Insights from the QNova Life Sciences Partnering Forum have highlighted how investor expectations around volatility, artificial intelligence (AI), and commercial discipline are reshaping life sciences fundraising strategies. The forum, held during JPM Healthcare Week, made it clear that the current fundraising landscape is undergoing a fundamental restructuring rather than a temporary slowdown.

Eric Matson, principal at Denver-based private equity firm Excellere Partners, kickstarted the discussions with a seasoned perspective on a market increasingly characterized by volatility, selectivity, and execution risk. With nearly 25 years of experience in life sciences investment and advisory, Matson underlined the reality that capital dynamics have irrevocably changed. “We’re going to have continued volatility,” he stated, emphasizing that this is now the environment that life sciences companies must learn to navigate.

This sentiment echoed through various sessions and conversations throughout the first day of the forum, where the focus shifted from a sense of optimism to a more realistic appraisal of how capital operates today. The traditional fundraising principles that once guided investors are no longer applicable in this new landscape.

Historically, venture and private investment in life sciences followed a predictable upward trajectory, bolstered by reliable public market exits. However, since the mid-2010s, this pattern began to falter as investment surged alongside expanding expectations, leaving a volatile market in its wake. Today, public biotech indices remain erratic, and healthcare IPO activity is sluggish compared to historical norms, further complicated by macro uncertainties, ranging from geopolitical tensions to fluctuating trade policies.

For founders who started companies during the previous expansion cycle, the current climate presents stark contrasts. As Matson highlighted, the conditions affecting many companies today are distinctly different from those experienced over the last two decades, and indications suggest that a return to earlier dynamics is unlikely.

One notable theme emerging from the forum was the disconnect between the abundance of available capital and its actual deployment. Life sciences investors are currently sitting on historically high levels of dry powder across various funds. However, much of this capital remains stagnant. “We have hundreds of millions of dollars that we’re trying to find a home for,” Matson remarked, illustrating the paradox of plentiful funds yet a challenging investment climate.

Investors are prioritizing established relationships, evidenced by follow-on financings or internal extensions, over initiating new partnerships. This results in a landscape where capital is available but confidence in deploying it is uneven, thus shifting the fundraising challenges from scarcity to issues of trust, perceived downside protection, and clarity in value creation.

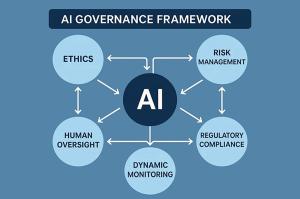

Artificial intelligence has emerged as a crucial discussion point at the forum. As Matson pointed out, it is now essential for founders to articulate how AI influences their development timelines, cost structures, or scalability. “You have to be able to answer the AI questions,” he noted, stressing that fluency in AI has transitioned from a differentiating factor to a baseline expectation among investors.

Alongside this, the definition of success in life sciences development is evolving. Regulatory approval, once seen as a pivotal milestone, now requires credible evidence of reimbursement and market adoption to gain investor confidence. Matson pointed out that commercial strategy must now be integrated earlier into the development lifecycle, compelling founders to grasp payer dynamics and market access considerations before late-stage clinical validation.

As discussions progressed, Matson reiterated practical realities that founders must acknowledge in today’s environment: differentiation must be clear and swift, targeting aligned capital is crucial, and demonstrating capital discipline through transparent deployment strategies is vital. The ability to transfer conviction to potential investors becomes a paramount necessity. “Conviction has to be transferable,” Matson emphasized, indicating that belief alone is insufficient; investors seek assurance that capital will generate returns.

The closing Q&A session offered insights into evolving exit expectations from a private equity standpoint. Excellere Partners increasingly focuses on profitable, founder-led life sciences businesses, prioritizing operational scaling and de-risking to create value. Early exits tied to clinical milestones are giving way to an emphasis on infrastructure, predictability, and scalability, leading to a longer road to liquidity for earlier-stage companies.

As the first day of the QNova Life Sciences Partnering Forum illustrated, the life sciences capital landscape has undergone a significant recalibration. Capital is now more selective, disciplined, and demanding. AI has become a fundamental expectation, while commercial strategies have moved upstream in the development process. Volatility is no longer a temporary condition, but a new norm.

For founders and industry leaders, the key takeaway is one of clarity rather than pessimism. Understanding these new rules is essential for raising capital at any stage. Despite the caution highlighted throughout the forum, Matson concluded on a note of long-term optimism, emphasizing the ongoing advancements in AI-enabled drug development and personalized medicine, which continue to propel opportunities forward. Progress will favor those who can adeptly navigate complexity, effectively communicate their convictions, and build companies that are tailored for the realities of today’s market.

See also AI’s Job Impact: Employment in High-Risk Roles Grows 1.7%, Defying Doomsday Predictions

AI’s Job Impact: Employment in High-Risk Roles Grows 1.7%, Defying Doomsday Predictions X Enables Grok AI Image Manipulation, Sparks Global Outcry Over Non-Consensual Content

X Enables Grok AI Image Manipulation, Sparks Global Outcry Over Non-Consensual Content India Joins US-Led Pax Silica Initiative to Secure AI and Semiconductor Supply Chains

India Joins US-Led Pax Silica Initiative to Secure AI and Semiconductor Supply Chains SK Hynix Invests $13B in South Korea’s Advanced AI Chip Plant to Meet Rising Demand

SK Hynix Invests $13B in South Korea’s Advanced AI Chip Plant to Meet Rising Demand AI Fashion Market Reaches $2.14 Billion, Projected to Hit $75.9 Billion by 2035

AI Fashion Market Reaches $2.14 Billion, Projected to Hit $75.9 Billion by 2035