In the evolving landscape of banking and financial services, discussions surrounding artificial intelligence (AI) have intensified over the past two years. Stakeholders grapple with a pivotal question: Is AI merely a fleeting tech bubble, or does it signal a transformative shift in the industry? Current enthusiasm for AI often overlooks an essential reality: its success hinges on effective integration within diverse, highly regulated ecosystems around the globe, rather than on achieving immediate wins.

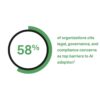

Regardless of their scale, whether a massive global bank, a mid-tier regional institution, a fintech startup, or a local credit union, financial organizations must navigate robust regulatory frameworks, including the EU AI Act, ISO/IEC 42001, and NIST’s AI Risk Management Framework (AI RMF). These regulations serve as enablers, allowing institutions to harness AI safely, responsibly, and efficiently. Consequently, this regulatory environment facilitates the transition from experimental pilots to scalable, inclusive operational models.

Early adoption of AI in the BFSI sector primarily involved pilot projects focused on customer service, fraud detection, document automation, and risk modelling. While many of these initiatives yielded promising results, smaller players often faced resource constraints, exposing a gap between AI’s vast potential and its widespread implementation. With increasing regulatory scrutiny, numerous global banks and credit unions have struggled with challenges related to explainability, bias, and data privacy.

Global supervisory bodies, including the Bank for International Settlements (BIS), the US Federal Reserve, and national regulators such as the Reserve Bank of India (RBI), have emphasized the importance of model risk management, governance, and accountability in AI-led decision-making. As a result, AI initiatives lacking traceability and control have frequently faced difficulties in scaling. A more disciplined approach has surfaced, with banks prioritizing a limited number of use cases, enhancing validation mechanisms, and aligning AI deployments with existing risk and compliance frameworks. For instance, fintechs like India’s Paytm have leveraged RBI-compliant AI for micro-lending, cutting approval times by 50%. Concurrently, U.S. community banks are utilizing NIST-guided chatbots to bolster member services without necessitating extensive in-house expertise.

The common misconception that regulation hampers innovation is often countered within the BFSI sector. Rather than stifling growth, regulatory clarity has frequently led to improved engineering decisions. AI systems designed to thrive under regulatory oversight tend to be more robust, explainable, and resilient. Fields such as credit decisioning, fraud analytics, and compliance monitoring exemplify this dynamic. As AI models increasingly influence customer outcomes, banks are required to exhibit the rationale behind their decisions, data utilization, and handling of exceptions. Explainability is not just a best practice but a regulatory requirement. Furthermore, human oversight remains a critical component, particularly for high-impact decisions, underscoring the necessity of human-in-the-loop operating models.

The growing emphasis on assurance reflects this regulatory shift, as quality engineering and validation have evolved to encompass model behaviour, data drift, and operational resilience, in addition to traditional functional testing. These practices align with regulatory expectations, subsequently helping institutions cultivate greater confidence in their AI systems over time. Rather than inflating a bubble, regulation is shaping AI into a more sustainable entity.

Insights from McKinsey’s 2025 Global Banking Annual Review show that AI adoption among smaller institutions has surged by 25% year over year, driven largely by regulatory clarity that lowers entry barriers. Guidelines from the RBI and similar organizations in emerging markets are pivotal in safeguarding against systemic risks, enabling more confident innovation.

As AI becomes increasingly embedded within core workflows—from transaction monitoring to customer engagement—it is seamlessly integrated into banking platforms. This evolution raises imperative questions regarding governance at scale. As AI systems interconnect across platforms and ecosystems, accountability becomes more intricate. Regulators have already begun to signal expectations surrounding continuous monitoring, adaptive controls, and enterprise-wide model oversight.

Research indicates that banks with mature data platforms and integrated governance models achieve higher returns from AI initiatives. For instance, JPMorgan Chase leads the 2025 Evident AI Index, generating over $2 billion annually from AI applications in fraud analytics and predictive servicing, attributing its success to robust integrated governance. The demand for talent that merges AI expertise with domain knowledge and regulatory understanding is rapidly increasing, further shaping the landscape.

Ultimately, compliance, governance, and engineering will delineate the future of AI in the BFSI sector. Success will hinge on constructing systems that regulators, customers, and corporate boards can trust, while the industry’s capacity to operationalize AI responsibly will be closely scrutinized.