Investors are cautiously optimistic as global stock markets are forecasted to continue rising in 2026, despite lingering concerns over a potential **AI bubble** and instability within the **US central bank**. Wall Street strategists expect the **S&P 500** index to gain over the next year, although they warn that geopolitical tensions and persistent inflation could lead to volatility.

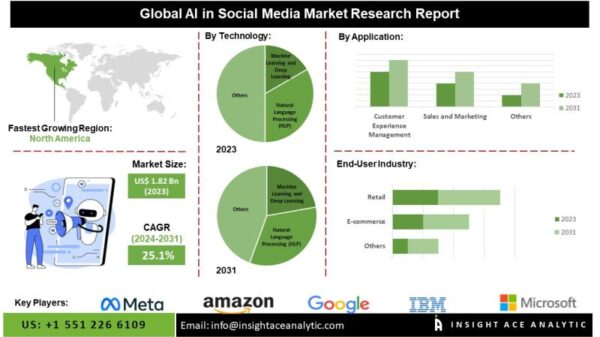

A recent survey conducted by **Deutsche Bank** among 440 investors, economists, and analysts revealed that **57%** of respondents view a significant drop in technology valuations or diminishing enthusiasm for AI as a primary threat to market stability in 2026. This sentiment highlights a growing apprehension surrounding the tech sector, which has been a driving force behind market gains.

Investors have never before been in such agreement about the biggest market risk for a year ahead than they are now: Deutsche Bank survey. “AI/tech bubble risk towers over everything else.” The next biggest risks: a loss in Fed independence and crisis in private credit. pic.twitter.com/RO4q1IAwZP

— Lisa Abramowicz (@lisaabramowicz1) December 18, 2025

The second most significant fear among investors is the possibility that **Donald Trump** will appoint a new chair to the **Federal Reserve** who advocates for aggressive interest rate cuts, potentially leading to market upheaval. On **December 17**, Trump stated he would announce his choice for the next Fed chair soon, indicating a preference for someone who supports significantly lower rates.

Another critical concern raised in the Deutsche Bank survey was a potential crisis in the private capital market, involving private equity, venture capital, and private debt. In a separate poll conducted by **Quilter**, a wealth management firm, respondents identified stress in the private credit market as an underappreciated risk, despite warnings from global policymakers about the shadow banking sector.

Meanwhile, **UBS** has suggested that while supportive economic conditions may bolster global equities, challenges may arise if AI advancements stall, inflation rises, or debt issues come to the forefront. In the UK, analysts are maintaining a positive outlook for the stock market, with the **FTSE 100** recently surpassing the 10,000-point mark for the first time. Analysts forecast **14%** profit growth for the index in 2026, with **total dividends** expected to reach a record £85.6 billion, eclipsing the previous peak.

UK retail investors share this optimism, with **53%** expressing confidence that the current bull market will endure through 2026. Additionally, experts, including **Robert Timper**, chief global fixed income strategist at **BCA Research**, predict a strong year for **UK government bonds**, or gilts, especially if the **Bank of England** implements rate cuts more swiftly than other central banks.

On a global scale, **UBS** forecasts that equities will rise by approximately **15%** by the end of 2026, with double-digit gains anticipated in the US and China. The **S&P 500** is projected to end 2026 at **7,700 points**, reflecting a **12.5%** gain, while **Deutsche Bank** sets its target at **8,000 points** (+17%). **Oppenheimer Asset Management** is even more optimistic, predicting an **8,100-point** year-end for the S&P 500.

Amidst this financial landscape, the implications of **artificial intelligence** on the economy are becoming increasingly significant. After substantial investments in AI infrastructure over the past year, stakeholders will be closely monitoring whether major AI companies can validate their lofty valuations and deliver the productivity growth that many policymakers anticipate. A shortfall in these areas could lead to declines in valuations.

With the global economy expected to remain resilient in 2026, **Goldman Sachs** analysts predict **2.8%** growth despite potential risks from a fragile job market and skepticism surrounding AI-related revenues. The US economy is anticipated to thrive, aided by reduced trade barriers and easing financial conditions, while **China** is expected to maintain strong export performance despite slower domestic demand.

As the year progresses, market participants will remain vigilant about potential pitfalls that could derail growth. Experienced analysts acknowledge that market consensus often proves inaccurate, with some suggesting that a stronger-than-expected rebound could exacerbate inflation concerns, prompting discussions of monetary tightening in the latter half of the year. Ultimately, navigating these complexities will be critical for both policymakers and investors in the coming year.

For ongoing updates, visit the official websites of [**UBS**](https://www.ubs.com), [**Goldman Sachs**](https://www.goldmansachs.com), and [**Deutsche Bank**](https://www.db.com).

See also Meta Aims to Transform WhatsApp into a Global Super App by 2026, Predicts AI Experts

Meta Aims to Transform WhatsApp into a Global Super App by 2026, Predicts AI Experts AI Revolutionizes Daily Life in America: From Smart Homes to Healthcare Innovations

AI Revolutionizes Daily Life in America: From Smart Homes to Healthcare Innovations Microsoft’s Satya Nadella Urges Users to Reject ‘Slop’ Label Amid AI Backlash

Microsoft’s Satya Nadella Urges Users to Reject ‘Slop’ Label Amid AI Backlash Anthropic President Daniela Amodei Warns AI Growth Could Stagnate Amid Economic Factors

Anthropic President Daniela Amodei Warns AI Growth Could Stagnate Amid Economic Factors AI Streamer Neuro-sama Surpasses 165K Subscribers on Twitch, Earning $400K Monthly

AI Streamer Neuro-sama Surpasses 165K Subscribers on Twitch, Earning $400K Monthly