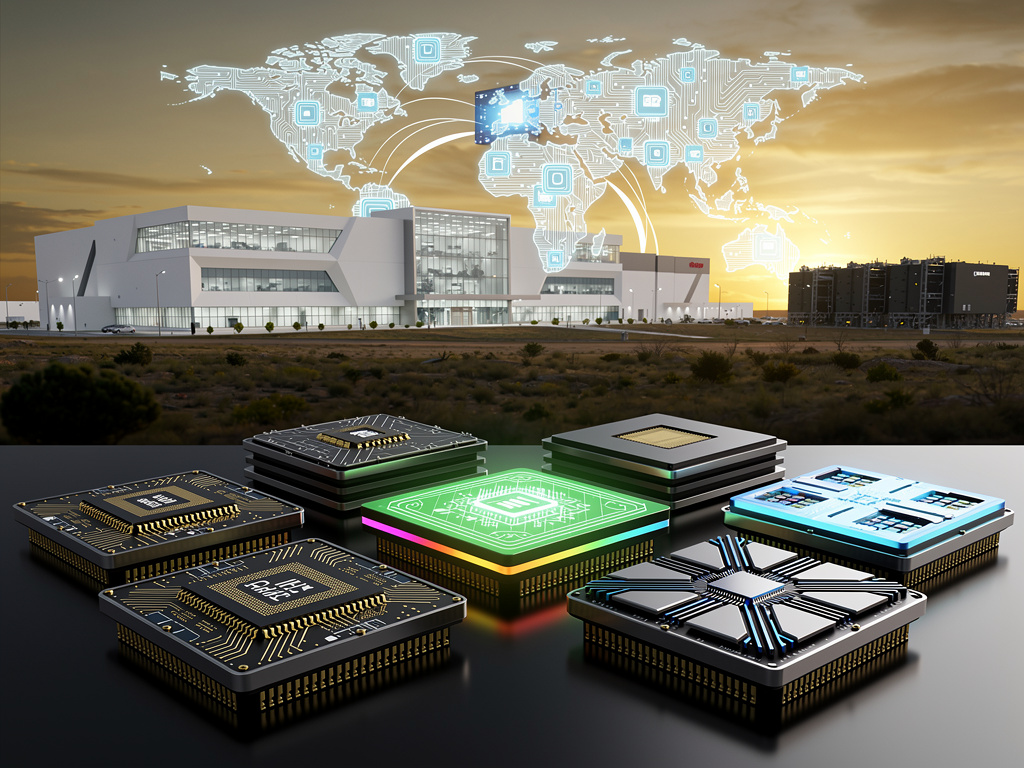

In a significant move within the semiconductor sector, Advanced Micro Devices Inc. (AMD) and Alphabet Inc.’s Google are reportedly in advanced talks with Samsung Electronics Co. to produce next-generation artificial intelligence chips at Samsung’s facility in Taylor, Texas. This potential partnership emerges in response to surging global demand for advanced processors that can fuel a variety of AI applications, ranging from data centers to autonomous systems. Sources indicate that discussions are centered around leveraging Samsung’s anticipated 2-nanometer process technology, which promises notable improvements in both efficiency and performance over existing technologies.

The Taylor fabrication plant, part of Samsung’s expansive U.S. operations, represents a strategic maneuver for the company as it aims to challenge the dominance of Taiwan Semiconductor Manufacturing Co. (TSMC) in the foundry market. Samsung has already invested billions in the Taylor facility, supported by U.S. government incentives under the CHIPS and Science Act. This site has the potential to serve as a crucial hub for North American technology firms keen on mitigating geopolitical risks related to overseas production. For AMD and Google, collaborating with Samsung in Texas offers an opportunity to diversify supply chains while utilizing domestic manufacturing capabilities.

Insider information suggests that the ongoing negotiations encompass not only chip fabrication but also joint research and development focused on AI-specific architectures. Google’s Tensor Processing Units (TPUs), which are customized for machine learning tasks, are likely candidates for production at this site. Similarly, AMD’s Instinct accelerators, which play a vital role in AI training and inference, could benefit from Samsung’s advanced technology, enabling them to compete more effectively with Nvidia Corp.’s offerings.

