On January 8, 2026, investors grappling with soaring demand forecasts for artificial intelligence weighed these figures against concerns regarding valuation, access to the Chinese market, and capital intensity. Shares of Nvidia (NVDA 2.09%), a leader in GPU and AI solutions, ended Thursday’s trading session at $185, down 2.17%. Since its initial public offering in 1999, Nvidia has seen an extraordinary growth rate of 450,934%. However, trading volume on Thursday reached 163.5 million shares, which was nearly 12% below its three-month average of 185.9 million shares.

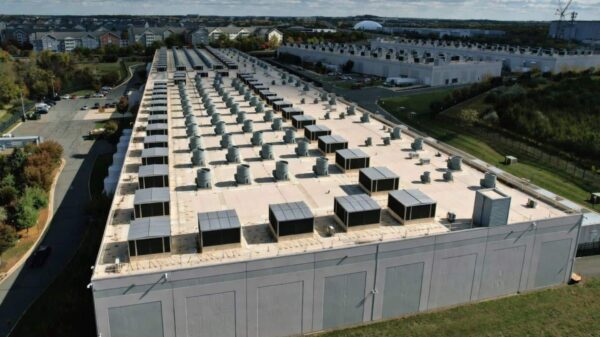

This dip in share price came as analysts noted that AI demand could potentially exceed $500 billion by 2026, alongside a renewed focus on Nvidia’s access to its H200 chips in China. Investors are closely monitoring Nvidia’s growth in the data center segment and the ongoing demand for AI chips as key indicators of the company’s future trajectory.

The S&P 500 (^GSPC +0.01%) closed nearly flat at 6,921, while the Nasdaq Composite (^IXIC 0.44%) fell 0.44% to 23,480. Among semiconductor peers, Advanced Micro Devices (AMD 2.54%) saw a decrease of 2.54%, and Intel (INTC 3.53%) declined 3.57%. This suggests that leading chipmakers remain under pressure, despite the robust narratives surrounding AI servers and data centers.

Nvidia has established itself as a bellwether in the AI space, and the recent market behavior may indicate that investors are seeking to diversify their portfolios. Nonetheless, Nvidia’s growth runway appears extensive. Company CFO Colette Kress noted during an investor event that demand for Nvidia’s AI products could exceed $500 billion through 2026. This ambitious forecast reflects both the potential for substantial revenue growth and the competitive landscape in AI technology.

Market speculation suggests that investors may be capitalizing on profits following Nvidia’s impressive stock performance in 2025. However, with business prospects appearing solid, the potential for future appreciation in Nvidia’s stock value remains considerable. Investors are keenly observing how the company navigates challenges related to supply and demand dynamics, especially in light of geopolitical factors impacting access to key components.

Investor Howard Smith holds positions in both Intel and Nvidia. He has taken a bearish stance on Nvidia, shorting February 2026 $170 calls, while also shorting March 2026 $26 calls on Intel. Meanwhile, The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, and Nvidia, suggesting a consensus on the industry’s future potential despite recent market fluctuations.

The ongoing evolution of the semiconductor and AI sectors seems poised to shape not only Nvidia’s fortunes but also the broader technology landscape in the coming years. As AI demand shifts from projections to realized revenue, the ability of companies like Nvidia to capitalize on emerging opportunities will be critical in determining their market standing and investor confidence.

See also Unlock Massive Returns: Invest in These 3 AI Stocks Transforming the Tech Landscape

Unlock Massive Returns: Invest in These 3 AI Stocks Transforming the Tech Landscape Microsoft Launches Agentic AI Solutions for Retail: Streamlining Operations and Enhancing Customer Engagement

Microsoft Launches Agentic AI Solutions for Retail: Streamlining Operations and Enhancing Customer Engagement Germany’s Mittelstand Slashes AI Investment to 0.35% of Revenue Amid Rising Corporate Spending

Germany’s Mittelstand Slashes AI Investment to 0.35% of Revenue Amid Rising Corporate Spending Neo and SpoonOS Unveil Scoop AI Hackathon Seoul Bowl Winners, Awarding $8,000 in Prizes

Neo and SpoonOS Unveil Scoop AI Hackathon Seoul Bowl Winners, Awarding $8,000 in Prizes