SoundHound AI (NASDAQ: SOUN) is facing a challenging year despite its growth trajectory, with its stock price declining by 38% over the past 12 months. The company, which holds a market capitalization of $4.5 billion, has seen daily trading volumes exceeding 21 million shares—more than double that of comparable firms. While management aims to decrease losses in the upcoming quarter and eventually achieve profitability, the road ahead appears steep.

SoundHound AI operates within the swiftly expanding artificial intelligence (AI) sector, offering a platform that facilitates voice-enabled interactions across various applications. The company’s prominence surged in 2024 when Nvidia revealed its stake in SoundHound during an earlier private funding round. Although Nvidia divested its shares over a year ago, the attention surrounding SoundHound persists among investors.

Currently, SoundHound’s stock trades at approximately $11 per share. The company is rapidly broadening its customer base, which includes technology firms, automakers, and restaurants, while maintaining a robust cash position devoid of debt. Its range of applications spans automotive solutions, voice commerce, and a music identification app capable of recognizing songs played or hummed by users.

SoundHound’s capabilities are underpinned by an advanced automatic speech recognition (ASR) product named Polaris, which promotes automation through omnichannel AI-powered ordering. This technology allows for seamless interactions across drive-thru kiosks, phone calls, and text orders. According to CEO Keyvan Mohajer, “Polaris, in our view, is another significant disruption that widens the gap between us and the competition in our journey to realize SoundHound’s vision.”

Building on its momentum, SoundHound has secured contracts with seven of the top ten global financial institutions and recently signed a deal with an unnamed Chinese company to integrate SoundHound Chat AI into millions of smart devices, initially targeting the Indian market. Additional partnerships span various sectors, including healthcare, energy, and notable restaurant chains like Chipotle Mexican Grill and Five Guys.

Despite its record revenue of $42 million for the third quarter—reflecting a 68% year-over-year increase—SoundHound reported a net loss of $109.2 million, translating to a loss per share of $0.27. The losses are attributed to rising data center costs and ongoing acquisitions as the company scales its operations. Management anticipates full-year revenue between $165 million and $180 million, with fourth-quarter losses expected to be less than $10 million. Chief Financial Officer Nitesh Sharan noted, “We see additional acquisition cost synergies of roughly $20 million on an annual run rate basis to be realized more fully in 2026, which will set us up well as we align our organization with the massive tailwinds behind us.”

SoundHound’s innovative efforts are commendable, as evidenced by its latest product, an agentic AI platform capable of managing tasks such as checking emails, adjusting schedules, and making reservations. However, the company continues to grapple with significant losses, leading many investors to reconsider their positions.

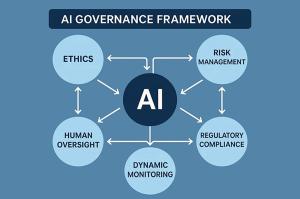

With its stock having surged an impressive 929% over the last three years, the recent downturn raises questions about its future potential. While the technological advancements SoundHound is developing attract considerable interest, potential investors should approach cautiously, especially given the recent recommendation against investing in SoundHound AI from The Motley Fool’s Stock Advisor. The advisory team has highlighted ten other stocks they believe hold superior potential for returns.

As the AI industry continues to evolve rapidly, SoundHound AI’s trajectory will be closely monitored. Should the company manage to mitigate its losses and move toward profitability, it may present a valuable opportunity for investors looking to capitalize on the burgeoning AI market as we approach 2026.

See also Quill.org Leads $2.8M Initiative to Elevate AI Literacy Standards in Education

Quill.org Leads $2.8M Initiative to Elevate AI Literacy Standards in Education Gloo’s Flourishing AI Initiative Reveals Bias in AI Models Against Christian Worldview

Gloo’s Flourishing AI Initiative Reveals Bias in AI Models Against Christian Worldview Top 10 AI Stocks for 2026: Nvidia, Amazon, and Emerging Players Poised for Major Gains

Top 10 AI Stocks for 2026: Nvidia, Amazon, and Emerging Players Poised for Major Gains