The launch of ChatGPT in November 2022 marked a transformative moment in the technology sector, rapidly evolving into a global phenomenon. This conversational AI model has not only captivated users but has also significantly altered the stock market landscape.

According to Bloomberg, the financial ramifications following ChatGPT’s debut reflect a major realignment within the market. A select group of Big Tech companies has experienced unprecedented growth, paving the way for a new tech-driven market environment.

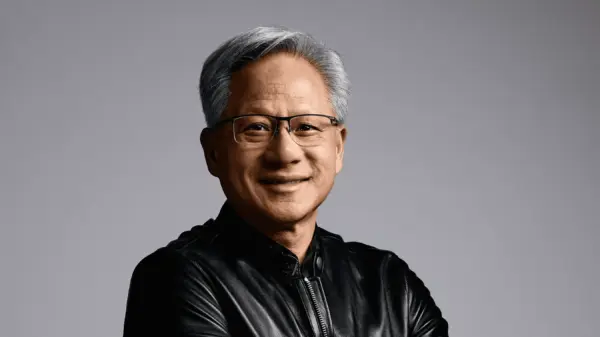

The most notable beneficiary has been Nvidia, whose stock has skyrocketed by an astonishing 979% since the chatbot’s introduction. This surge is closely linked to the company’s essential role in supplying the hardware that sustains the AI revolution.

This AI-driven excitement has also positively impacted other technology giants. The seven most valuable companies in the S&P 500 are all tech-related, and their combined growth accounts for nearly half of the benchmark’s remarkable 64% increase. These firms include Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta, and Broadcom. As a result, the market has become increasingly top-heavy; these seven companies now represent 35% of the S&P 500’s weighting, a significant rise from about 20% three years ago.

However, industry leaders are beginning to question the sustainability of this market trajectory. There are growing concerns regarding the possibility of an AI bubble, reminiscent of the dot-com boom in the late 1990s. OpenAI CEO Sam Altman has cautioned that significant financial losses are likely, stating that someone will inevitably lose a “phenomenal amount of money” in AI investments. Similarly, Bret Taylor, CEO of Sierra and board chair of OpenAI, concurred, suggesting that while we might be in an AI bubble, the technology will ultimately reshape the economy and create enormous value, akin to the internet’s impact.

This emerging reality has stirred a pervasive sense of uncertainty across different generations. Younger workers now encounter unpredictable career paths in an evolving marketplace, while older individuals fear that their skills could soon become obsolete. As the landscape continues to shift, the implications for both groups are profound and unsettling.

The impact of the ChatGPT phenomenon on the stock market is unmistakable, defining clear winners and fostering a concentrated market structure. The overarching question remains whether this AI-induced growth represents a lasting economic transformation or whether it is merely a speculative bubble, poised to burst. The answer to this dilemma will likely shape the financial landscape for years to come.

For more information about the potential volatility in the AI market, visit OpenAI or explore the latest developments at Nvidia.

See also Wall Street Eyes AI Profitability, Economic Signals as Fed Rate Cut Bets Surge

Wall Street Eyes AI Profitability, Economic Signals as Fed Rate Cut Bets Surge OpenAI Limits Sora to 6 Free Videos Daily; Google Caps Nano Banana Pro to 2 Images

OpenAI Limits Sora to 6 Free Videos Daily; Google Caps Nano Banana Pro to 2 Images Trump’s Draft EO Aims to Override State AI Laws, Centralizing Federal Control Over AI Regulation

Trump’s Draft EO Aims to Override State AI Laws, Centralizing Federal Control Over AI Regulation Google Deletes Infographic After Plagiarism Allegations from Food Blogger; Faces Backlash Over AI Practices

Google Deletes Infographic After Plagiarism Allegations from Food Blogger; Faces Backlash Over AI Practices Accenture Partners with OpenAI to Upskill 50,000 Professionals with ChatGPT Enterprise

Accenture Partners with OpenAI to Upskill 50,000 Professionals with ChatGPT Enterprise