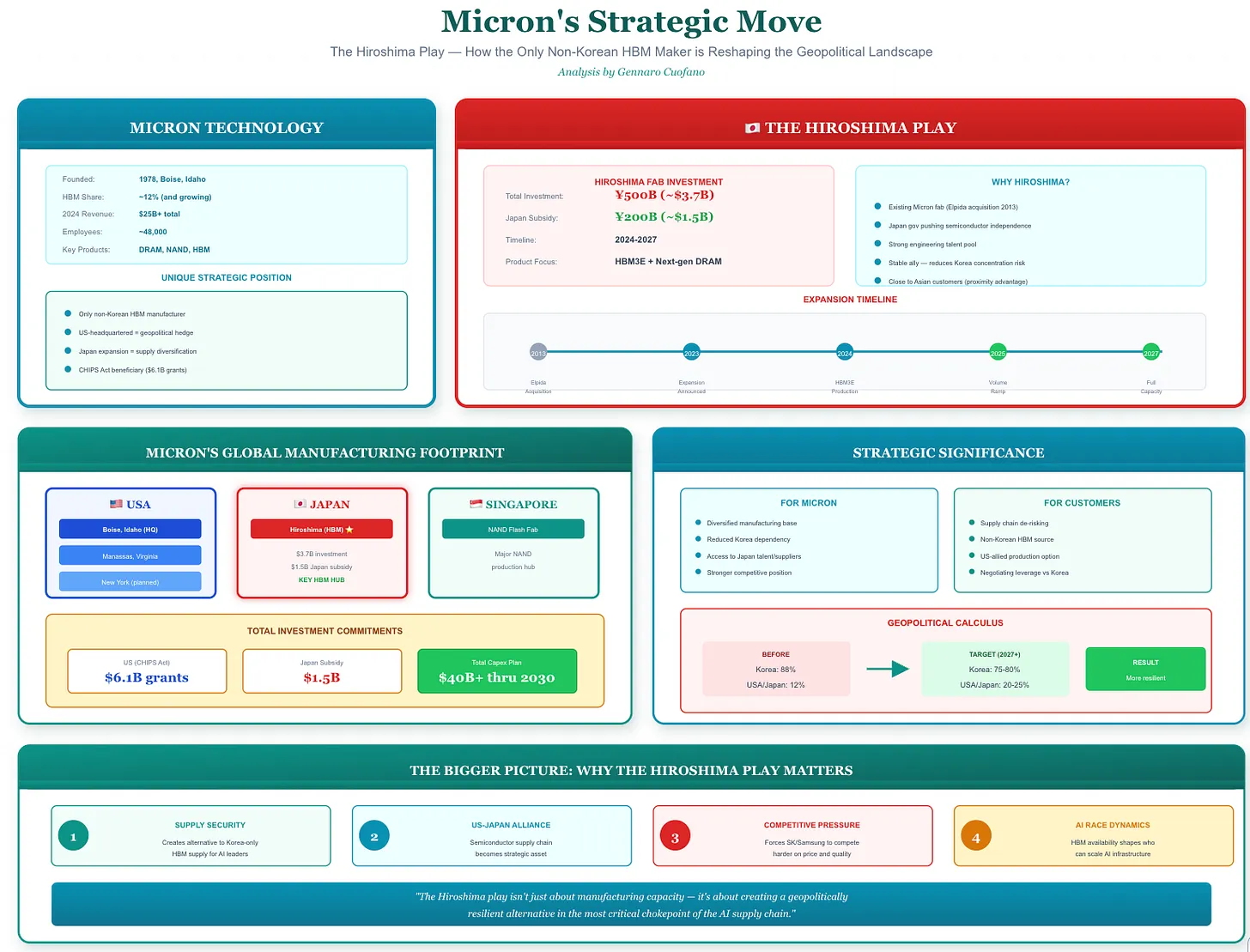

Micron Technology is taking a bold step in the global memory industry with its recent announcement to invest $3.7 billion in a new facility in Hiroshima, Japan. This move positions Micron as a key player in the memory supply chain for artificial intelligence (AI), as the demand for high-bandwidth memory (HBM) surges. The investment, supported by ¥200 billion in subsidies from the Japanese government, reflects a strategic shift not merely in manufacturing but in geopolitical dynamics surrounding AI technology.

