Billionaire investor Peter Thiel has made significant changes to his investment strategy, selling his entire stake in chipmaker Nvidia (NVDA) and reducing his holdings in Tesla (TSLA). These moves come amid rising concerns over a potentially overinflated “AI Bubble.” According to Thiel Macro LLC’s latest 13F filing for the September quarter, the fund’s portfolio shrank from $212 million at the end of Q2 to $74.4 million as of September 30, 2025.

Alongside the divestment from Nvidia, Thiel’s fund also exited its entire position in Vistra Corp. (VST), a U.S. electricity generation company involved in various energy sectors including natural gas, solar, and nuclear power. Conversely, Thiel increased his stakes in Microsoft (MSFT) and Apple (AAPL). Following these transactions, Thiel Macro now holds only three major tech stocks: Microsoft, Apple, and Tesla. This shift indicates a preference for firms with diversified revenue streams across cloud services, devices, and software, rather than those heavily reliant on AI chips.

Thiel’s Portfolio Restructuring

During the third quarter, Thiel sold 537,742 shares of Nvidia, which previously constituted about 40% of his portfolio, marking a reduction of nearly two-thirds. His initial investment in Nvidia began in Q4 of 2024. Additionally, the fund sold all 208,747 shares of Vistra, which represented approximately 19% of its total holdings.

Regarding Tesla, Thiel Macro sold 207,613 shares, cutting its Tesla position by roughly 76%. The fund currently retains 65,000 shares of Tesla, valued at $28.91 million, making it still the largest investment in Thiel’s portfolio at 38.83% of total assets. On the buying side, Thiel added 49,000 shares of Microsoft, increasing his stake to $25.38 million (34.09% of the portfolio) and purchased 79,181 shares of Apple, bringing that position to $20.16 million (27.08% of the portfolio).

Insights on Thiel’s Exit from Nvidia

Thiel’s complete exit from Nvidia has surprised many, especially given his previous endorsement of the company’s position in AI hardware. However, he has consistently cautioned that enthusiasm surrounding AI may be outpacing its actual financial fundamentals. Thiel likened the current AI frenzy to the tech bubble of 1999 when investors anticipated rapid technological advances that, in reality, took 15 to 20 years to materialize.

This skepticism is important to note, as Thiel has been a prominent figure in the technology sector, co-founding significant companies like PayPal (PYPL) and Palantir Technologies (PLTR), where he serves as chairman. His venture capital firm, Founders Fund, has also invested in transformative companies like SpaceX and Airbnb.

While Thiel remains optimistic about AI’s long-term potential, he believes that the technology’s impact will materialize gradually. He posits that tech giants like Microsoft and Apple, with their diversified offerings, represent more stable long-term investments than firms whose valuations are heavily reliant on AI chips.

Market Analysts Weigh In

According to the TipRanks Stock Comparison Tool, both Microsoft and Nvidia are currently rated as “Strong Buy” by analysts. Notably, Nvidia’s stock is projected to offer higher upside potential over the coming twelve months compared to its competitors.

As Thiel navigates the complexities of AI investments, his recent market maneuvers serve as a cautionary tale for investors in the technology sector. His actions highlight the importance of evaluating the financial health of companies in the AI space, particularly as the industry continues to evolve rapidly.

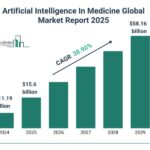

See also Artificial Intelligence in Medicine Market Projected to Reach $58.16 Billion by 2029

Artificial Intelligence in Medicine Market Projected to Reach $58.16 Billion by 2029 Google VP Shantanu Sinha Highlights Creative Student Uses of AI in Education

Google VP Shantanu Sinha Highlights Creative Student Uses of AI in Education Interior Designers’ AI Tool Adoption Triples to 29% in 2025, Survey Reveals

Interior Designers’ AI Tool Adoption Triples to 29% in 2025, Survey Reveals Yann LeCun Exits Meta to Launch AI Startup Amid Shift to Product-Driven Development

Yann LeCun Exits Meta to Launch AI Startup Amid Shift to Product-Driven Development Siemens Announces AI-Driven Solutions to Accelerate Clean Energy Transition

Siemens Announces AI-Driven Solutions to Accelerate Clean Energy Transition