Investing in the rapidly evolving landscape of artificial intelligence (AI) does not necessitate venturing into high-risk stocks. While many investors often chase speculative micro-cap stocks, the reality is that established companies in the tech sector are poised to capitalize on the AI boom as they leverage their resources and experience. This article examines three prominent tech stocks that exhibit substantial potential for significant returns driven by advancements in AI.

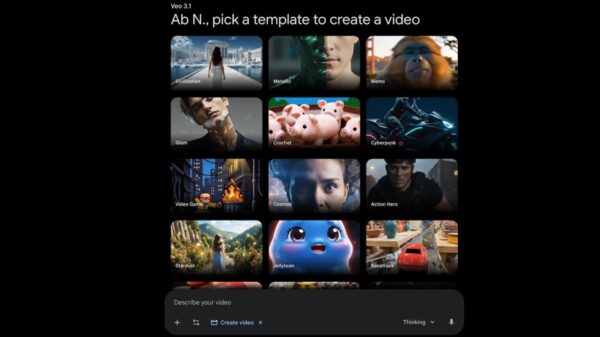

The first company to consider is Alphabet (GOOGL), the parent of Google. With a market capitalization exceeding $3.9 trillion, Alphabet has demonstrated remarkable growth, evidenced by a 64.8% increase in its stock price in 2025. Despite its size, the company remains a formidable player in the AI arena, investing heavily in innovations such as its Gemini AI and proprietary tensor processing units (TPUs). These TPUs are critical in AI development and provide Alphabet with a competitive edge, particularly as demand for AI technologies surges. Analysts project that the company’s AI assets, including its DeepMind division, could be worth as much as $900 billion.

In addition to its AI initiatives, Alphabet continues to thrive with its traditional revenue streams from services like Google Search and YouTube ads, both experiencing double-digit growth. This combination of robust legacy businesses and a forward-looking AI strategy positions Alphabet as a strong contender for investors seeking to benefit from AI advancements.

Next, Micron Technology (MU), a key player in the memory chip sector, presents another compelling investment opportunity. As the third-largest manufacturer of memory chips globally, Micron specializes in dynamic random access memory (DRAM), which is essential for AI applications. The company’s main competitors are South Korean giants SK Hynix and Samsung, together controlling a significant portion of the market. Currently, Micron is well-situated to leverage the increasing demand for high bandwidth memory (HBM) vital for AI, as the company has recently opted to shift its focus from consumer memory to higher-margin AI-related products.

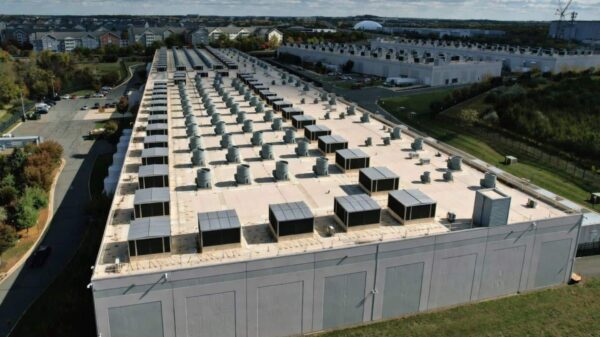

Micron’s pricing power, attributed to supply constraints and soaring demand, has bolstered its gross margins to over 50%. The company’s ambitious plans to invest $200 billion in new manufacturing facilities in the U.S. are expected to further enhance its capacity for DRAM production, making it an attractive option for investors seeking growth. With a forward price-to-earnings ratio of 8.8, Micron is positioned to be a potential millionaire-maker stock.

The final company to consider is Nvidia (NVDA), which has been the undisputed leader in the GPU market. Valued at $4.6 trillion, Nvidia has achieved extraordinary returns, with a staggering 1,330% increase in share price over the past five years. The company’s dominance in providing high-performance GPUs for AI data processing remains unmatched. Despite the rise of competitors like AMD and newcomers, Nvidia continues to innovate, with new chips that promise to be five times faster in AI applications already in production.

Nvidia’s revenue has surged 62% year over year, driven by the ongoing demand for its cutting-edge technology. As AI continues to reshape industries, Nvidia is uniquely positioned to capitalize on this growth trajectory, reinforcing its potential as a millionaire-maker stock. With its strong market position and ongoing investments in next-gen technology, Nvidia is a prime candidate for investors keen on benefiting from the AI revolution.

In summary, investors looking for exposure to the AI sector need not rely solely on high-risk ventures. Established companies like Alphabet, Micron Technology, and Nvidia offer substantial growth potential driven by their investments in AI technologies. Each of these firms is strategically positioned to thrive as demand for AI solutions continues to expand, making them worthy considerations for investors aiming for significant returns in this dynamic market.

Alphabet | Micron Technology | Nvidia | OpenAI | Microsoft

See also Microsoft Launches Agentic AI Solutions for Retail: Streamlining Operations and Enhancing Customer Engagement

Microsoft Launches Agentic AI Solutions for Retail: Streamlining Operations and Enhancing Customer Engagement Germany’s Mittelstand Slashes AI Investment to 0.35% of Revenue Amid Rising Corporate Spending

Germany’s Mittelstand Slashes AI Investment to 0.35% of Revenue Amid Rising Corporate Spending Neo and SpoonOS Unveil Scoop AI Hackathon Seoul Bowl Winners, Awarding $8,000 in Prizes

Neo and SpoonOS Unveil Scoop AI Hackathon Seoul Bowl Winners, Awarding $8,000 in Prizes Soluna and Siemens Launch 2 MW AI Power Stability Pilot to Optimize Renewable Energy Usage

Soluna and Siemens Launch 2 MW AI Power Stability Pilot to Optimize Renewable Energy Usage