As the AI boom continues into its fourth year, market participants—including retail traders, professional investors, and Wall Street analysts—are focusing on a strategic approach to capitalize on the demand surge: identifying bottlenecks in the infrastructure that supports AI, particularly in the production of data centers. With key inputs like memory chips in short supply, the financial sector is turning its attention to the high-end machinery required by chipmakers to ramp up production.

This machinery, known as wafer fabrication equipment (WFE) or semiconductor capital equipment (semicap), is essential for transforming silicon wafers into functional computer chips. Companies such as Applied Materials, ASML, Lam Research, Tokyo Electron, and KLA Corp are gaining traction among investors looking for opportunities in this sector.

The rationale for this focus is simple: semiconductor manufacturers like TSMC, Samsung Electronics, and Intel have been hesitant to expand their production capacity due to the cyclical nature of the industry. However, the current surge in demand for chips necessitates rapid expansion of clean-room spaces, along with an influx of tools to produce more chips.

“The ingredients are probably in place for a sustained upcycle,” said Stacy Rasgon, an analyst at Bernstein Research. Others on Wall Street share a similar outlook, with reports indicating an upward trend in spending for wafer fabrication. RBC Capital recently noted, “We see upward bias to wafer fab spending for the next two years,” while Goldman Sachs has highlighted AI spending as a driving force behind WFE expenditure.

Further validating this trend, major chip manufacturers have announced plans to significantly increase capital expenditures in response to rising demand. Recently, Taiwan Semiconductor reported intentions to exceed Wall Street’s forecasts for capital spending, while Intel‘s shares fell after the company undershot its quarterly guidance, partially due to supply issues. Intel’s CFO, David Zinser, stated, “We are ramping up tool spending quite a bit in 2026 relative to 2025 to address this supply shortfall.”

Meanwhile, SK Hynix reported record profits alongside a commitment to boost equipment spending, and ASML has announced record orders, increasing its sales outlook for 2026. Despite these positive indicators, the rapid rise in stock prices raises concerns about whether it’s too late for new investors to enter the semicap market.

Since late August, stocks of key players have surged dramatically: Lam Research has risen about 140%, ASML more than 100%, and both Applied Materials and KLA have increased nearly 80%. Such gains have led to high valuations based on forward price-to-earnings ratios, suggesting that investors buying in now are not capitalizing at the lowest point.

“Semiconductor equipment stocks largely discounted some chunk of the next cycle in like a couple of quarters,” remarked Jay Deahna, who manages AI and tech hardware coverage at BWG Global. He added that the current valuations may seem high following this significant increase. However, the sector still has potential for further growth. If the explosive rise of stocks in other AI-related segments—such as AI energy plays and memory chips—is any indicator, the semicap sector could see substantial gains moving forward.

In the last two years, companies like GE Vernova and Vistra have seen stock increases of 400% and 300%, respectively, while memory chip producer Micron has soared over 350% in the past year. Even Sandisk has witnessed an astonishing 1,000% increase in just six months.

With uncertain projections around the potential growth and profitability of semicap companies, historical valuation metrics may be less useful for traders and investors. “Is this going to be the mother of all cycles? Nobody knows yet,” Deahna noted, implying that institutional investors may still have room to maneuver as they look to capitalize on continuing trends in AI.

As long as the AI infrastructure boom persists—projected by McKinsey to surpass $7 trillion in spending through 2030—capital will likely flow toward various levels of the AI supply chain. “Yeah, the valuations are kind of reaching nosebleed levels. But I think you still want to be long semicap,” remarked Bernstein’s Rasgon, emphasizing the ongoing allure of this sector in the current investment landscape.

The continued demand for chip manufacturing equipment suggests that the narrative surrounding semicap stocks is only beginning to unfold, with significant implications for investors and the broader technology market.

See also Illinois AG Leads Coalition of 35 States Urging xAI to Curb Nonconsensual AI Image Generation

Illinois AG Leads Coalition of 35 States Urging xAI to Curb Nonconsensual AI Image Generation U.S. Megacap Earnings Surge 21.5% as AI Investments Face Critical Test This Week

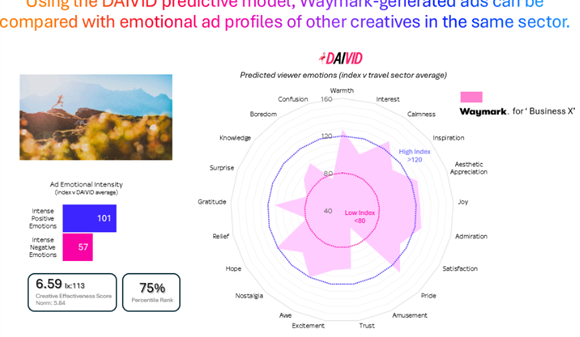

U.S. Megacap Earnings Surge 21.5% as AI Investments Face Critical Test This Week AIP Corp Partners with Caterpillar to Launch 2 GW Power Solution for AI Data Centers

AIP Corp Partners with Caterpillar to Launch 2 GW Power Solution for AI Data Centers