Suppliers for parts of tech major Nvidia‘s H200 chips have halted production following reports that Chinese customs officials have blocked the entry of the AI processor’s shipments into China, according to the Financial Times. This unexpected development comes as Nvidia’s early shipments arrived in Hong Kong this week, leaving the company “caught by surprise,” as one source revealed.

Despite having received approval from the United States in December for the sale of AI processors in China, the situation has turned precarious. Parts manufacturers responsible for essential components are now grappling with uncertainty, fearing that Chinese authorities may impose further shipping restrictions and seek financial write-offs in the future. Chu Wei-Chia, an analyst at SemiAnalysis, pointed out to the Financial Times that the printed circuit boards designed for the H200 chips are specifically tailored for this product, rendering them unusable in other applications. This has raised alarms about the potential for excess production.

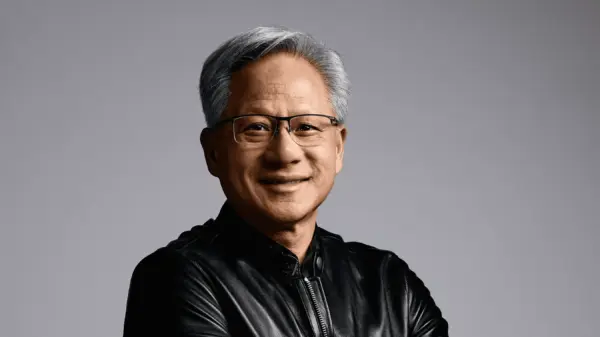

Nvidia’s CEO, Jensen Huang, has been a vocal advocate for the Chinese market, having lobbied both Washington and Beijing for the approval of his company’s H200 chips. Following a signal from former U.S. President Donald Trump that he would allow the sale, Nvidia ramped up production, anticipating over 1 million orders from Chinese clients. These deliveries were initially scheduled for March but now face an uncertain future amid the customs blockade.

This week, Chinese customs authorities informed a logistics company based in Shenzhen that Nvidia’s H200 chips would not be allowed entry into the country. The reason for this block remains unclear, and there has been no indication whether this is a temporary measure or a permanent ban. Sources have indicated that domestic technology firms have been advised against purchasing Nvidia chips, with directives to prioritize domestic alternatives instead.

In a notable shift, discussions within Chinese authorities are reportedly focused on restricting access to H200 chips solely for major tech players such as Tencent, Alibaba, and ByteDance for specific high-performance projects that require enhanced capabilities. The uncertainty surrounding the H200 has led some Chinese clients to reconsider their purchases; one supplier disclosed that orders for the chips have been canceled, prompting the emergence of a black market for Nvidia’s more advanced B200 and B300 chips.

The implications of these developments extend beyond Nvidia and its suppliers. With China’s tech landscape rapidly evolving, the impact of custom restrictions may signify a broader shift in the dynamics of international technology trade and innovation. As domestic options are increasingly prioritized, the ability of foreign firms to compete in China could face new challenges amid a shifting regulatory environment. How this situation unfolds will likely be closely monitored by industry stakeholders, as it may set a precedent for future interactions between Western tech companies and the Chinese market.

See also ST Engineering (S63.SI) Surges 2.24% to S$9.60 Amid Strong AI Contract Demand

ST Engineering (S63.SI) Surges 2.24% to S$9.60 Amid Strong AI Contract Demand NVIDIA’s H100 Chip Power Consumption Hits 700W, Advanced Packaging Sector Surges 14%

NVIDIA’s H100 Chip Power Consumption Hits 700W, Advanced Packaging Sector Surges 14% Geekom Launches GeekBook X16 Pro: Affordable 16-Inch AI Laptop Starting at $1,149

Geekom Launches GeekBook X16 Pro: Affordable 16-Inch AI Laptop Starting at $1,149 Japanese Researchers Unveil Ultrafast Laser Method to Control Chip Heat at Nanoscale

Japanese Researchers Unveil Ultrafast Laser Method to Control Chip Heat at Nanoscale AI Data Centers Face Engineer Shortage; U.S. Needs 400,000 Workers by 2033

AI Data Centers Face Engineer Shortage; U.S. Needs 400,000 Workers by 2033