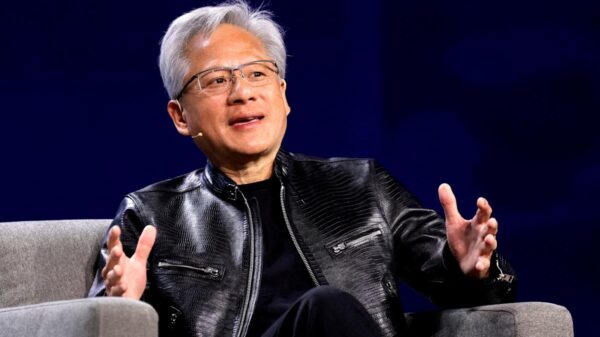

ISLAMABAD: The Trump administration has formally approved limited sales of Nvidia‘s H200 AI chips to China, marking a pivotal shift in U.S.-China technology policy. Announced on January 13, 2026, the sales will be contingent upon non-military use cases and approval from a third-party testing laboratory. This decision comes after years of stringent export controls that limited Beijing’s access to advanced AI chips, specifically those with computing power surpassing the A100 model.

The H200 chip represents Nvidia’s second-best offering, which had previously been inaccessible to Chinese firms, who were relegated to procuring the H20— a version with almost seven times less processing power. The easing of these export restrictions signals a strategic recalibration, particularly as Huawei emerges as a serious contender in the AI chip market.

Pakistan has initiated discussions with Huawei’s vice president about developing GPU-based AI infrastructure under its cloud-first policy. This reflects a broader trend among developing nations seeking alternatives to American cloud services, motivated by both cost and geopolitical considerations. At recent Belt and Road Forums for International Cooperation, China has highlighted its Global AI Governance Initiative, while its open-source AI model, DeepSeek-R1, has been touted as a significant milestone.

When comparing performance metrics, however, the U.S. government’s assumption of Huawei as a formidable competitor appears tenuous. Huawei’s premier chip, the Ascend 910C, operates at about 60% of the capability of Nvidia’s H100, the predecessor of the newly available H200. Furthermore, Huawei’s annual chip production is estimated at under one million units, insufficient to meet the burgeoning demand from Chinese tech companies for high-performance chips.

Nvidia’s roadmap indicates that the memory bandwidth of its flagship chips will increase from 8 TB per second in 2026 to 20 TB per second in 2027, while Huawei anticipates reaching around 9 TB per second by 2028. In stark contrast, Nvidia’s upcoming Rubin Ultra is projected to surpass 50 TB per second by the end of that timeline.

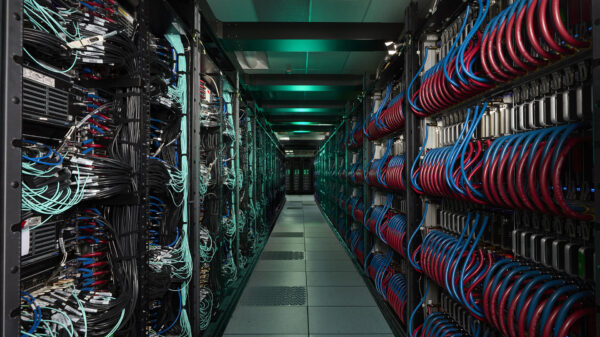

Chinese technology firms have reportedly already ordered more than two million H200 chips at approximately $27,000 each, amounting to a staggering total of around $54 billion. With Nvidia’s inventory dwindling to about 700,000 units, the company is ramping up production to fulfill this surge in demand, resulting in a shortage of high-performance memory chips.

This policy shift from containment to a conditional opening provides crucial relief for Chinese firms. China excels in various aspects of the AI value chain, including access to data, algorithms, and human resources. The past three years have seen high-end GPU chips as the main bottleneck hindering its progress. Despite the U.S. retaining advantages in semiconductor design and partnerships with leading foundries like TSMC, China now has a chance to learn and compete on a more balanced playing field.

Nevertheless, Chinese authorities remain cautious about fully reopening their market to Nvidia. Reports suggest that the purchase of these chips will be approved only under specific circumstances, such as for research initiatives. Local companies are also being advised against stockpiling U.S. chips without explicit consent, reflecting a desire to minimize reliance on foreign technology.

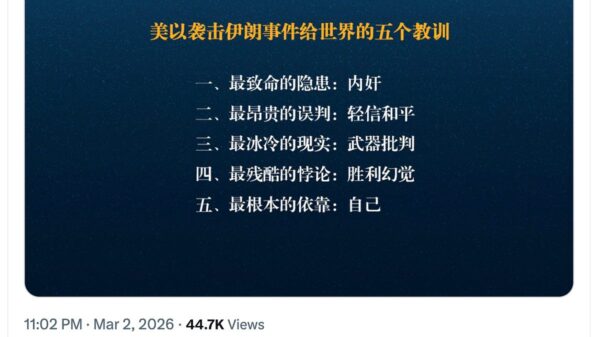

In essence, the U.S. has effectively pressed the “reset” button on the ongoing chip wars by allowing H200 exports. This move validates Nvidia’s technological dominance, translating into a $54 billion opportunity. For China, it alleviates the critical bottleneck that has constrained its AI aspirations. While the U.S. maintains its lead in processing power and memory bandwidth, Beijing’s cautious approach to stockpiling suggests a reluctance to trade long-term self-sufficiency for immediate hardware upgrades.

In this high-stakes diplomatic game centered on silicon, the U.S. is banking on the rapid pace of its innovation while China is focusing on integrating these chips into a robust, state-led AI ecosystem.

See also Tesla Revives Dojo AI Chip Project, Targets $16.5B Chip Market with AI5 Development

Tesla Revives Dojo AI Chip Project, Targets $16.5B Chip Market with AI5 Development Automation Revolutionizes AI Processor Interconnects, Enhancing Efficiency and Design Speed

Automation Revolutionizes AI Processor Interconnects, Enhancing Efficiency and Design Speed Microsoft’s AI Strategy Drives $281.7B Revenue, Apple Focuses on Hardware Ecosystem

Microsoft’s AI Strategy Drives $281.7B Revenue, Apple Focuses on Hardware Ecosystem Vista AI Secures $29.5M Series B Funding to Expand Automated MRI Scanning Capabilities

Vista AI Secures $29.5M Series B Funding to Expand Automated MRI Scanning Capabilities Quantum Computing Market Projected to Surge to $72 Billion by 2035, Says McKinsey

Quantum Computing Market Projected to Surge to $72 Billion by 2035, Says McKinsey