Micron’s unique standing in the memory market is underscored by several factors. It is the only non-Korean HBM supplier, the sole DRAM manufacturer based in the U.S., and boasts significant production capacity outside of Korea, which dominates the market. As AI applications intensify, the demand for memory has become a critical bottleneck, making Micron’s geographic footprint an essential asset in a world increasingly reliant on AI technologies.

The partnership with Japan signifies more than capital injection; it is part of a broader industrial strategy to fortify semiconductor independence in the region. The Hiroshima facility will leverage a skilled workforce, distance from Korean supply risks, and proximity to major Asian technology firms, creating an advantageous environment for innovation and production. Scheduled to commence volume production in 2026 and reach full capacity by 2027, this facility is set to align with the global transition toward HBM4 architectures, where memory bandwidth and stack height will be pivotal.

Micron’s manufacturing base now spans multiple locations, including Boise, Idaho, Manassas, Virginia, and a new facility in New York, all contributing to a diversified strategy to mitigate supply risks and enhance resilience. The integration of operations in Japan and existing capabilities in Singapore solidifies Micron’s stance as a formidable competitor against industry giants like Samsung and SK Hynix.

This expansion comes at a crucial time as the semiconductor sector grapples with supply chain vulnerabilities. With Korea currently accounting for 88% of global HBM production, Micron’s efforts could shift this dynamic significantly. By 2027, projections suggest that Korea’s share may drop to between 70% and 80%, while the U.S. and Japan could collectively increase their share to 20% to 25%. Such a shift aims to create a more resilient supply chain capable of supporting the growing demands of AI.

The implications for customers such as NVIDIA, AMD, and other major hyperscalers are profound. Micron’s approach offers a credible alternative to Korean suppliers, which are often perceived as risky due to geopolitical tensions. This diversification not only reduces dependency on a single region but also enhances negotiating leverage for customers, who can now explore dual-sourcing options, thereby stabilizing supply contracts and mitigating exposure to geopolitical disruptions.

Moreover, the collaboration between the U.S. and Japan in the semiconductor space is fostering a strategic alliance that extends across memory, logic production, and manufacturing materials. As the AI race intensifies, control over HBM supply will be fundamental, and Micron’s diversified manufacturing strategy places it in a unique position to influence this critical component of the AI ecosystem.

In conclusion, Micron’s investment in Hiroshima is emblematic of a larger trend in the semiconductor industry, where collaboration and geographic diversification are becoming essential for resilience. As the memory landscape evolves, Micron’s strategic choices will not only impact its own future but also shape the trajectories of its customers and the broader AI market, where memory bandwidth and reliability are paramount. The emergence of a geopolitically resilient alternative in the memory supply chain could redefine competitive dynamics in the AI sector.

For more information, you can visit Micron’s official website, NVIDIA, and AMD.

See also OpenAI Disables ChatGPT Ads After Subscriber Backlash Over Intrusive Promotions

OpenAI Disables ChatGPT Ads After Subscriber Backlash Over Intrusive Promotions Investors Forecast Stagnant Growth Amid Rising Cyber Risks and AI Transparency Demands

Investors Forecast Stagnant Growth Amid Rising Cyber Risks and AI Transparency Demands Top 15 Retail GCC Leaders in India Transforming Global Brands with AI and Digital Innovation

Top 15 Retail GCC Leaders in India Transforming Global Brands with AI and Digital Innovation Warner Bros. Discovery Sues Midjourney for $150K per Copyright Infringement Claim

Warner Bros. Discovery Sues Midjourney for $150K per Copyright Infringement Claim AI in Manufacturing Market Set to Surge to $76.73 Trillion by 2035, Driven by Automation and Predictive Maintenance

AI in Manufacturing Market Set to Surge to $76.73 Trillion by 2035, Driven by Automation and Predictive Maintenance