Investments in artificial intelligence (AI) are attracting attention as the sector continues to reshape the technology landscape. AI-focused stocks have experienced significant growth in recent years, resulting in investor optimism. While concerns about a market bubble linger, a recent report from The Motley Fool indicates that 62% of Americans are confident in AI’s long-term earnings potential. As many see ample room for expansion in this industry, early investments could yield substantial returns in the future.

Despite the promise of AI, navigating stock selection can be challenging due to the volatility inherent in the sector. Investing in AI exchange-traded funds (ETFs) offers a more manageable approach, allowing investors to gain exposure to the industry while diversifying their portfolios and mitigating risk. Three notable funds exemplify different strategies for capitalizing on AI’s growth potential.

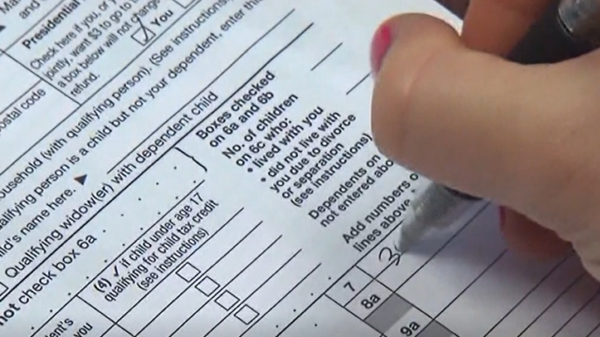

The iShares Future AI and Tech ETF (ARTY +2.99%) includes 49 stocks that contribute to the advancement of AI technology, encompassing sectors from infrastructure to hardware and software. This relatively small fund focuses narrowly on companies involved in AI, which increases its risk profile. However, more targeted funds can also enhance potential returns, as underperforming stocks have less impact on overall earnings. Over the past year, the iShares Future AI and Tech ETF has achieved a total return of approximately 30%, substantially outpacing the S&P 500 (^GSPC +0.19%), which gained around 18% during the same period. The fund’s holdings predominantly comprise small-cap stocks, known for their volatility but also for the potential for explosive growth should the AI sector continue to thrive.

In contrast, the Invesco Semiconductors ETF (PSI +5.08%) targets the foundational technologies necessary for AI development. This fund invests in companies involved in semiconductor production, a crucial component in powering the advanced computing capabilities required for AI applications. With a portfolio of just 30 stocks, the Invesco Semiconductors ETF offers less diversification than broader funds but could yield higher returns. Over the last year, it has delivered a total return of approximately 38%, and since its inception in 2005, it has generated a remarkable 1,660% in total returns.

For investors seeking a balance between exposure to AI and reduced risk, the Vanguard Information Technology ETF (VGT +0.29%) presents an appealing option. Although it does not focus exclusively on AI, this fund encompasses 322 stocks across various technology sectors, including significant players like Nvidia, Micron Technology, and Advanced Micro Devices, which are heavily involved in AI. The Vanguard ETF provides substantial diversification, which can help mitigate the risks associated with individual stocks. However, its performance over the last year, with a total return just under 22%, is somewhat modest compared to the other two AI-focused funds and only slightly above the S&P 500’s performance.

AI represents a potentially lucrative investment avenue in the coming years, and ETFs can serve as a strategic means to enter this evolving sector without the need to analyze a multitude of individual stocks. By assessing individual goals and risk tolerance, investors can better determine which AI ETF aligns with their financial objectives. As the AI industry continues to mature, its impact on various sectors and investment strategies will likely become increasingly significant.

See also Two AI Stocks Set for Major Gains in 2026: SentinelOne and Datadog Poised for 42% Upside

Two AI Stocks Set for Major Gains in 2026: SentinelOne and Datadog Poised for 42% Upside FuriosaAI Launches RNGD Chip, Promises Double Efficiency Over Nvidia GPUs

FuriosaAI Launches RNGD Chip, Promises Double Efficiency Over Nvidia GPUs Microsoft AI CEO Mustafa Suleyman Warns of Existential AI Risks, Demands Global Regulations

Microsoft AI CEO Mustafa Suleyman Warns of Existential AI Risks, Demands Global Regulations Meta Acquires AI Startup Manus for $2B Amid Legal Challenges and Strategic Shift

Meta Acquires AI Startup Manus for $2B Amid Legal Challenges and Strategic Shift China’s DeepSeek Unveils AI Framework Amid Strong Policy Support, Eyes Global Dominance by 2027

China’s DeepSeek Unveils AI Framework Amid Strong Policy Support, Eyes Global Dominance by 2027