Nvidia’s (NVDA) recent partnership with Microsoft (MSFT) and Anthropic highlights the chipmaker’s aggressive strategy in the artificial intelligence (AI) sector, reflecting a remarkable pace of dealmaking this year. This move arrives amid investor concerns over circular agreements within the AI landscape, raising questions about the sustainability of these investments.

According to data from PitchBook, Nvidia has invested approximately $23.7 billion in AI firms through 59 deals from the start of 2025 to the present day. In 2024 alone, the company completed 54 deals valued at around $22.8 billion. From 2020 to 2025, Nvidia’s total investments in AI firms have reached nearly $53 billion across 170 deals.

The newly announced collaboration involves Nvidia and Microsoft committing up to $10 billion and $5 billion in funding, respectively, for AI developer Anthropic (ANTH.PVT). As part of the agreement, Anthropic will purchase $30 billion worth of compute capacity from Microsoft Azure while collaborating with Nvidia on design and engineering efforts.

This partnership follows Nvidia’s notable investments last year, including a $6.6 billion investment in OpenAI (OPAI.PVT) in October and a $6 billion investment in Elon Musk’s xAI (XAAI.PVT) in November. Furthermore, Nvidia has pledged to invest up to $100 billion in OpenAI in a deal announced this September, which had a positive impact on its stock price.

Nvidia’s substantial financial input into the AI sector signals its intent to solidify its position in a market that has experienced explosive growth following the emergence of generative AI technologies like ChatGPT in 2022. As the leading provider of AI chips, Nvidia’s GPUs (graphics processing units) play a vital role in training and executing AI models.

Nevertheless, analysts and investors are beginning to scrutinize the nature of Nvidia’s investments, particularly in relation to its direct customers. Recent volatility in tech stocks has raised concerns about a potential bubble fueled by AI hype.

“It’s very murky,” stated Jay Goldberg, an analyst at Seaport, who has issued a rare Sell rating on Nvidia stock. He elaborated on Nvidia’s investment in OpenAI, suggesting that the partnership could artificially inflate demand for Nvidia’s chips. “To what degree is Nvidia investing versus buying demand or subsidizing demand?”

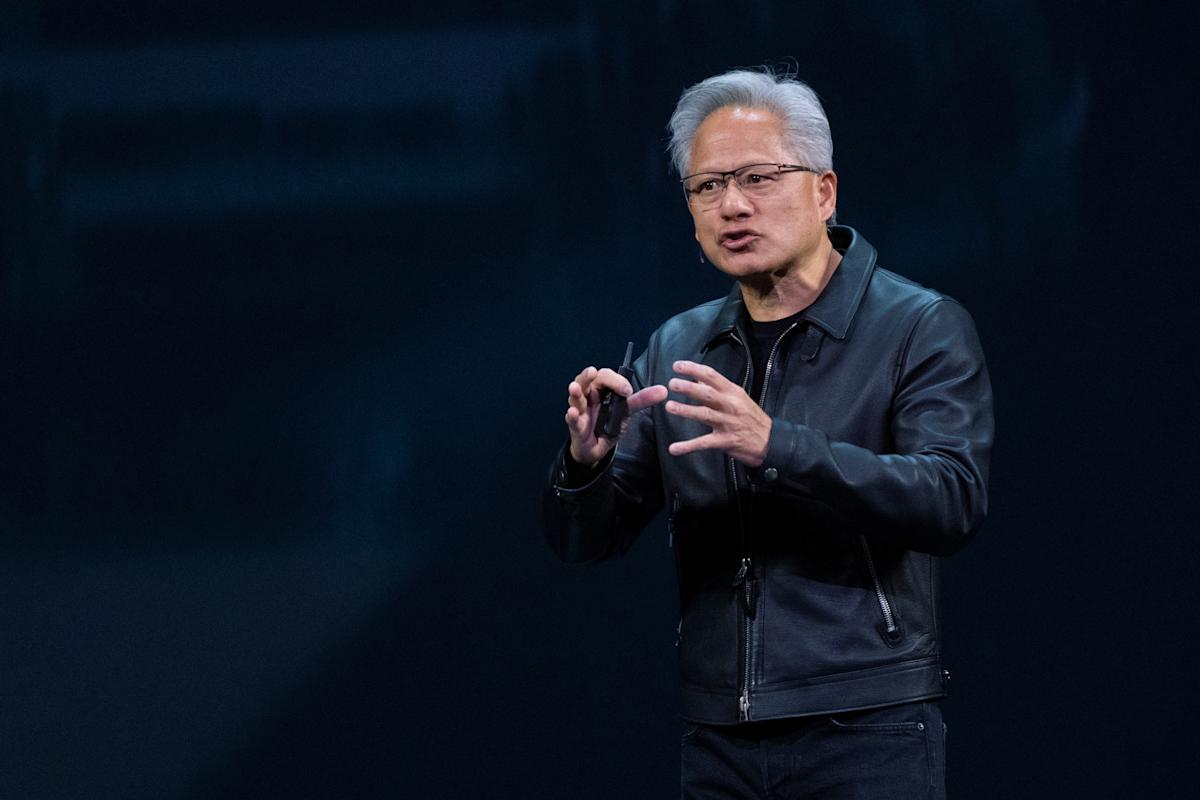

Nvidia has refrained from commenting on its investments in its own customers. When Nvidia CEO Jensen Huang was questioned about the implications of the investment in OpenAI during a recent podcast, he emphasized that this financial commitment is separate from the revenue Nvidia anticipates from the AI developer. “OpenAI is likely going to be the next multitrillion-dollar hyperscale company, and who doesn’t want to be an investor in that?” Huang remarked, expressing some regret for not investing earlier.

Despite the critiques, many analysts concur with Huang’s perspective, believing Nvidia’s significant investments in AI, such as its partnership with OpenAI, are strategic moves that will enhance the overall AI ecosystem. Bernstein analyst Stacy Rasgon noted, “I could argue that there’s no better use of Nvidia’s cash right now,” reinforcing the notion that such investments serve to bolster Nvidia’s standing in the market.

Nvidia is expected to release its earnings report shortly, which may provide additional insights into the company’s financial strategies and the performance of its recent investments.

See also EU Launches Investigations into Amazon and Microsoft as Potential Cloud Gatekeepers

EU Launches Investigations into Amazon and Microsoft as Potential Cloud Gatekeepers OpenAI’s GPT-5 Update Sparks Controversy Among AI Relationship Users and Community Reactions

OpenAI’s GPT-5 Update Sparks Controversy Among AI Relationship Users and Community Reactions Amitabh Kant Warns of Neo-Colonization as Global AI Firms Access Indian Data for Free

Amitabh Kant Warns of Neo-Colonization as Global AI Firms Access Indian Data for Free Laura Davis Highlights Texas’ AI Leadership at Texas Dynamism Summit with Key Insights on Innovation

Laura Davis Highlights Texas’ AI Leadership at Texas Dynamism Summit with Key Insights on Innovation Perplexity AI Secures FedRAMP Prioritization, Offers Government Services at $0.25 per Agency

Perplexity AI Secures FedRAMP Prioritization, Offers Government Services at $0.25 per Agency