Meta reported ambitious plans during its Q4 2025 earnings call on Wednesday, revealing a significant investment in artificial intelligence (AI) initiatives. The company is set to allocate between $115 billion and $135 billion for capital expenditures in 2026, largely focusing on enhancing AI capabilities to pursue its vision of “personal superintelligence.”

CEO Mark Zuckerberg highlighted the potential of AI in providing a personalized user experience, stating, “We’re starting to see the promise of AI that understands our personal context, including our history, our interests, our content and our relationships.” He hinted at a future where AI glasses could assist users in navigating daily tasks, generating tailored information in real-time.

The strategic focus on AI also intertwines with Meta’s advertising model. The same AI infrastructure aimed at personal superintelligence will optimize ad placement, improving how ads are shown and increasing overall engagement. Investors appeared unfazed by the hefty investments, as Meta’s stock climbed over 8% in after-hours trading, reflecting confidence in the company’s direction.

In 2025, Meta posted a revenue of $201 billion, marking a 22% increase from the previous year, with advertising revenue surpassing $196 billion. Zuckerberg acknowledged the fundamental role of advertising in Meta’s growth, asserting, “For the next couple of years, ads are going to be by far the most important driver of growth in our business.” This commitment to AI advancements complements the ongoing enhancements in their advertising-supported applications.

Meta’s AI strategy is evident in its latest improvements to algorithms governing ads and recommendations. Key projects like GEM for ad ranking, Andromeda for ad retrieval, and Lattice for ad performance predictions are reshaping how ads are delivered. Notably, watch time for Instagram Reels increased over 30% year-over-year, while enhancements to the ranking system resulted in a 7% uptick in views for organic content on Facebook. CFO Susan Li noted that these updates have led to “the largest quarterly impact from Facebook product launches in the past two years.”

Li emphasized the importance of delivering engaging experiences alongside monetizing that engagement effectively. Meta’s approach aims to enhance monetization efficiency rather than simply increasing the volume of advertisements. The company has been refining its systems to strategically deliver ads, capitalizing on users’ interests without overwhelming their feeds.

During the second half of 2025, adjustments to ad distribution across Facebook’s user base resulted in nearly four times the revenue impact compared to simply increasing ad load. In Q4, the total number of ad impressions across Meta’s platforms rose by 18% year-over-year, while the average price per ad grew by 6%, driven by improved performance and advertiser demand. Li expressed optimism, stating, “And we see a lot of headroom to improve recommendations in 2026.”

As Meta ventures further into the realm of AI, the implications extend beyond enhanced advertising efficiency to potentially transformative user experiences. The company’s aggressive investment signals a continued commitment to integrating advanced technologies into its core operations, positioning itself at the forefront of the evolving digital landscape.

See also AI-Driven Drug Commercialization Market to Surge 24.12% CAGR, Transforming Pharma Strategies by 2032

AI-Driven Drug Commercialization Market to Surge 24.12% CAGR, Transforming Pharma Strategies by 2032 China Approves ByteDance, Alibaba, Tencent to Buy 400,000 Nvidia H200 AI Chips

China Approves ByteDance, Alibaba, Tencent to Buy 400,000 Nvidia H200 AI Chips Students Tackle AI Ethics in Competitive ‘Iron Bowl’ Debate, Shaping Future Discourse

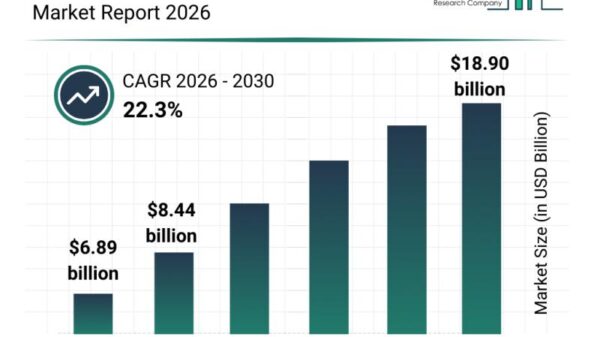

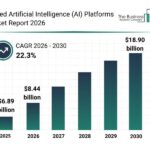

Students Tackle AI Ethics in Competitive ‘Iron Bowl’ Debate, Shaping Future Discourse Unified AI Platforms Market Set to Surge to $18.90B by 2030, Driven by Enterprise Demand and Innovations

Unified AI Platforms Market Set to Surge to $18.90B by 2030, Driven by Enterprise Demand and Innovations Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere