Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL) emerged as the standout performer among the “Magnificent Seven” stocks in 2025, outpacing numerous other major technology companies. The year was characterized by multiple catalysts that propelled its stock price higher, although some of these drivers may not carry over into 2026.

While it’s unlikely that Alphabet will replicate its impressive 65% gain from 2025, projections indicate that the stock is poised to outperform the broader market. Analysts predict a revenue increase of approximately 14% in 2026, a benchmark that typically places big tech firms in a competitive investment light.

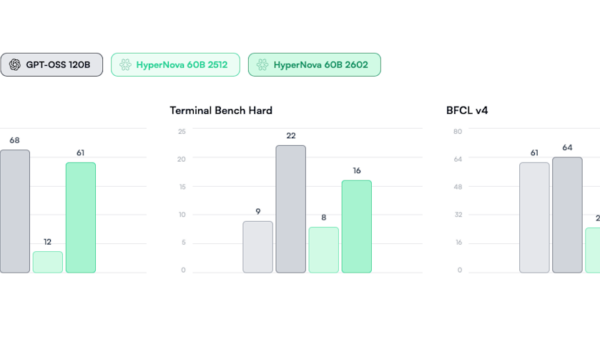

Entering 2026, Alphabet enjoys a robust position in the generative AI landscape, having addressed initial investor concerns about falling behind competitors. Throughout 2025, Alphabet’s Gemini model emerged as a significant contender among large language models, challenging established players on various performance metrics. This competitive edge in AI could foster continued client interest and investment in Alphabet’s products, which may yield long-term benefits despite the time required for these investments to materialize fully.

Investors had expressed anxiety regarding Google Search, Alphabet’s primary revenue generator. In the third quarter of 2025, Google Search accounted for $56.6 billion of the company’s total revenues of $102.3 billion. Initially, concerns centered around the impact of generative AI on search traffic, as alternatives like ChatGPT gained traction. However, Alphabet successfully integrated AI Overviews into search responses, enhancing user experience and reinforcing its dominance in the market.

Legal challenges also loomed over Alphabet, particularly regarding antitrust allegations and potential divestitures of key assets such as the Chrome browser and Android operating system. A recent ruling from a federal judge imposed lighter penalties on Alphabet for anticompetitive behavior, allowing it to continue operating its integrated services without major structural changes. While minor concessions were required, the outcome was far less severe than many had anticipated, contributing to a positive sentiment around the stock.

As these issues were resolved throughout 2025, Alphabet’s stock regained its valuation, aligning more closely with its big tech peers. Currently trading at 30 times forward earnings, analysts consider this price reasonable within the current tech investment landscape. Future stock price movements are likely to correlate closely with earnings growth, which underscores the importance of the upcoming fiscal year.

Looking ahead, if Alphabet maintains its trading multiple of 30 times forward earnings by the end of 2026, projections suggest a share price of approximately $383, based on an average earnings estimate of $12.76 per share for 2027 from ten Wall Street analysts. This would represent a 14% increase from current levels and exceed the market’s average annual return of around 10%. However, if the overall market performs exceptionally well, Alphabet could still underperform despite achieving solid year-over-year growth.

Investors contemplating a stake in Alphabet might also consider that the company’s stock has not made the cut among the top recommendations from the Motley Fool Stock Advisor team. Their latest analysis highlights ten stocks they believe have the potential for significant returns, with Alphabet not included in this list. Historical data from the advisory service reveals that early investments in stocks like Netflix and Nvidia yielded extraordinary returns, emphasizing the potential for selecting high-growth opportunities.

As Alphabet navigates the complexities of the evolving tech landscape in 2026, its position within the generative AI sector and the performance of its core business will be critical factors for investors to monitor. While the company has shown resilience and adaptability, potential investors should weigh Alphabet’s prospects against other emerging opportunities in the market.

See also X Limits Grok’s AI Image Generation Amid Global Criticism and Legal Concerns

X Limits Grok’s AI Image Generation Amid Global Criticism and Legal Concerns Google Launches Veo 3.1 to Generate Social-Ready Vertical Videos for Mobile Users

Google Launches Veo 3.1 to Generate Social-Ready Vertical Videos for Mobile Users AI Models Struggle with Visual Tasks, Scoring Below Average Toddlers, Reveals UniPat Study

AI Models Struggle with Visual Tasks, Scoring Below Average Toddlers, Reveals UniPat Study Android Studio Otter Launches LLM Flexibility and Enhanced Agent Workflows for Developers

Android Studio Otter Launches LLM Flexibility and Enhanced Agent Workflows for Developers