Gartner, Inc. recently hosted its Data & Analytics Summit 2026 in Sydney from January 16–17, where the firm highlighted emerging trends in enterprise AI spending and readiness for organizational adoption. As the tech landscape evolves, Gartner has projected that worldwide AI spending could reach US$2.52 trillion by 2026, emphasizing the demand for proven outcomes and the necessary organizational infrastructure to support such investments.

However, amid these optimistic forecasts, investors are grappling with potential headwinds that could impact Gartner’s business model. The firm is experiencing slowing contract renewals and margin pressures, raising concerns that the proliferation of AI tools might undermine the demand for its traditional advisory services. These factors have led investors to speculate how they might reshape Gartner’s broader investment narrative.

At the summit, Gartner executives underscored the importance of their research and advisory model in a landscape increasingly characterized by AI tools that allow clients to source and synthesize information independently. For investors, the crux of the issue lies in determining whether Gartner can maintain its relevance against the backdrop of a rapidly changing technology ecosystem. The recent forecasts affirm the long-term value of Gartner’s insights but offer little comfort concerning immediate contract value trends.

Investors in Gartner must navigate this complexity, weighing the firm’s projection of $7.4 billion in revenue and $821.8 million in earnings by 2028 against the required 4.7% annual revenue growth and a significant earnings decrease from $1.3 billion today. This trajectory necessitates a stabilization of contract value growth that has recently exhibited softness.

The market is currently divided on Gartner’s valuation, with fair value estimates from the Simply Wall St Community ranging from approximately US$283.7 to US$420.7 per share. This variance underscores a broader disagreement among analysts regarding Gartner’s potential upside, particularly in light of the ongoing issues surrounding contract renewals and profit margins.

Moreover, as enterprises increasingly experiment with AI to meet their information needs, there is a palpable risk that clients may turn to generative AI solutions which could gradually render some advisory use cases redundant. Investors are carefully monitoring these trends, acknowledging that while AI investment is on the rise, Gartner’s ability to adapt its service offerings will be critical.

The current landscape presents both opportunities and challenges for Gartner. With its emphasis on AI adoption and the corresponding demand for its expertise, the company is positioned to capitalize on growth in this sector. However, the challenges presented by margin compression and client behavior pose significant risks that could influence investor sentiment.

As the technology sector continues to evolve, the implications for Gartner and its shareholders are profound. This period of transformation may redefine not just the company’s business model but also the broader advisory landscape as organizations increasingly look towards AI solutions to drive efficiency and innovation. Future earnings reports and contract renewal trends will be closely scrutinized as stakeholders seek clarity on the company’s direction in this rapidly changing environment.

For more detailed information on Gartner’s performance and forecasts, you can visit their official site at Gartner.

See also TKMS and Cohere Collaborate to Enhance AI for Canada’s Submarine Program

TKMS and Cohere Collaborate to Enhance AI for Canada’s Submarine Program ServiceNow Flaw Exposes AI Integration Risks, Bypasses Security with Default Agent Access

ServiceNow Flaw Exposes AI Integration Risks, Bypasses Security with Default Agent Access Amazon Invests $35 Billion in India’s AI and Logistics by 2030, Aiming for 1 Million Jobs

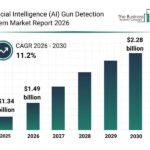

Amazon Invests $35 Billion in India’s AI and Logistics by 2030, Aiming for 1 Million Jobs AI Gun Detection Market Poised for $2.28B Growth by 2030, Driven by Real-Time Threat Solutions

AI Gun Detection Market Poised for $2.28B Growth by 2030, Driven by Real-Time Threat Solutions Hugging Face and Render Launch Tools for Seamless AI Model Deployment

Hugging Face and Render Launch Tools for Seamless AI Model Deployment