Shifting Alliances in Chip Production

This potential alliance comes at a time when TSMC has imposed restrictions on exporting its most advanced technologies outside Taiwan, commonly referred to as the “N-2” rule. This policy limits the deployment of 2nm and finer processes to non-Taiwanese facilities, prompting companies like AMD and Google to explore alternatives. According to reports, both companies are evaluating Samsung’s Texas operations to circumvent these limitations and secure timely access to next-generation silicon.

Samsung’s Taylor plant is poised to commence mass production of 2nm chips as early as 2026 and is equipped with state-of-the-art tools that some experts believe surpass those found in TSMC’s U.S. facilities. Elon Musk, CEO of Tesla Inc. and xAI, has publicly praised the site’s capabilities via social media, noting its advantages in 3nm-era equipment, although he clarified that it may not directly impact Tesla’s own AI chip needs. Observations from tech analysts suggest that Samsung is positioning itself as a viable partner for U.S.-based technology companies amid Taiwan’s export restrictions.

The economic implications for Texas are significant. Samsung’s initial $17 billion investment in the Taylor facility, announced in 2021, has already created thousands of jobs, with potential further expansions supported by up to $6.4 billion in federal funding. Texas Governor Greg Abbott has promoted the state as a premier destination for semiconductor investments, emphasizing partnerships that bring high-tech manufacturing closer to home. This influx not only bolsters local economies but also aligns with national security objectives aimed at reducing reliance on Asian supply chains that are vulnerable to disruptions.

Beyond economic factors, the AMD-Google-Samsung discussions illustrate broader geopolitical tensions within the tech industry. U.S. restrictions on exporting advanced chipmaking tools to China have expedited the shift towards “friendshoring,” where production is relocated to allied nations or domestic venues. Samsung, a South Korean company with substantial U.S. operations, fits this model seamlessly. Reports indicate that Google may rely on Samsung for fabricating its most powerful TPUs, potentially disrupting the existing hierarchy in AI hardware and providing a reliable alternative to TSMC.

Industry observers note that while Samsung’s foundry business has struggled with profitability in recent years, securing orders from AMD and Google could signify a pivotal turnaround. Demand for AI chips is rapidly increasing, with market analysts forecasting the global AI semiconductor industry could surpass $100 billion by 2030, driven by applications in cloud computing and edge devices. For Google, this collaboration aligns with its aggressive AI strategy, as the company has heavily invested in custom silicon to enhance its extensive data centers where TPUs manage everything from search algorithms to advanced generative AI models.

As negotiations advance, the ramifications could extend beyond AMD and Google, impacting competitors such as Nvidia, which heavily relies on TSMC. Increased production capabilities at Samsung’s Texas facility could pressure Nvidia if Samsung’s offerings prove competitive in both price and performance. Reports suggest Samsung could capture more 2nm orders amidst rising global demand, potentially increasing its foundry market share significantly by the end of the decade.

Ultimately, the ongoing discussions signal a maturing U.S. semiconductor landscape, where collaborations like the one between AMD, Google, and Samsung could mitigate risks associated with global trade tensions. With the Taylor fab poised to produce cutting-edge chips, American firms may maintain a competitive edge in an evolving technological arena. As these negotiations develop, they underscore the growing trend of localized production in critical technologies, positioning Samsung as a key player in the AI ecosystem.

See also Study Reveals AI in Healthcare Reflects Human Biases, Challenging Accountability Norms

Study Reveals AI in Healthcare Reflects Human Biases, Challenging Accountability Norms AI inside Inc. Stock Falls 4.37% to JPY 2582; Future Forecasts Signal Mixed Outlook

AI inside Inc. Stock Falls 4.37% to JPY 2582; Future Forecasts Signal Mixed Outlook NVIDIA GPUs Drive AI Boom as Data Center Sales Surge, Stock Hits New Highs

NVIDIA GPUs Drive AI Boom as Data Center Sales Surge, Stock Hits New Highs Bernie Sanders Calls for AI Moratorium, Warns of Economic Impact on American Workers

Bernie Sanders Calls for AI Moratorium, Warns of Economic Impact on American Workers