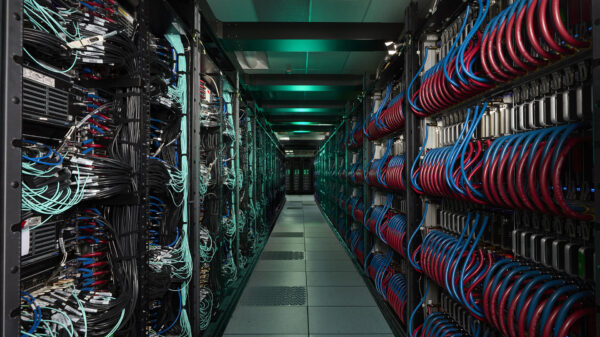

BEIJING – A report released by the Hurun Report has highlighted the ascendance of AI chip companies within China’s technology landscape, positioning them as the most significant players in the AI sector for 2025. The report ranks the top 50 AI companies in China, revealing that seven of the top ten spots are occupied by firms specializing in AI chips. Leading the ranking are Cambricon, Moore Threads, and MetaX, all of which are dedicated to the development of AI chip technology.

According to Rupert Hoogewerf, chairman and chief researcher of the Hurun Report, this surge in prominence can be partially attributed to recent tightening of U.S. export restrictions on advanced AI chips. This situation is accelerating China’s push towards self-reliance in computing power, facilitating a stronger position for its domestic AI companies.

The report reflects a notable evolution in China’s AI capabilities. Data from a third-party platform indicates that the market share of Chinese open-source AI models has grown from just 1.2% at the close of 2024 to approaching 30% in 2025, marking a significant increase. This rapid development underscores the increasing influence of Chinese enterprises in the global AI market.

Interestingly, many of the AI companies listed are relatively young, with an average founding age of just 12 years. The youngest firms—Moonshot AI, Baichuan AI, and StepFun—were established in 2023 and focus on large models for AI-generated content (AIGC). This trend reflects a growing interest in innovative applications of AI technology.

The report also identifies companies diving into emerging fields such as AI-driven drug discovery, autonomous vehicle technology, and enterprise decision-making, highlighting the tangible adoption of AI solutions across various sectors in China. These advancements demonstrate the role of AI companies as “enablers” for industries like consumer electronics and new energy vehicles to enhance their competitive edge globally.

Geographically, Beijing leads the ranking with 19 companies, followed by Shanghai with 14 and Shenzhen with 6, illustrating a significant concentration of AI innovation in China’s first-tier cities. Collectively, these urban centers account for over 80% of the companies featured in the report, showcasing the clustering effect within the nation’s burgeoning AI sector.

The ranking methodology considers corporate value, using market capitalization for publicly listed firms based on closing stock prices as of January 9. For unlisted companies, valuations are derived from comparable listed firms or their latest financing rounds. Notably, firms that focus primarily on robotics, such as UBTECH, and those whose core business is not primarily AI, like ByteDance and DeepSeek, were not included in this particular ranking.

As AI technology continues to evolve and integrate into various industries, China’s emphasis on self-sufficiency in AI chip production and broader technological capabilities suggests a strategic shift that may reshape global market dynamics in the coming years. The growth of homegrown companies could not only bolster China’s position in the tech arena but also significantly impact international competition.

See also Salesforce Enhances AI Strategy to Tackle Last-Mile Adoption Challenges in Enterprises

Salesforce Enhances AI Strategy to Tackle Last-Mile Adoption Challenges in Enterprises NVIDIA Stock Drops 3% as China Blocks H200 AI Chip Shipments Amid Trade Tensions

NVIDIA Stock Drops 3% as China Blocks H200 AI Chip Shipments Amid Trade Tensions Trump Launches ‘Pax Silica’ Initiative to Secure AI Supply Chains and Greenland’s Minerals

Trump Launches ‘Pax Silica’ Initiative to Secure AI Supply Chains and Greenland’s Minerals AI Processor Market: 17 IPOs and 21 Acquisitions Since 2010 Amid $28B Investment Surge

AI Processor Market: 17 IPOs and 21 Acquisitions Since 2010 Amid $28B Investment Surge