The global system is entering a precarious phase, with a convergence of geopolitical rivalries, economic confrontations, and rapid technological changes heightening uncertainty as the world moves toward 2026, according to the latest Global Risks Report from the World Economic Forum (WEF).

This assessment indicates a shift from isolated shocks to a dense network of overlapping threats that erode resilience. Based on a survey of approximately 1,300 leaders in government, business, and civil society, the report highlights a significant decline in near-term confidence. Half of the respondents anticipate turbulence over the next two years, while only 1% foresee calmer conditions ahead.

The WEF’s central conclusion is stark: the global economy and political order are “sitting on a precipice,” making them vulnerable to miscalculation, escalation, and policy paralysis. The rise of geoeconomic confrontation has emerged as a primary concern for businesses. Countries increasingly wield tariffs, export controls, sanctions, regulatory barriers, supply-chain pressures, and capital restrictions as strategic tools, intertwining economic policymaking with national security.

This trend risks substantially contracting global trade, disrupting investment flows, and fragmenting markets. Leaders now perceive a splintered economic landscape defined by competing blocs and selective decoupling, rather than a unified global economy governed by shared rules. Such an environment raises costs for businesses, diminishes efficiency, and heightens the risk of economic disputes escalating into broader political or military conflicts.

“It’s very much about state-based armed conflict and the concerns around that,” said Saadia Zahidi, WEF Managing Director, in a recent interview on CNBC. Nearly a third of survey respondents express deep concern about the impact of geopolitical tensions on global growth, financial stability, and social cohesion as early as 2026.

Economic risks have risen at a faster pace than any other category in the survey. Issues such as recession, stubborn inflation, volatile capital markets, and high public debt burdens are intensifying, even as governments find themselves with diminished capacity to respond to shocks. Many economies are still grappling with the aftereffects of the pandemic, energy price fluctuations, and aggressive monetary tightening, rendering them vulnerable to further disruptions.

Real-world developments echo these concerns. China’s rare-earth exports surged in 2025 to their highest level since at least 2014, even as Beijing began restricting shipments of several medium to heavy elements in April. Analysts interpret this move as a calculated demonstration of leverage over Washington amid ongoing negotiations regarding soybean purchases, a potential Boeing aircraft deal, and the future of TikTok’s operations in the U.S.

Rare earths are critical for defense systems, electric vehicles, and advanced electronics, making them vital in strategic competition. Simultaneously, China imported a record volume of soybeans in 2025, primarily from South America, as buyers shunned U.S. crops due to lingering trade tensions. Geopolitical rivalry is thus reshaping trade geography, redirecting flows, and creating new dependencies that come with their own risks.

Economists expect China to expand its global market share in 2026, aided by overseas manufacturing hubs that provide lower-tariff access to the United States and European Union, alongside strong demand for lower-grade chips and consumer electronics. However, Beijing has also begun recalibrating its industrial strategy, recently scrapping export tax rebates for its solar industry, a long-standing point of contention with EU states concerned about unfair competition.

The lingering influence of U.S. President Donald Trump on the global risk landscape remains significant. Analysts argue that the challenges posed by his trade posture toward China and other major economies will not diminish swiftly. As the U.S. Supreme Court evaluates legal challenges to tariff measures, Trump continues to leverage trade threats as a policy tool.

On Tuesday, he indicated that China could open its markets to American goods, following a warning of a potential 25% tariff on countries trading with Iran. Such statements could reignite tensions between the U.S. and China, as Zichun Huang, a China economist at Capital Economics, noted.

Beyond geopolitical and trade concerns, the report highlights deepening social and informational fractures. Misinformation and disinformation rank as the second most pressing near-term risks, closely followed by societal polarization. Leaders worry that manipulated information ecosystems and widening ideological divides are eroding trust in institutions and complicating coordinated responses to crises.

The WEF identifies inequality as the most interconnected risk over the next decade, linking economic instability, political unrest, health outcomes, and technological disruption. Persistent inequality is viewed as a force multiplier that intensifies the impact of other shocks and feeds cycles of resentment.

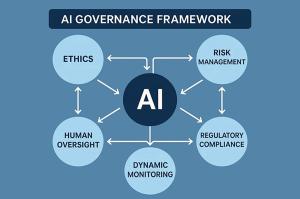

Artificial intelligence has rapidly ascended to one of the top concerns. The potential for adverse outcomes from AI rose from 30th place among short-term risks last year to fifth among long-term risks. The report notes the convergence of machine learning and quantum computing, warning that accelerating capabilities could outpace governance frameworks and human oversight.

The report underscores that environmental risks, while still severe, have dropped in immediate priority as leaders face wars, inflation, and technological upheaval. However, extreme weather remains a dominant concern for the coming decade, with global insured losses from natural disasters projected to surpass $107 billion in 2025, maintaining a trend of high losses.

The WEF concludes that cooperation is essential to navigating this complex risk landscape, advocating for “coalitions of the willing” comprising governments, businesses, academic institutions, and civil society to strengthen resilience and devise workable solutions. However, it warns that a retreat from multilateralism threatens the trust and coordination necessary to address shared challenges.

See also Wikipedia Owner Teams with Microsoft, Meta for AI Content Training Initiatives

Wikipedia Owner Teams with Microsoft, Meta for AI Content Training Initiatives Walmart and Google Shift Retail Landscape with AI-Driven Commerce: Small Brands Face New Risks

Walmart and Google Shift Retail Landscape with AI-Driven Commerce: Small Brands Face New Risks AZIO AI and EVTV Launch Pilot to Validate High-Density Cooling for AI Data Centers

AZIO AI and EVTV Launch Pilot to Validate High-Density Cooling for AI Data Centers