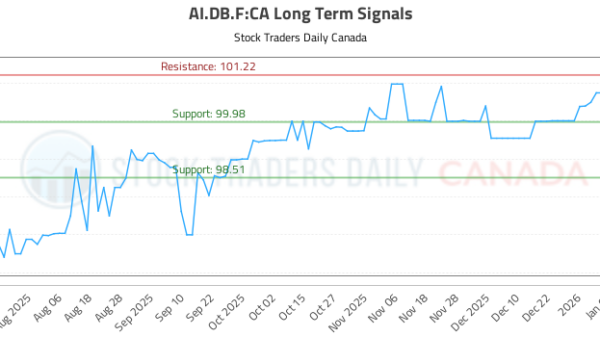

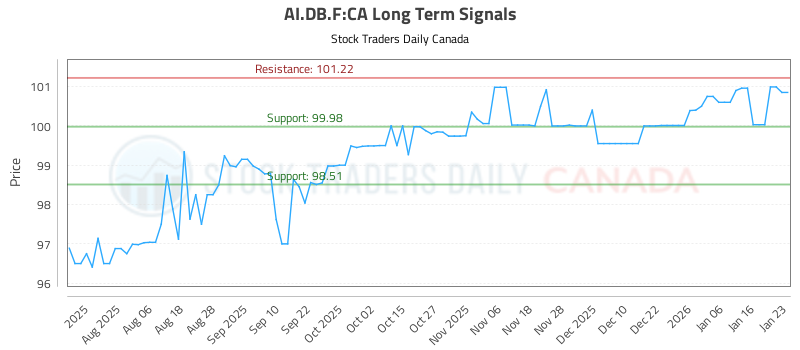

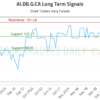

The market for Atrium Mortgage Investment Corporation’s 5.00% convertible unsecured subordinated debentures (AI.DB.F:CA) is currently showing neutral ratings across all terms as of January 25, 2026. Traders are eyeing specific price levels for potential buy and sell opportunities. The current buy target is situated near 99.98, with an aim to reach 101.22. A stop loss is advised at 99.48. Conversely, for those considering short positions, the recommended entry point is near 101.22, with a target of 99.98 and a stop loss set at 101.73.

The outlook for these debentures remains neutral, reflecting a cautious sentiment among investors. The market’s current state can be observed in the accompanying AI-generated signals, which offer visual insights into trading patterns. These signals can serve as a guide for traders navigating the fluctuating interest rates and economic conditions affecting mortgage investments.

Recent market dynamics for the Atrium Mortgage Investment Corporation have been influenced by wider trends in the mortgage sector, which has been adjusting to varying interest rates and changing regulatory landscapes. As investors look to capitalize on potential price movements, the emphasis on strategic entry and exit points becomes critical. The aforementioned targets and stop losses highlight the tactical approach that traders are adopting in this uncertain environment.

To provide further context, the financial landscape for mortgage investments has been evolving, with various debt instruments responding differently to economic indicators. This shift is particularly evident as the market weighs the implications of interest rate adjustments by central banks. Such movements can have far-reaching impacts on the pricing of convertible debentures, including those issued by Atrium Mortgage Investment Corporation.

The attached chart illustrating the trading signals for AI.DB.F:CA presents a visual representation of the recent price action, allowing traders to gauge momentum and determine their strategies effectively. The signals indicate areas of potential support and resistance that are vital for making informed decisions in a competitive trading environment.

As of this writing, the ratings for AI.DB.F:CA remain neutral, suggesting that while there may be opportunities, significant caution is warranted. Stakeholders are urged to stay attuned to market developments that could affect the performance of these debentures in the coming weeks. With economic indicators continuing to fluctuate, the situation may evolve rapidly, necessitating agile trading responses.

Investors interested in the latest updates and analyses can refer to the original source for AI-generated signals and further insights into Atrium Mortgage Investment Corporation’s offerings. It will be essential for traders to remain vigilant and adaptable as the market landscape continues to change.

For more detailed information, visit the official site for Atrium Mortgage Investment Corporation.

See also DeepSnitch AI Surges 140% as Investors Shift from Shiba Inu to High-Utility Presales

DeepSnitch AI Surges 140% as Investors Shift from Shiba Inu to High-Utility Presales Anthropic Unveils Security Center for Claude Code to Enhance Code Security Management

Anthropic Unveils Security Center for Claude Code to Enhance Code Security Management 2026 Local SEO Revolution: Embrace AI Trust Signals or Face Business Obsolescence

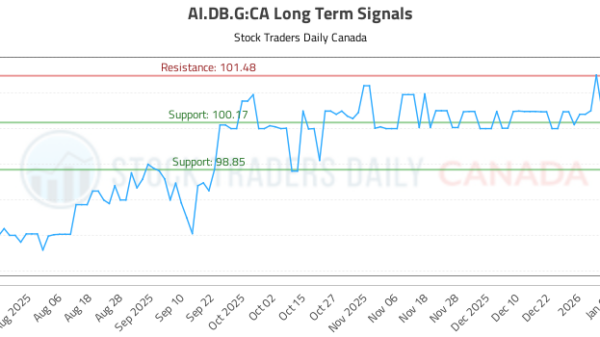

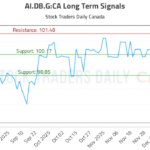

2026 Local SEO Revolution: Embrace AI Trust Signals or Face Business Obsolescence AI.DB.G:CA Trading Signals Updated—Optimal Buy/Sell Levels for January 25

AI.DB.G:CA Trading Signals Updated—Optimal Buy/Sell Levels for January 25 Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere