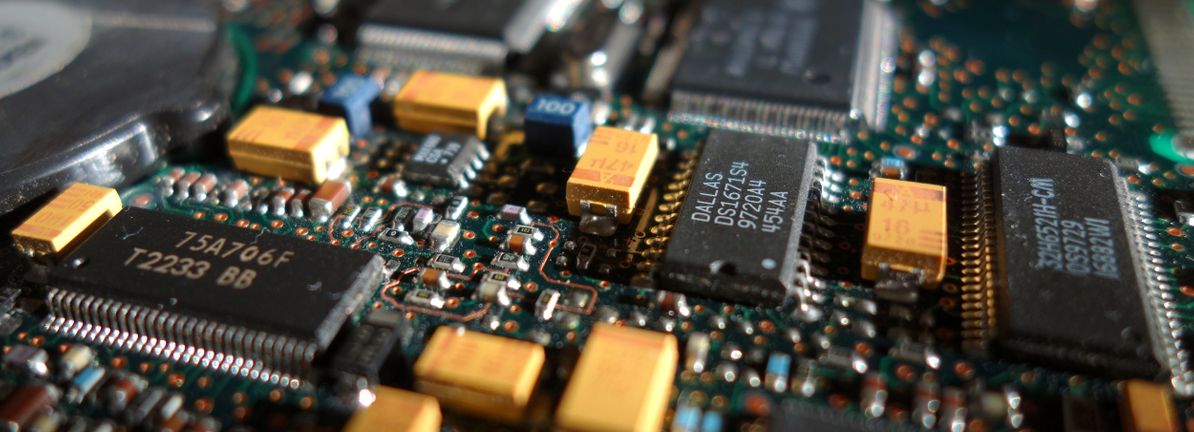

Rambus (RMBS) has captured investor attention following an Outperform rating from William Blair, focusing on the company’s advances in AI-driven memory products. As Rambus approaches its upcoming earnings call, market scrutiny has intensified, particularly after the stock recently reached a 52-week high. The company’s stock has demonstrated impressive performance, showcasing a 22.5% return over the last 30 days and an 83.1% total shareholder return over the past year, despite a 7.6% pullback in a single day.

Investors considering Rambus may also want to explore other high-growth technology and AI stocks that are currently gaining traction. With Rambus trading at $115.31, just below its fair value estimate of $120, the pressing question arises: has the market already priced in future growth, or is there still an opportunity for gains?

The anticipated industry transition to MRDIMM technology in the latter half of 2026 is expected to substantially increase silicon content per memory module. Rambus is strategically positioned to leverage this shift, which could expand its addressable market and fuel multi-year revenue growth.

While the fair value estimate suggests Rambus is currently 3.9% undervalued at around $120, the company’s price-to-earnings (P/E) ratio of 54.2x presents a contrasting narrative. This valuation is significantly higher than the US Semiconductor industry average of 40.8x and the peer average of 36.3x. Analysts suggest a fair ratio of 38.5x, raising concerns about whether the market is overvaluing the AI narrative or if these premiums are justified by Rambus’s potential for future execution.

Investors are encouraged to examine the underlying data that inform this valuation breakdown. While the fair value is compelling, it’s crucial to consider the potential risks. Rambus relies heavily on products related to DDR5, and increasing competition may pose challenges to its revenue and margins.

As the market continues to evolve, Rambus remains a focal point amid broader trends in AI and semiconductor technology. Those already tracking Rambus should also diversify their watchlist with other promising tech stocks that may enhance investment strategies. The current climate in the tech sector underscores the importance of diligent research and understanding market dynamics.

This analysis from Simply Wall St emphasizes the necessity of integrating historical data and analyst forecasts while noting that it is not intended as financial advice. Investors should be aware that the article does not take individual objectives or financial situations into account, and it is essential to conduct independent research before making investment decisions.

For further insights into Rambus and other companies mentioned, you can explore [Rambus](https://www.rambus.com/), [Nvidia](https://www.nvidia.com/), and [IBM](https://www.ibm.com/), among others. Readers interested in understanding the complexities behind Rambus’s valuation should review the complete analysis that outlines key rewards and cautionary factors impacting investment choices.

See also OpenAI’s ChatGPT Goes Viral with Self-Portrait Feature, Reflecting User Interactions

OpenAI’s ChatGPT Goes Viral with Self-Portrait Feature, Reflecting User Interactions AI Job Losses Loom as CEOs Warn of Disruption in 40% of Global Workforce at Davos 2026

AI Job Losses Loom as CEOs Warn of Disruption in 40% of Global Workforce at Davos 2026 Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032