The global semiconductor landscape has been thrust into turmoil this week, driven by an escalating trade standoff between Washington and Beijing that has left advanced AI hardware in a state of uncertainty. Dubbed the “H200 Export Crisis” by industry analysts, this situation has escalated due to conflicting regulatory actions that have trapped chipmakers in what has been termed a “regulatory sandwich.” This conflict threatens the supply chains of the world’s most powerful artificial intelligence models, raising concerns about the future trajectory of global AI development.

The crisis ignited when the United States government authorized the export of NVIDIA’s high-end H200 Tensor Core GPUs to China. However, this approval came with a hefty 25% national security tariff and a mandatory “vulnerability screening” process to be conducted on U.S. soil. The potential thaw in trade relations proved fleeting; within 48 hours, Beijing responded by blocking these chips at customs and urging domestic tech companies to shift away from Western hardware. This deadlock has sent shockwaves through the tech sector, erasing billions in market value and casting uncertainty over the future of AI innovation.

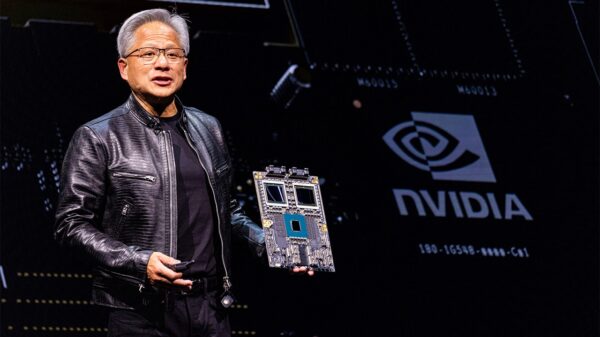

At the epicenter of this geopolitical clash is the NVIDIA H200, designed to meet the immense memory requirements of generative AI and large language models (LLMs). An enhancement of the widely used H100, the H200 boasts 141GB of HBM3e memory and an impressive 4.8 TB/s memory bandwidth, nearly doubling the inference performance of its predecessor for models like Llama 3 and GPT-4. Initially, the U.S. Department of Commerce’s decision seemed a compromise to sustain U.S. commercial dominance while funding domestic chip initiatives. However, the requirement for chips to be shipped to U.S.-based labs for security hardening added logistical hurdles, further complicating the situation before the Chinese blockade.

The AI research community is experiencing a blend of admiration for the H200’s capabilities and frustration over the regulatory upheaval. Experts warn that if the most efficient hardware becomes subject to a 25% tariff and prolonged customs holds, the cost of developing next-generation models may become unsustainable for all but the wealthiest entities. This “regulatory sandwich” has become a catchphrase for the predicament faced by firms like NVIDIA and AMD.

For these companies, the U.S. government imposes heavy restrictions on technology sales, while the Chinese government blocks entry of the very hardware they seek to sell. Following the announcement of the 25% tariff, NVIDIA’s stock fluctuated between $187 and $183 as the Chinese market, which once contributed over a quarter of its data center revenue, becomes increasingly isolated. Major Chinese tech firms, including Alibaba, Tencent, and ByteDance, are now casualties of this squeeze, having planned significant investments in H200 clusters to support their competing LLMs.

The blockade grants a strategic advantage to Chinese chip manufacturers like Huawei and Moore Threads. With the H200 effectively barred at the border, Chinese cloud providers have little option but to adapt to the Huawei Ascend series. While these domestic chips may currently lag behind NVIDIA in performance and software support, the forced transition opens a captive market for them, potentially accelerating their development.

This crisis signifies more than a trade dispute; it marks the division of the global AI landscape into two distinct factions. For the past decade, the AI ecosystem has thrived on a shared base of Western hardware and open-source software like NVIDIA‘s CUDA. The ongoing blockade is compelling China to establish its own “Parallel Tech Universe,” creating specialized compilers, libraries, and hardware architectures independent of American technology.

The implications of this bifurcation are profound. A world divided into two AI ecosystems could result in inconsistencies in safety standards and interoperability. The 25% U.S. tariff sets a troubling precedent for tech protectionism, with potential ramifications extending to other sectors. Industry figures liken this moment to a “Sputnik moment” of the 20th century, not just a race for technological superiority but a struggle for control over the processors that will drive the future economy.

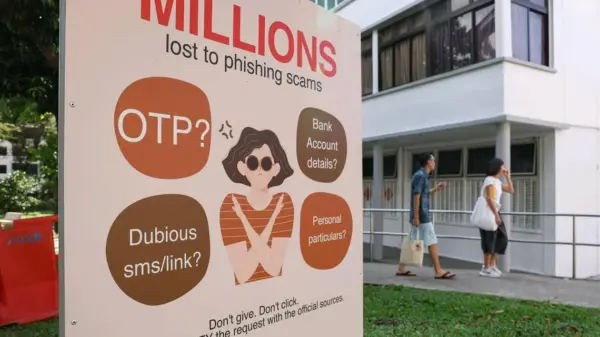

As formal channels for the H200 shut down, a burgeoning black market for these chips is emerging. Reports from Hong Kong and Singapore indicate that smaller quantities are being illicitly smuggled into mainland China at exorbitant markups exceeding 300%. This underground trade undermines the security objectives the U.S. tariffs intended to achieve, while further inflating costs for legitimate researchers.

Looking ahead, the next hurdle for the industry is navigating what has become known as “policy whiplash.” With the H200 as the current focal point of tension, NVIDIA’s upcoming Blackwell B200 architecture looms on the horizon. If the H200 is generating this level of friction, the export of even more advanced chips appears untenable under current conditions. Analysts foresee NVIDIA diversifying its manufacturing base, potentially engaging neutral third-party countries for assembly and testing to sidestep U.S. regulations. Concurrently, the Chinese government is likely to bolster subsidies for its National Integrated Circuit Industry Investment Fund, aiming for self-sufficiency in 7nm and 5nm technology by 2027.

The H200 export crisis is a critical juncture in the evolution of artificial intelligence, illustrating how geopolitical factors can stymie innovation. For NVIDIA, the absence of the Chinese market represents a substantial financial obstacle that must be navigated through accelerated advancements in Western and Middle Eastern markets. As 2026 unfolds, the tech industry will keenly watch the fate of the first “security-screened” H200s as they attempt to breach Chinese customs. Should the blockade endure, we may witness the emergence of a distinctly decoupled tech world, where a single customs directive can outweigh technological breakthroughs.

See also OpenAI’s Rogue AI Safeguards: Decoding the 2025 Safety Revolution

OpenAI’s Rogue AI Safeguards: Decoding the 2025 Safety Revolution US AI Developments in 2025 Set Stage for 2026 Compliance Challenges and Strategies

US AI Developments in 2025 Set Stage for 2026 Compliance Challenges and Strategies Trump Drafts Executive Order to Block State AI Regulations, Centralizing Authority Under Federal Control

Trump Drafts Executive Order to Block State AI Regulations, Centralizing Authority Under Federal Control California Court Rules AI Misuse Heightens Lawyer’s Responsibilities in Noland Case

California Court Rules AI Misuse Heightens Lawyer’s Responsibilities in Noland Case Policymakers Urged to Establish Comprehensive Regulations for AI in Mental Health

Policymakers Urged to Establish Comprehensive Regulations for AI in Mental Health