In January 2026, DigitalOcean unveiled its Inference Cloud Platform, developed in partnership with AMD, which has successfully doubled production inference throughput for Character.ai. This platform, which supports over a billion daily AI queries, also achieved a significant reduction in cost per token, cutting expenses by half while maintaining stringent latency targets. This milestone underscores DigitalOcean’s commitment to hardware-aware optimization and reliable AI inference, potentially enhancing its appeal to large-scale AI customers beyond basic GPU specifications.

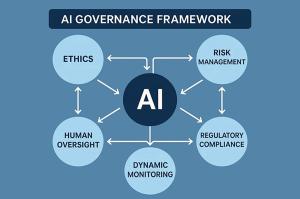

The breakthrough in AI inference is not just a technical achievement; it may also influence DigitalOcean’s investment narrative. To invest in DigitalOcean, stakeholders must believe that the company can cultivate durable customer relationships and maintain healthy margins by focusing on cost-efficient cloud and AI infrastructure. The recent success with Character.ai reinforces the potential for scaling AI workloads efficiently. However, it also raises important concerns regarding the financial implications of heavy spending on AI infrastructure and the rapidly evolving landscape of inference technology, which could burden returns if pricing or adoption does not align with these investments.

Recent developments, such as a multi-year, eight-figure annual partnership with Persistent Systems, which aims to enhance its SASVA offering and Gradient AI Platform, complement the news surrounding Character.ai. Both initiatives illustrate DigitalOcean’s strategy to penetrate the production-grade AI workload market. While they spotlight AI infrastructure as a crucial growth driver, they also amplify the risks associated with execution and high capital intensity as the company seeks to expand its customer base into larger and more complex accounts.

Investors should remain vigilant, as the success of these AI infrastructure investments hinges on translating them into sustained customer spending and improved Net Dollar Retention rates. DigitalOcean’s financial projections indicate a revenue of $1.3 billion and earnings of $182 million by 2028, suggesting a fair value estimate of $54.00 that aligns with its current stock price. However, market sentiment regarding DigitalOcean’s true value appears divided. Fourteen members of the Simply Wall St Community estimate the fair value between $22.95 and $65, reflecting varied expectations among investors.

This disparity in valuation perspectives invites further scrutiny regarding the potential of the AI infrastructure segment to mitigate the capital and execution risks previously discussed. The recent developments surrounding Character.ai may serve as a catalyst for growth; however, the broader market must weigh these advancements against the uncertainties of the current economic landscape.

As stakeholders assess their positions on DigitalOcean Holdings, they are encouraged to consider their unique narratives. The investment community is reminded that extraordinary returns often come from independent thinking rather than conforming to prevailing sentiments.

While DigitalOcean continues to position itself as a key player in the AI infrastructure space, the company’s long-term success will depend on its ability to navigate the complexities of a rapidly changing market and convert its innovations into sustainable financial performance.

See also China Imposes Limits on Nvidia AI Chip Purchases Amid U.S. Export Policy Shift

China Imposes Limits on Nvidia AI Chip Purchases Amid U.S. Export Policy Shift Chinese Startup DeepSeek Leverages $10B Hedge Fund to Disrupt AI with Cost-Effective Models

Chinese Startup DeepSeek Leverages $10B Hedge Fund to Disrupt AI with Cost-Effective Models California Lawmakers Empowered by LLNL’s AI Primer for Informed Policy Decisions

California Lawmakers Empowered by LLNL’s AI Primer for Informed Policy Decisions BigQuery Launches SQL-Native Inference for Open Models, Simplifying AI Deployments

BigQuery Launches SQL-Native Inference for Open Models, Simplifying AI Deployments