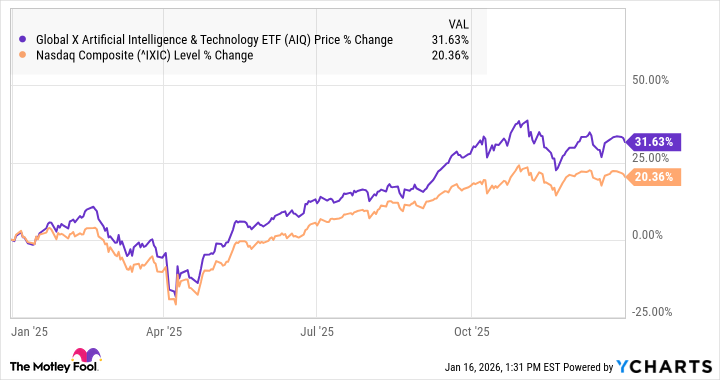

Artificial intelligence (AI) stocks demonstrated remarkable performance last year, with exchange-traded funds (ETFs) that focus on these equities also experiencing significant gains. Notably, the Global X Artificial Intelligence and Technology ETF (NASDAQ: AIQ) emerged as a standout in this sector.

AIQ, which includes major tech companies such as Samsung (OTC: SSNL.F), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), Advanced Micro Devices (NASDAQ: AMD), Taiwan Semiconductor (NYSE: TSM), and Alibaba, saw its value increase by 32% by year-end, according to data from S&P Global Market Intelligence. The ETF largely mirrored the movements of the Nasdaq Composite, but managed to outperform it consistently throughout the year, even amidst market turbulence leading up to the Liberation Day tariffs announcement.

AIQ’s diversified portfolio, featuring 86 holdings, mitigates the risk associated with any single stock affecting the fund’s performance significantly. Currently, Samsung represents the largest holding, accounting for 5.25% of total assets.

Approximately 72% of AIQ is invested in information technology stocks, indicating a strong emphasis on the tech sector. This allocation includes a range of companies from semiconductor manufacturers to digital platforms. Furthermore, AIQ offers a considerably higher exposure to international stocks compared to U.S.-based index funds that track the Nasdaq or the S&P 500. Three of its top five holdings—Samsung, TSMC, and Alibaba—are based outside the United States, with SK Hynix, a South Korean memory chipmaker, listed as the seventh largest holding.

The ETF has made significant investments in the leading memory chip manufacturers: Samsung, Micron, and SK Hynix, all of which reported strong performance last year and appear well-positioned for continued growth this year. The fund aims to track the Indxx Artificial Intelligence & Big Data Index.

As of January 16, 2026, AIQ was already up 3%, reflecting the ongoing strength of AI stocks in the early part of the new year. Despite its impressive growth trajectory, many of AIQ’s top holdings maintain reasonable valuations, suggesting that the ETF may remain a strong performer as the AI boom continues.

However, potential investors should consider that the Motley Fool Stock Advisor analyst team has identified what they believe to be the ten best stocks for investment currently, which notably does not include the Global X Artificial Intelligence and Technology ETF. This list has a proven track record of generating substantial returns, with examples such as Netflix, which was recommended on December 17, 2004, resulting in a potential $474,578 return on a $1,000 investment, and Nvidia, which, if invested in upon recommendation on April 15, 2005, would yield around $1,141,628 today.

The total average return from Stock Advisor stands at 955%, significantly outperforming the S&P 500‘s return of 196%. With such history, investors are encouraged to consider the latest top ten list available through Stock Advisor, which reflects a community of individual investors sharing insights and strategies.

In summary, while the Global X Artificial Intelligence and Technology ETF has shown strong performance and a diversified portfolio, potential investors may wish to evaluate alternatives highlighted by experienced analysts. The ongoing advancements in AI technology and its applications suggest that the sector holds considerable promise in the coming years.

See also AI Rally Begins: Expert Predicts Winners Amidst Market Selection, Avoids 2000 Bubble Collapse

AI Rally Begins: Expert Predicts Winners Amidst Market Selection, Avoids 2000 Bubble Collapse DeepSeek Unveils Engram Technique to Cut AI Memory Costs by 25% and Enhance Reasoning

DeepSeek Unveils Engram Technique to Cut AI Memory Costs by 25% and Enhance Reasoning Master AI: Essential Glossary of Terms, Trends, and Key Players Transforming Tech

Master AI: Essential Glossary of Terms, Trends, and Key Players Transforming Tech Sweden Bans AI-Created Hit ‘I Know, You’re Not Mine’ from Music Charts After 5M Streams

Sweden Bans AI-Created Hit ‘I Know, You’re Not Mine’ from Music Charts After 5M Streams Meta Cuts 1,000 Jobs in Reality Labs as AI Investments Surge to $72 Billion by 2025

Meta Cuts 1,000 Jobs in Reality Labs as AI Investments Surge to $72 Billion by 2025