Elon Musk’s SpaceX is in preliminary discussions to merge with his artificial intelligence company xAI ahead of a significant public offering anticipated later this year. The merger would consolidate Musk’s diverse ventures, including rockets, Starlink satellites, the X social media platform, and the Grok AI chatbot, under a single corporate entity, as reported by sources familiar with the negotiations and company filings viewed by Reuters.

This potential merger aims to enhance SpaceX’s capability to launch data centers into orbit, positioning Musk to compete more aggressively in the quickly evolving AI landscape against industry titans such as Google, Meta, and OpenAI. Musk, who is the CEO of both SpaceX and xAI, did not respond to multiple requests for comment regarding the discussions.

Under the proposed arrangement, xAI shares would be exchanged for SpaceX shares. Two entities created in Nevada on January 21 are reportedly set up to facilitate the transaction. One of these entities, a limited liability company, lists SpaceX and its Chief Financial Officer Bret Johnsen as managing members. The purpose and details surrounding these entities, however, remain unclear as corporate filings provide minimal information.

Although the precise valuation of the merger has not been disclosed, it is evident that both companies have seen substantial increases in their worth. SpaceX was last valued at approximately $800 billion, while xAI reached a valuation of around $230 billion in November. As both companies prepare for their respective public offerings, analysts expect that SpaceX’s valuation could exceed $1 trillion.

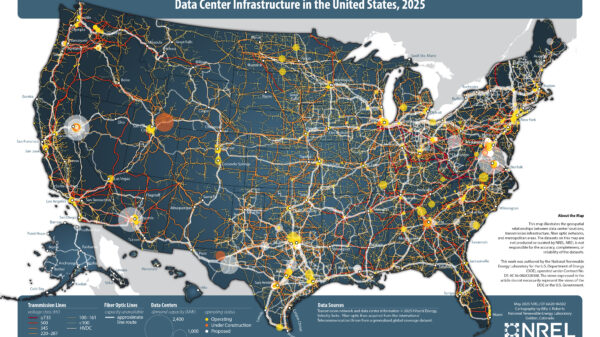

The discussions come at a time when Musk is making significant investments in AI infrastructure, including a major supercomputer named Colossus, being developed in Memphis, Tennessee. This aligns with his statement made at the recent World Economic Forum in Davos, where he asserted that “the lowest cost place to put AI will be in space,” projecting that this innovation could become a reality within two to three years.

Space-based AI processing, harnessed by solar energy, aims to reduce the costs associated with generating the computing power necessary to develop and train AI models, such as Grok. Competing businesses are also entering this niche; for instance, Jeff Bezos’ Blue Origin recently announced plans for a vast network of satellites designed to support high-capacity Internet services, while Google is exploring similar concepts with its Project Suncatcher.

The idea of establishing data centers in space has not been without skepticism. Analysts express concerns regarding the costs versus benefits of adapting existing technologies for space environments, particularly as investments in AI continue to evolve rapidly. However, merging xAI with SpaceX could strengthen the companies’ positions for lucrative defense contracts, especially as the Pentagon seeks to accelerate AI adoption within military networks.

Recent comments from Defense Secretary Pete Hegseth during a visit to SpaceX’s Starbase in Texas underscored the strategic importance of xAI’s technologies, including Grok, which are expected to be integrated into military networks as part of the Pentagon’s “AI acceleration strategy.” xAI has secured a contract potentially worth up to $200 million to supply Grok products to the Pentagon.

Moreover, SpaceX’s existing platforms, such as Starlink and its national security variant Starshield, already leverage advanced AI for automated satellite operations. Starshield, under a contract with a U.S. intelligence agency, is developing a network of classified satellites equipped with sensors that utilize AI for tracking moving targets on Earth.

This proposed merger marks another chapter in Musk’s long history of consolidating his business interests. In 2025, he previously merged the social media platform X into xAI in a share swap arrangement that enabled the AI startup to access the platform’s data. Earlier, in 2016, he also utilized Tesla stock to acquire the solar energy firm SolarCity.

Recently, xAI raised $20 billion in an oversubscribed Series E funding round, surpassing its $15 billion goal, further solidifying its financial standing. Concurrently, Tesla announced plans to invest around $2 billion in xAI, reflecting a growing interdependence among Musk’s ventures.

Founded in 2002, SpaceX has revolutionized the global space industry through innovations like its reusable Falcon rockets, which have played a crucial role in the swift deployment of the Starlink satellite broadband network, now comprising thousands of satellites. The company is reportedly in talks with financial institutions to facilitate its IPO, which could occur as early as this year.

See also New Hampshire’s HB 124: Pioneering AI’s ‘Right to Compute’ for Enhanced Innovation

New Hampshire’s HB 124: Pioneering AI’s ‘Right to Compute’ for Enhanced Innovation Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032 Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs

Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs