The landscape of oversight for UK insurers has intensified in 2025, as regulatory bodies such as the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA) prioritize operational and conduct risks. Insurers are now compelled to monitor communications across various platforms—including voice, chat, and mobile apps—to bolster conduct-risk prevention and ensure ethical governance. This evolving demand presents insurers with the challenge of embedding meaningful oversight without infringing on employee trust.

Historically, insurers experienced more lenient scrutiny compared to universal banks, but this is swiftly changing. Regulators are increasingly focused on critical areas such as operational risk, third-party resilience, and data access. According to the Allianz Risk Barometer, “changes in legislation and regulation” rank as the third top risk for UK firms in 2025.

As workplace communication evolves, the rise of hybrid working models and tools like Microsoft Teams and mobile messaging applications have become vital for insurers. This digital proliferation complicates communication surveillance while increasing its necessity. With the multitude of communication channels, the potential for hidden misconduct or regulatory oversights grows, posing significant risks to firms.

As insurers extend their oversight capabilities, they must navigate the delicate balance between effective monitoring and maintaining trust among employees. Tools such as chat audits and meeting transcriptions can help identify potentially risky behaviors, including mis-selling or unauthorized disclosures. However, if surveillance is perceived as excessive or opaque, it may undermine employee confidence and hinder open communication.

This concern is particularly pronounced in the insurance sector, where nuanced conversations between underwriters, brokers, and clients often occur through informal channels. A misinterpreted message or an undocumented agreement can lead to complications in regulatory reviews. A recent FCA multi-firm review indicated that while many insurers monitor communications, few could convincingly demonstrate that their oversight practices align with customer outcomes under the Consumer Duty. This underscores the risk of expanding surveillance without a clear purpose, particularly if employees feel scrutinized rather than supported.

To meet these challenges, insurers must rethink how they govern their communication platforms. When oversight mechanisms are thoughtfully integrated into daily systems, they can foster trust instead of serving as a barrier. The role of artificial intelligence (AI) is becoming increasingly relevant in this context; AI can enhance oversight by flagging anomalous behaviors and identifying shifts in communication patterns that conventional methods might miss. This proactive approach to risk management enables insurers to transition from reactive investigations to a more anticipatory stance.

However, the integration of AI also brings forth concerns regarding the technology’s reliability. The UK’s flexible, sector-specific approach to AI governance may lead to inconsistencies across the industry. Insurers employing AI for surveillance must ensure clarity in flagging conversations, reflect their unique business contexts, maintain human oversight, and protect employee privacy while adhering to transparency and auditability standards.

Ultimately, for insurers, the challenge lies in redefining effective oversight in a manner that not only captures necessary data but also preserves trust. Transparency and purpose are essential; employees should be informed about which channels are monitored and why. Establishing clear policies and fostering open dialogue can help mitigate feelings of surveillance, transforming it from a covert operation to a constructive governance tool.

Contextual monitoring is equally crucial. Recognizing that not all communications pose the same risk allows firms to focus on significant patterns. For instance, sudden shifts in communication styles for sensitive discussions should be prioritized. This approach makes oversight more targeted, thus enhancing its effectiveness.

Moreover, the importance of human interpretation and accountability cannot be overstated. While AI can identify potential issues, human judgment remains essential for validation and response. Clear audit trails and transparent decision-making processes are necessary to align with evolving governance standards. A 2025 report by PwC emphasized the necessity for strong accountability frameworks and board-level involvement in operational decisions, illustrating that trust in AI is ultimately built on confidence in the systems and individuals responsible for it.

As UK insurers navigate this complex terrain, the focus shifts towards establishing a culture of ethical decision-making. The goal is to embed oversight as a safeguard rather than a constraint, thereby transforming surveillance into a mechanism that supports integrity and accountability. By achieving the right balance, insurance firms can ensure that their oversight practices bolster, rather than hinder, the ethical foundations upon which they operate.

For more insights on the evolving landscape of AI in insurance, visit OpenAI, PwC, or FCA.

See also Mistral AI Launches OCR 3 with 74% Performance Boost and $2 Pricing per 1,000 Pages

Mistral AI Launches OCR 3 with 74% Performance Boost and $2 Pricing per 1,000 Pages Meeks Unveils RESTRICT Act to Block Advanced AI Chip Sales to China, Safeguard U.S. Security

Meeks Unveils RESTRICT Act to Block Advanced AI Chip Sales to China, Safeguard U.S. Security 30% of U.S. Consumers Ready to Embrace Autonomous AI Assistants for Daily Tasks

30% of U.S. Consumers Ready to Embrace Autonomous AI Assistants for Daily Tasks ELCOT Partners with Perplexity AI to Train Tamil Nadu College Students in AI for Free

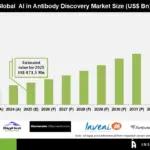

ELCOT Partners with Perplexity AI to Train Tamil Nadu College Students in AI for Free AI-Driven Antibody Discovery Market to Surge to $3 Billion by 2034, Led by Precision Therapies

AI-Driven Antibody Discovery Market to Surge to $3 Billion by 2034, Led by Precision Therapies