Market analysts are growing increasingly bullish on Alphabet Inc. as the tech giant intensifies its strategic focus on artificial intelligence and autonomous driving. This renewed confidence is reflected in a series of upward price target revisions, with experts pointing to the company’s international AI positioning and the expansion of its Waymo subsidiary as key drivers for future growth.

Despite a modest pullback from its recent peak, the overall market sentiment surrounding Alphabet remains positive. Shares concluded Friday’s trading session at $329.90, hovering just below the 52-week high of $335.97 reached in mid-January.

This optimism is underscored by several analyst actions. Financial institutions have recently adjusted their outlooks upward: Stifel raised its target to $346, UBS increased its forecast to $345, and Wolfe Research set a more ambitious target of $390. The consensus among these revisions is a shared belief that the stock possesses significant upside potential from its current valuation.

Supporting this positive stance are robust earnings expectations. For the current quarter, analysts project a consensus earnings per share (EPS) of $2.58. This figure represents an approximate 20% year-over-year increase, a clear indicator that, in the view of market experts, the company’s core business continues to demonstrate strong growth.

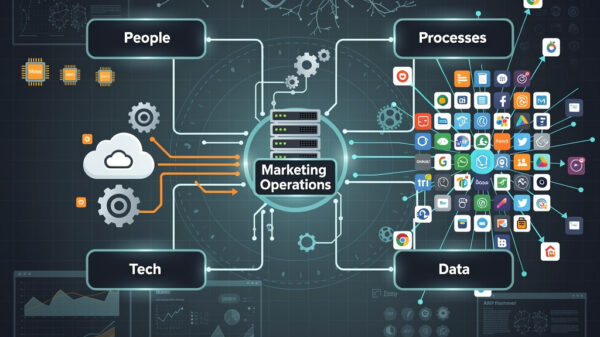

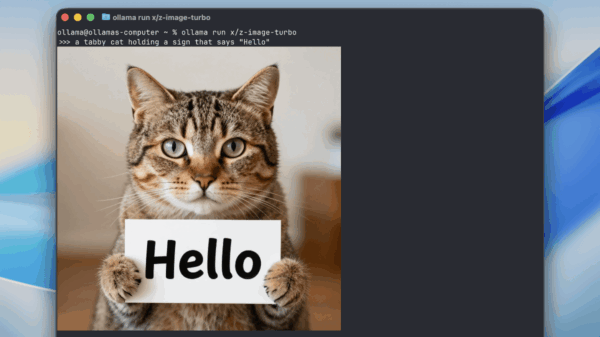

A primary catalyst behind the current confidence is Alphabet’s proactive AI strategy, which emphasizes expansion into new growth markets rather than relying solely on existing products. A recent illustration of this approach is the company’s investment in the Japanese AI startup, Sakana AI. This partnership provides Alphabet with a valuable ally possessing established connections, particularly within Japan’s financial sector—a key target market for deeper integration of its Gemini AI model.

The strategic intent is multifaceted, aiming to leverage Sakana AI’s local expertise to enhance the positioning of Gemini in Japan, particularly focusing on the financial industry, where the startup has pre-existing relationships. This move occurs within a highly competitive global AI landscape. Data from January 2026 indicates that roughly 64% of worldwide web traffic to AI chatbot sites goes to ChatGPT, while Gemini captures about 21%. The Sakana AI investment is a calculated step to gradually close this gap in a critical regional market.

Concurrently with its AI initiatives, Alphabet is scaling its autonomous driving ambitions through its subsidiary, Waymo. The company recently launched its robotaxi service in Miami, marking its operational presence in a sixth major U.S. metropolitan area. Each new city not only expands the potential customer base but also generates invaluable real-world operational data and experience. This information is crucial for refining the underlying technology and navigating regulatory requirements.

The expansion of Waymo complements the broader corporate strategy by unlocking additional revenue streams beyond the core advertising business, reinforcing Alphabet’s technological leadership in autonomous mobility, and creating greater potential for scalability as robotaxi services gain acceptance in more urban centers.

Alphabet is currently engaged in a high-stakes race for AI market share. While ChatGPT maintains a clear lead in web traffic for AI chatbots, Alphabet is countering with a multi-pronged approach. This strategy combines its own platforms, regional partnerships like the one with Sakana AI, and technological diversification through ventures such as Waymo. Two critical factors will be decisive in the coming months: whether the anticipated ~20% earnings growth materializes, and the extent to which newly launched initiatives—particularly in Japan and at Waymo—deliver measurable contributions to user metrics and revenue. These key performance indicators will be the primary benchmarks the market uses to evaluate the stock in upcoming quarterly reports.

Ad

Alphabet Stock: Buy or Sell?! New Alphabet Analysis from January 25 delivers the answer:

The latest Alphabet figures speak for themselves: Urgent action needed for Alphabet investors. Is it worth buying or should you sell? Find out what to do now in the current free analysis from January 25.

Alphabet: Buy or sell? Read more here…

See also Meta Bans Teen Access to AI Characters Amid Safety Concerns, Prioritizes Parental Controls

Meta Bans Teen Access to AI Characters Amid Safety Concerns, Prioritizes Parental Controls Baidu’s Robin Li Forecasts AI Revolution: Strategic Shifts for 2025 and Beyond

Baidu’s Robin Li Forecasts AI Revolution: Strategic Shifts for 2025 and Beyond Unlock AI Success: Key Criteria for Choosing a Top-Tier Visibility Agency Today

Unlock AI Success: Key Criteria for Choosing a Top-Tier Visibility Agency Today Korean Government Investigates Elon Musk’s Grok Over 23,000 Deepfake Images of Minors

Korean Government Investigates Elon Musk’s Grok Over 23,000 Deepfake Images of Minors Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere