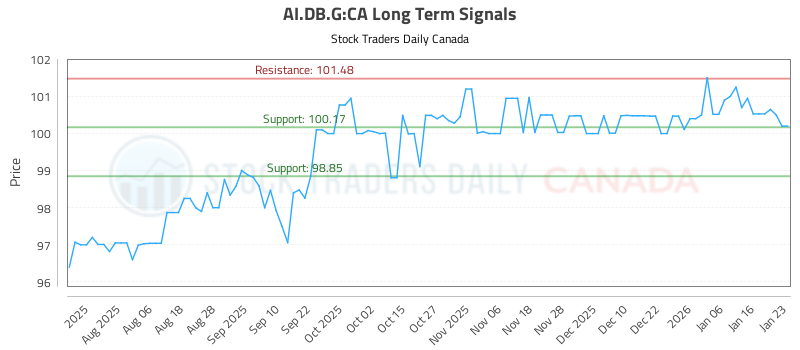

On January 25, 2026, trading signals for the Atrium Mortgage Investment Corporation 5.10% convertible unsecured subordinated debentures due March 31, 2029 (AI.DB.G:CA) indicate neutral market sentiment. Investors are advised to buy near 100.17, targeting a price of 101.48, with a stop loss set at 99.67. Conversely, short positions are recommended near 101.48, aiming for a target of 100.17, with a stop loss at 101.99. These signals are based on updated AI-generated data, reflecting the current trading landscape for this financial instrument.

As of the latest ratings, all trading terms—near, mid, and long—are classified as Neutral. This suggests a cautious approach in an environment where market fluctuations are common. The stability reflected in the ratings may encourage both short- and long-term investors to closely monitor price movements before making substantial commitments.

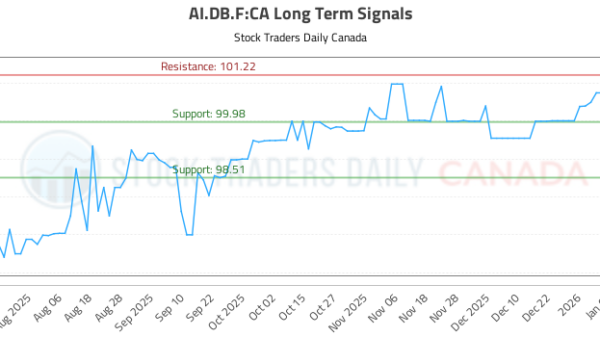

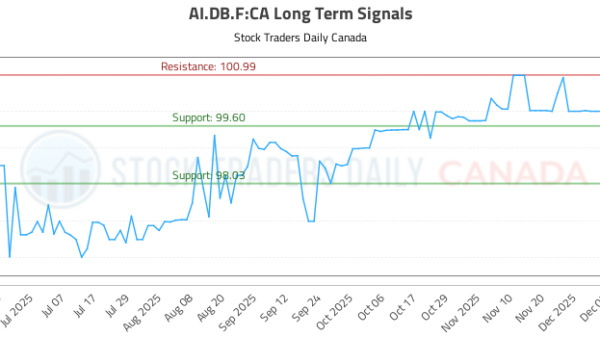

The charts accompanying the trading signals further illustrate the performance of AI.DB.G:CA, providing visual context for these recommendations. The first chart, generated on the same date, outlines the price movements throughout the trading day, while the second provides a graphical representation of the AI-generated signals affecting this specific financial instrument. The visual data could be particularly insightful for traders looking to capitalize on short-term fluctuations.

The financial market continues to evolve, with technology playing a crucial role in how investments are evaluated and executed. AI technologies are proving increasingly valuable in generating trading signals, allowing investors to make informed decisions based on real-time data analysis. The integration of these technologies into trading practices may fundamentally reshape market strategies in the coming years.

As the landscape evolves, stakeholders in the financial sector will need to adapt to new methodologies, ensuring they remain competitive. The interplay between traditional trading strategies and innovative technologies like AI will likely dictate market trends moving forward. Continued monitoring of such developments is essential for investors seeking to navigate an increasingly complex marketplace.

For more detailed information on the financial instrument, investors may refer to the official sources or platforms specializing in market analysis.

See also Lenovo Partners with Humain, Mistral AI, Alibaba for AI Solutions Amid Market Challenges

Lenovo Partners with Humain, Mistral AI, Alibaba for AI Solutions Amid Market Challenges 2026 Workforce Revolution: Companies Mandate AI Fluency Amid Skills Crisis and Hiring Overhaul

2026 Workforce Revolution: Companies Mandate AI Fluency Amid Skills Crisis and Hiring Overhaul Explore AI Ethics at 2026 Catholic Studies Series with Microsoft’s Taylor Black

Explore AI Ethics at 2026 Catholic Studies Series with Microsoft’s Taylor Black OpenAI Invests $500 Billion in Stargate to Mitigate Local Electricity Costs

OpenAI Invests $500 Billion in Stargate to Mitigate Local Electricity Costs CrowdStrike’s $4.6B Revenue vs. SentinelOne’s $956M: Capitalize on Cybersecurity Growth Now

CrowdStrike’s $4.6B Revenue vs. SentinelOne’s $956M: Capitalize on Cybersecurity Growth Now